|

|

20 February 2025 Resilient all things considered |

| LMAX Digital performance |

|

LMAX Digital volumes were lighter overall on Wednesday. Total notional volume for Wednesday came in at $305 million, 43% below 30-day average volume. Bitcoin volume printed $106 million on Wednesday, 61% below 30-day average volume. Ether volume came in at $46 million, 49% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $10,380 and average position size for ether at $1,952. Market volatility has been in cool down mode since peaking earlier this month. We’re looking at average daily ranges in bitcoin and ether of $3,135 and $169 respectively. |

| Latest industry news |

|

It’s been a quiet week for crypto assets. But overall, any setbacks continue to be well supported on dips by medium and longer-term players. Absence of any major headlines from within the crypto space have shifted the focus to the world of all things macro. We’ve seen a mild dose of turbulence amidst ongoing Trump tariff unpredictability and setbacks in peace talks between Russia and the Ukraine. This has translated to some US Dollar demand and downside pressure on risk assets that could be weighing on crypto prices. Meanwhile, Wednesday’s Fed Minutes have been released. There weren’t any major surprises, though the fact that the central bank made it clear it was in no rush to cut rates, could also be playing into US Dollar demand. The net takeaway is that the crypto market has actually been quite resilient in the face of these macro headwinds. The US administration’s commitment to embrace crypto has ultimately served as fuel to keep the momentum going, which should invite further adoption in the months ahead. After a slow start to February, we’ll also be interested to see if the month can live up to positive seasonality metrics that have February as one of the better months of performance for the asset class. |

| LMAX Digital metrics | ||||

|

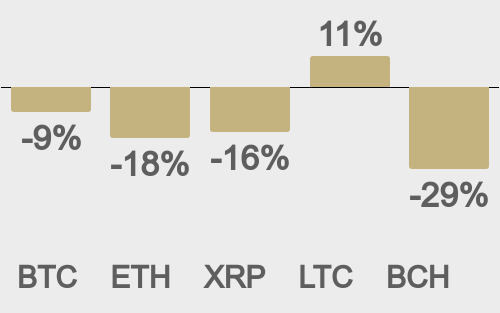

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

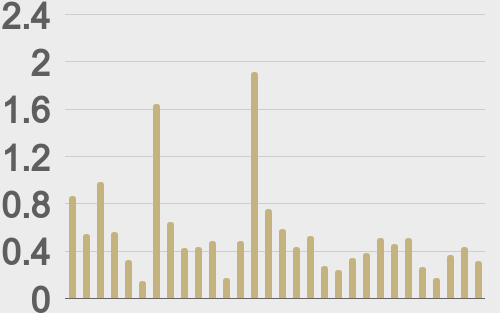

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

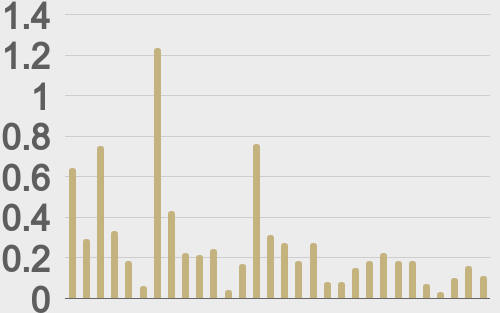

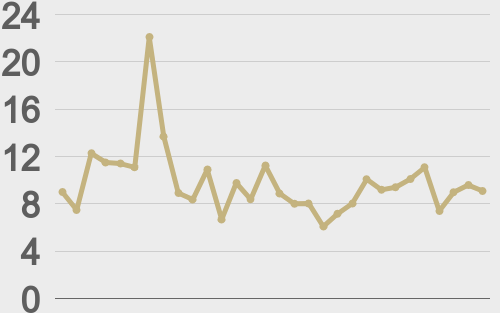

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||