|

|

25 March 2024 Putting it all in perspective |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital cooled off in the previous week. Total notional volume from last Monday through Friday came in at $4.6 billion, 20% lower than a week earlier. Breaking it down per coin, bitcoin volume came in at $2.3 billion in the previous week, 27% lower than the week earlier. Ether volume was an impressive outlier, coming in at $1.5 billion, 10% higher than the week earlier. Total notional volume over the past 30 days comes in at $28.1 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,915 and average position size for ether at $4,456. Market volatility has been trending up and is tracking at multi-month highs. We’re looking at average daily ranges in bitcoin and ether of $3,833 and $232 respectively. |

| Latest industry news |

|

There has been a lot of chatter around the outflows reported from the bitcoin spot ETFs in the previous week. It was the worst week of flows since inception in January. At the same time, nothing moves up in a straight line and after seeing bitcoin perform as it has in this first quarter of 2024, there was every expectation (from our end) that we would indeed get to a place where there would be a period of outflows. We don’t expect this to persist and fully anticipate inflows will pick back up as bitcoin finds its footing into the current correction. Technically speaking, as per our insights in today’s update, bitcoin is tracking within a strong uptrend, with no signs of the trend being compromised. Instead, the market is in the process of looking for the next higher low ahead of a bullish continuation. As far as risks associated with the price of bitcoin and other crypto assets go, we believe the biggest risk is the risk of a meltdown in the US equity market. We only believe bitcoin would suffer in the short-term should this play out. But it is a short-term risk that should be considered. The stock market has been charging higher at a relentless pace. Stocks are all about risk sentiment and we worry risk sentiment could be damaged if we see the Fed being forced into a less dovish stance over the coming weeks. But a critical fundamental difference between stocks and bitcoin is that unlike stocks, bitcoin has the ability to rally when sentiment is in deterioration mode, given its super attractive properties as a store of value asset. We believe the market will get a glimpse of this in the weeks ahead and we believe this will only serve to embolden investors to be wanting to add to their bitcoin exposure. As far as support goes, it’s possible bitcoin will find its next higher low at any moment. But if we do see a bigger correction, we believe any setbacks will be exceptionally well supported on any dips below $50k. |

| LMAX Digital metrics | ||||

|

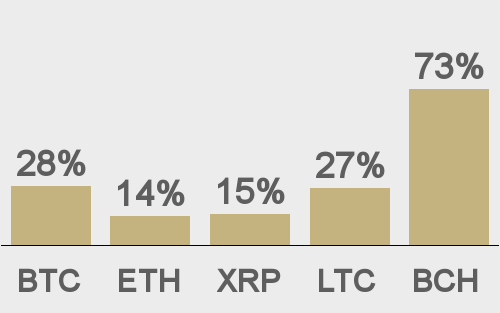

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

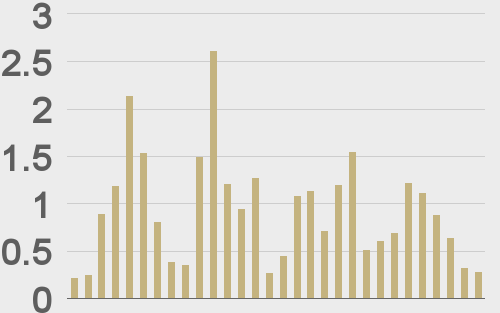

Total volumes last 30 days ($bn) |

||||

|

||||

|

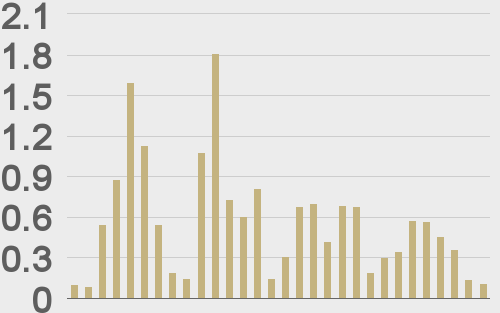

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

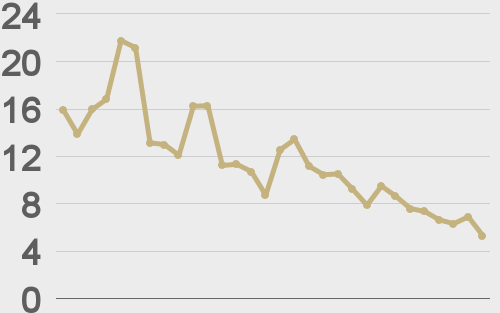

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

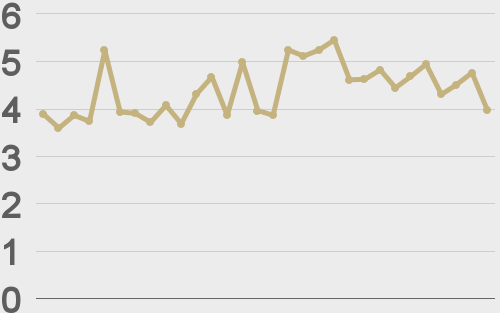

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||