|

|

8 May 2024 Quiet consolidation ahead of next big move |

| LMAX Digital performance |

|

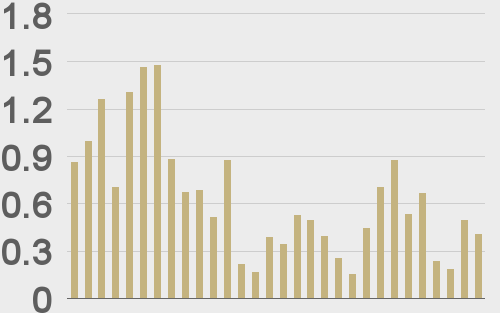

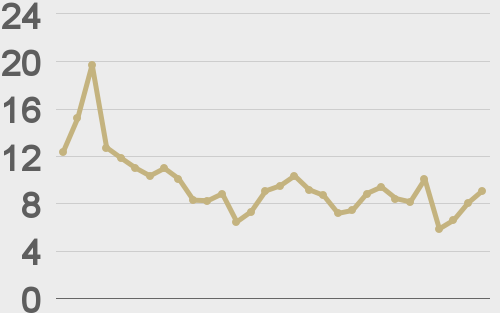

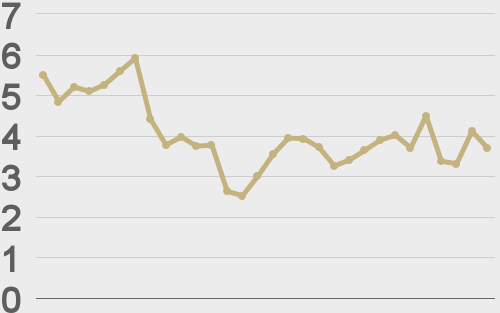

LMAX Digital volumes tracked on the lighter side on Tuesday. Total notional volume for Tuesday came in at $411 million, 36% below 30-day average volume. Bitcoin volume printed $273 million, 32% below 30-day average volume. Ether volume came in at $78 million, 54% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $10,092 and average position size for ether at $4,423. Market volatility continues to cool off since peaking in Mid-March. We’re looking at average daily ranges in bitcoin and ether of $2,868 and $158 respectively. |

| Latest industry news |

|

Things have been mostly quiet this week and what we’re seeing is nothing more than a period of tight choppy consolidation. As per our technical insights, we’ve introduced the possibility last week’s low could be an important level if it holds up as a higher low ahead of a bullish continuation to fresh record highs. Fundamentally speaking, now that H1 2024 risks around the bitcoin ETF approvals and bitcoin halving event have been taken in and things have settled down, the attention is shifting to the other side of the equation – where there has been more pressing volatility risk around the state of the US Dollar, yield differentials, and the outlook for monetary policy. All of this could prove to be a net bullish development if indeed the Fed is on the verge of the next easing cycle, which should translate to broad based US Dollar outflows and benefit other currencies, including cryptocurrencies by extension. There has been a somewhat of a run of negative sentiment around the prospect for an SEC eth spot ETF approval, with those bets getting cut down dramatically after there had been so much optimism when the bitcoin ETFs were approved earlier in the year. At the same time, while we’re not encouraged an SEC eth ETF approval is imminent, we always like to look at where market expectations are relative to the balance of risk. In this case, with so much negativity built in, and those odds tracking way down, we do believe this leaves the balance of risk tilting in eth’s favour. On a positive note, bitcoin spot ETF flows are looking good, with money moving back in after we had seen some outflows the other week. |

| LMAX Digital metrics | ||||

|

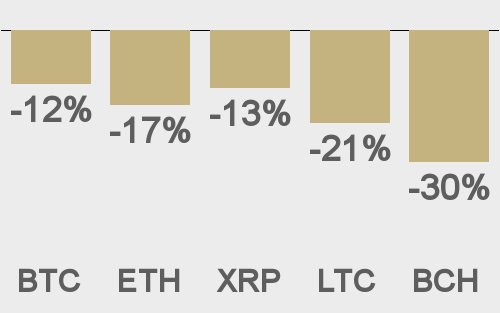

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||