|

| 5 August 2025 Regulatory progress offsets risk market drag |

| LMAX Digital performance |

|

LMAX Digital volumes got off to a quiet start this week. Total notional volume for Monday came in at $292 million, 53% below 30-day average volume. Bitcoin volume printed $124 million, 56% below 30-day average volume. Ether volume came in at $79 million, 50% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,858 and average position size for ether at $2,979. Bitcoin volatility continues to track just off yearly low levels. ETH volatility has been trending up since bottoming in May. We’re looking at average daily ranges in bitcoin and ether of $2,636 and $177 respectively. |

| Latest industry news |

|

Crypto prices are steady to slightly firmer over the past 24 hours. The broader risk backdrop has been shaped by Friday’s weaker‑than‑expected U.S. jobs data, which drove a sharp repricing of Fed policy expectations toward a September rate cut. Lower U.S. yields and a softer dollar have provided a constructive tailwind for digital assets, even as sentiment in traditional markets remains mixed. Ethereum continues to benefit from optimism around structural changes to U.S. crypto ETF rules. Recent SEC approvals enabling in‑kind creation and redemption, along with expanded options market capacity for leading U.S.‑listed Bitcoin ETFs, have been viewed as significant steps toward deeper institutional participation. This regulatory progress has helped offset the drag from a sluggish risk environment in equities and commodities. There has been a lot of talk around a period of weakness in US equities ahead. Ultimately, any pronounced weakness in U.S. equities is likely to exert short‑term pressure on Bitcoin, given its notable correlation with risk assets. However, Bitcoin’s store‑of‑value appeal and idiosyncratic positive drivers — including robust ETF inflows, ongoing regulatory progress, and broader adoption trends — should provide underlying support, encouraging dip‑buying even in the face of a sustained equity market decline. From a technical perspective, Bitcoin remains within a medium‑term uptrend. Ethereum’s price action has been more resilient, supported by improving on‑chain activity and continued demand for staking yields. Barring a significant deterioration in global risk sentiment, both assets appear well‑positioned to absorb near‑term volatility while retaining a constructive bias. |

| LMAX Digital metrics | ||||

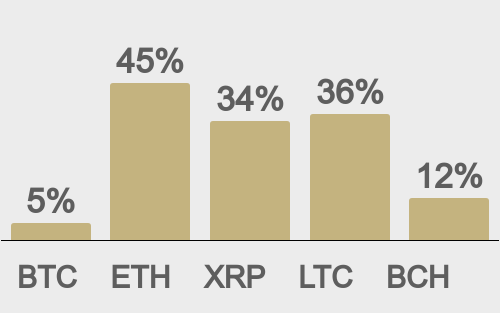

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

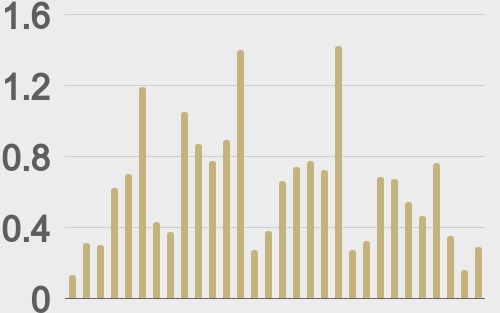

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

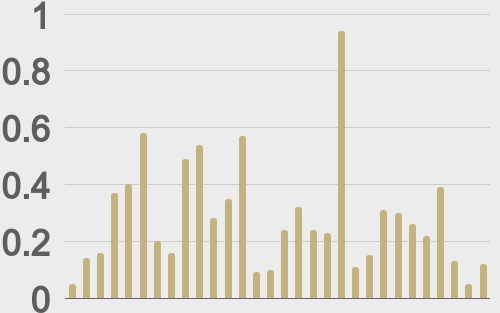

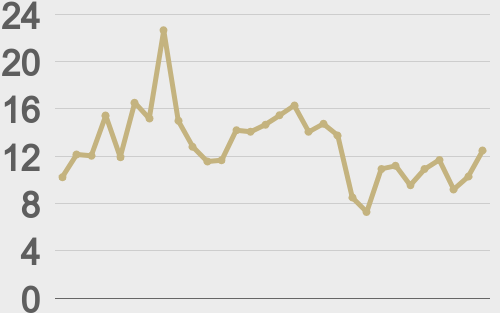

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

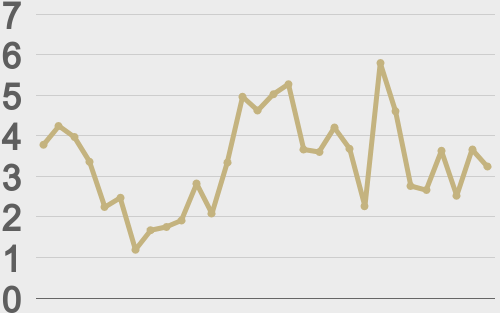

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||