|

|

19 March 2024 Price action that was expected |

| LMAX Digital performance |

|

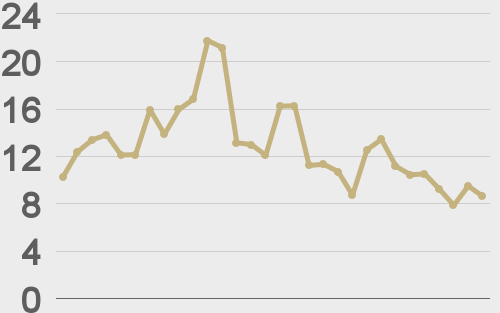

LMAX Digital volumes got off to a slower start this week. Total notional volume for Monday came in at $703 million, 20% below 30-day average volume. Bitcoin volume printed $345 million on Monday, 36% below 30-day average volume. Ether volume came in at $218 million, 3% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $13,334 and average position size for ether at $4,308. Market volatility is tracking at its highest levels for bitcoin since 2021 and ether since 2022. We’re looking at average daily ranges in bitcoin and ether of $3,610 and $219 respectively. |

| Latest industry news |

|

We are officially in the throes of a correction that had long been anticipated and was well overdue. Having said that, the uptrend remains firmly intact and setbacks need to be taken with a grain of salt. Indeed, volatility in crypto assets runs high on a relative basis and has been running exceptionally high in 2024 thus far. But at the same time, bitcoin could easily dip back down below $60k while doing nothing to compromise the strong uptrend. Year-to-date, bitcoin is up over 50%, while ether is not far behind, up some 47% into Tuesday. These gains far exceed those in traditional assets and offer a little more context to help mitigate any worry around the recent wave of declines. But as per our Monday commentary, we believe there will be a lot of attention on tomorrow’s Fed decision, which could play a part with respect to short-term price action, especially if the decision is perceived to be less dovish. If the Fed scales back its rate cut outlook and tweaks its expectation to two cuts in 2024 from three, look for yield differentials to move back in the US Dollar’s favor and stocks to sell off, which could then open more downside pressure on crypto assets. If on the other hand the Fed retains its rate outlook and the communication is satisfying to investors, we could see this serve as an excuse to get crypto assets looking to start trading back to the topside. |

| LMAX Digital metrics | ||||

|

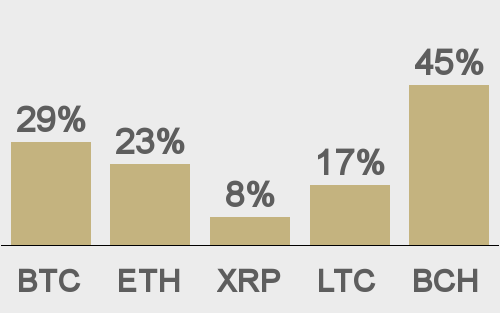

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

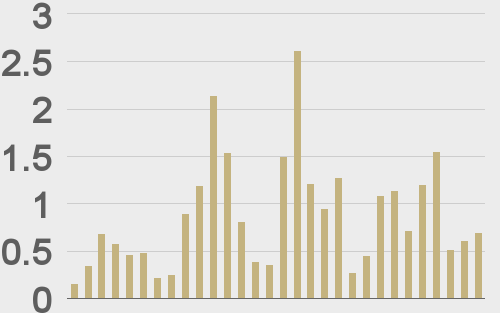

Total volumes last 30 days ($bn) |

||||

|

||||

|

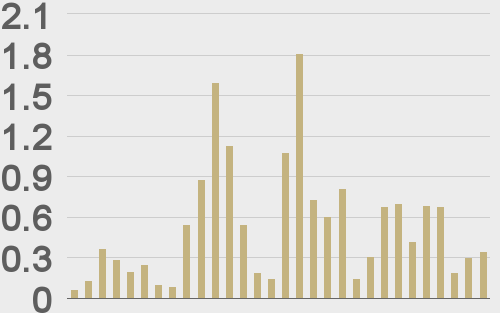

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

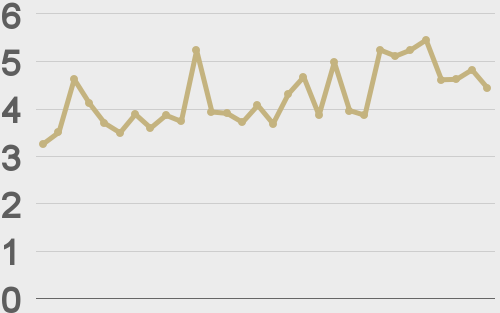

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@novogratz |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||