|

|

23 November 2021 Risk for more weakness |

| LMAX Digital performance |

|

LMAX Digital volume is looking good as the week gets going. Total notional volume for Monday came in at $1.48 billion, 20% above 30-day average volume. Bitcoin volume printed $858 million on Monday, 37% above 30-day average volume. Ether volume came in at $435 million, 13% above 30-day average volume. It is however worth noting that we might see volumes drop off for the remainder of the week on account of the US Thanksgiving holiday. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,849 and average position size for ether running up to $7,449. Volatility has been slowly picking up since finding a bottom in July. We’re now looking at average daily ranges in bitcoin and ether of $2,862 and $244 respectively. |

| Latest industry news |

|

We continue to see short-term risk tilted to the downside for cryptocurrencies. The combination of a technical picture begging for more correction and a fundamental outlook warning of headwinds is what is accounting for this outlook. Technically speaking, after extending to fresh record highs earlier this month, bitcoin and ether have come under pressure, with bitcoin triggering a double top formation on the daily chart projecting deeper setbacks towards $48,000. We were also concerned about the fact that the recent run higher in prices was not accompanied by a proportioned pickup in volume, something that already was raising red flags about the pace of recent moves. Fundamentally, we see two big risks ahead. One major risk comes from the regulatory side where there is still plenty of uncertainty and plenty of potential for governments to make things more difficult for cryptocurrencies. The other major risk over the coming days and weeks is the risk that comes from the US equity market and potential capitulation on that front in response to anticipation of the normalization of monetary policy. While we believe bitcoin to be an attractive asset in risk off settings, short-term, we also see bitcoin being exposed to risk off flow from a downturn in stocks. It’s important to remember that bitcoin (crypto) has also benefited greatly from this period of unprecedented risk on resulting from extending monetary policy accommodation. |

| LMAX Digital metrics | ||||

|

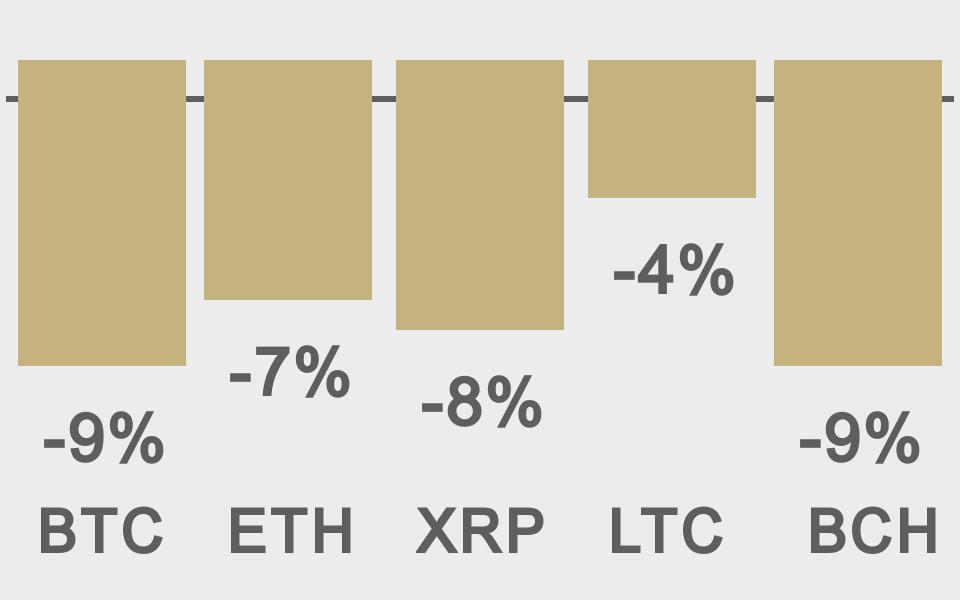

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

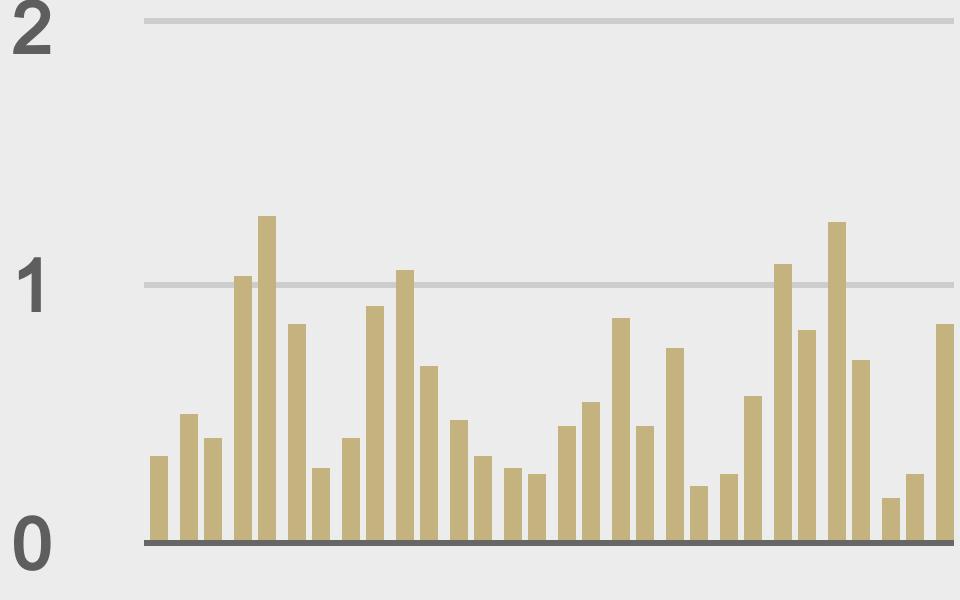

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

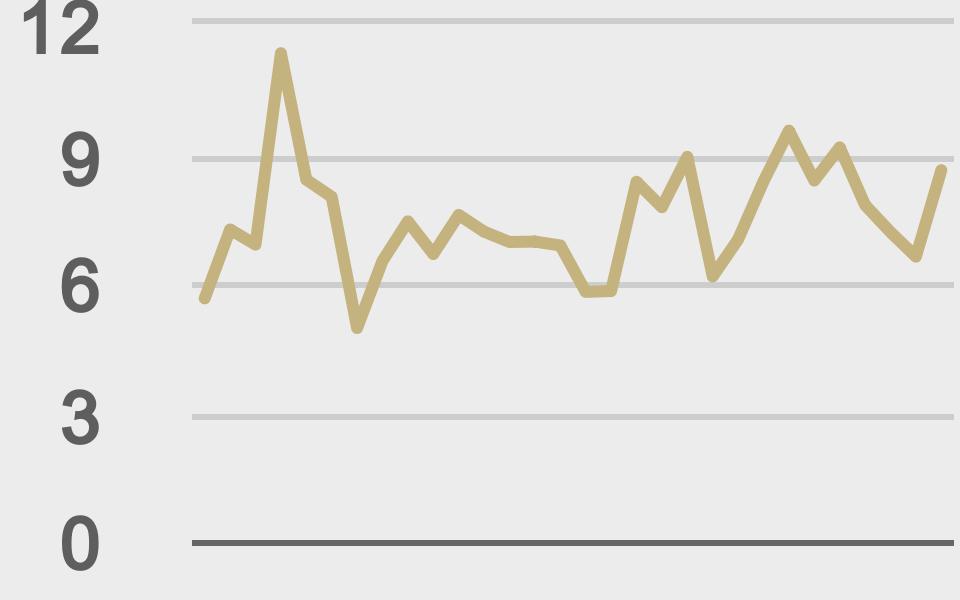

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||