|

| 13 November 2025 Q4 simply in neutral, not reverse |

| LMAX Digital performance |

|

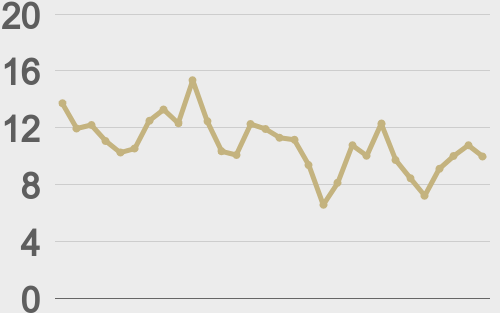

LMAX Digital volumes improved from Tuesday’s subdued levels but were still on the softer side overall on account of choppy, directionless trading conditions. Total notional volume for Wednesday came in at $522 million, 20% below 30-day average volume. Bitcoin volume printed $301 million, 14% below 30-day average volume. Ether volume came in at $123 million, 21% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $10,960 and average position size for ether at $3,420. Bitcoin and ETH volatility remains elevated just off recent multi-month highs. We’re looking at average daily ranges in bitcoin and ether of $3,917 and $226 respectively. |

| Latest industry news |

|

Despite high hopes for a strong Q4 — driven by what many believed would be a repeat of the rally phase we’ve seen in previous cycles — the market has yet to follow through. Optimism had been underpinned by a banner year for crypto regulation and institutional adoption, and fresh record highs in both bitcoin and ETH raised expectations for such a follow through into year end. Yet the fact that this momentum hasn’t clearly accelerated into October and now early November appears to be weighing on the conviction of weaker hands. But in our view, the softness we’re seeing stems more from pause than from any meaningful capitulation. That said, the price behavior in bitcoin and ETH remains more consolidative than outright bearish. Over the last 24 hours bitcoin has hovered near major support levels and ETH has similarly drifted without sharp breakdown. The broader macro backdrop also remains favorable. With the Federal Reserve likely to maintain an accommodative stance, and global equity markets still advancing, risk-assets remain attractive. Moreover, political developments — particularly the end to the government shutdown — are providing room for additional incremental upside. Looking ahead, it will be important to pay attention to key technical levels. A clear break above $107,500 for bitcoin would signal renewed upside momentum and open the door for the start to a bullish breakout. The takeaway? This is likely a “pause to reset” phase rather than the start of a fresh down-leg, and for patient investors, it’s an opportunity to build or simply sit back and hold exposure. |

| LMAX Digital metrics | ||||

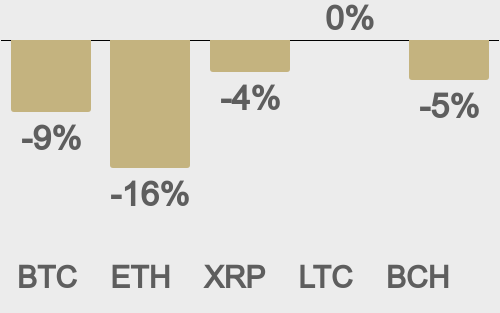

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||