|

|

28 July 2022 Prices up, volume up |

| LMAX Digital performance |

|

LMAX Digital volumes moved back up nicely on Wednesday. Total notional volume for Wednesday came in at $493 million, 27% above 30-day average volume. Bitcoin volume printed $302 million on Wednesday, 20% above 30-day average volume. Ether volume came in at $141 million, 42% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,250 and average position size for ether at 2,316. Volatility has been showing signs of picking up off yearly lows. We’re looking at average daily ranges in bitcoin and ether of $1,285 and $129 respectively. |

| Latest industry news |

|

Things have been looking up in the crypto space this week. A lot of this momentum has been further fueled in the aftermath of the latest Fed decision, in which the central bank was perceived to deliver a more investor friendly communication. On Wednesday, bitcoin rose some 8% in reaction to the central bank decision, which represented the biggest single day rise for the asset in over a month. Ether also enjoyed plenty of upside from the news. Still, we’re far from out of the woods at this stage and believe the market needs to be a little more cautious when considering the post FOMC risk on response. Investors were relieved a 100 basis point hike was avoided and excited to hear the Fed talking about relying on the data. At the same time, it felt like investors only heard what they wanted to hear, as it was also clear that continued upside pressure on inflation would necessitate more aggressive hikes going forward. Given that crypto has been very tied to global sentiment, we should expect another pullback if this post Fed reaction fades away. But, we’ve also seen an intense decline in crypto this year and believe there are many reasons to soon expect a breakdown of the correlation with risk sentiment, which could soon translate to crypto trading higher, or at least being well supported, even if stocks continue to fall from here. |

| LMAX Digital metrics | ||||

|

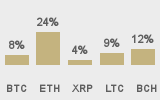

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

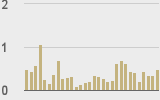

Total volumes last 30 days ($bn) |

||||

|

||||

|

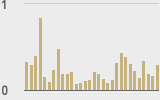

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

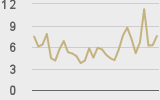

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||