|

|

25 September 2024 Risk on…risk off….it really doesn’t matter |

| LMAX Digital performance |

|

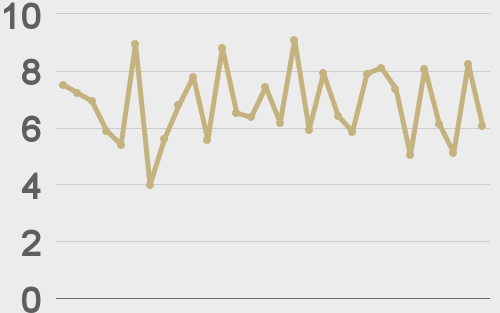

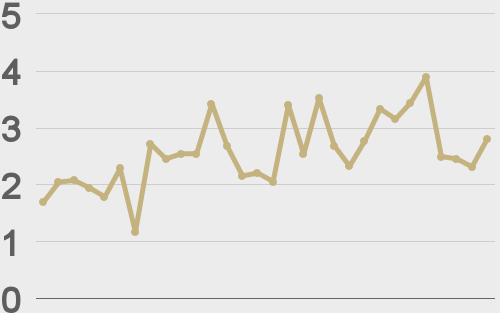

LMAX Digital volumes continued to trend higher on Tuesday. Total notional volume for Tuesday came in at $377 million, 28% above 30-day average volume. Bitcoin volume printed $205 million on Tuesday, 16% above 30-day average volume. Ether volume came in at $110 million, 48% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,959 and average position size for ether at $2,556. Market volatility continues to trend lower since peaking in August, now tracking at multi-week lows. We’re looking at average daily ranges in bitcoin and ether of $2,096 and $114 respectively. |

| Latest industry news |

|

Global markets have been feeling great about a wave of accommodation and stimulus out of the US and China, which has helped to drive US equities to record highs, while also inspiring demand for risk assets across the board, including crypto assets. But the funny thing about bitcoin is that it sits in a unique position where it has the ability to both rally as a risk asset and as a safe haven asset. In reality, when looking at bitcoin’s core value proposition, there should be no disputing why it is so compelling as a safe haven asset. Look no further than its extreme limited supply, decentralized composition and deflationary economics. As we’ve highlighted many times over the years, bitcoin in many ways is everything that gold is and more. After all, it’s far more scarce and a lot easier and cheaper to move around the globe than gold. So why does bitcoin rally when risk appetite is running high? The simple answer here is that bitcoin is still a young, maturing, emerging asset, which means it is still being discovered and therefore still considered to be risk correlated. When considering all of this, it becomes that much easier to understand why the outlook for bitcoin remains exceptionally bright. Throw in all of the traditional market adoption in 2024 and the case becomes even stronger as consensus grows. Technically speaking, we continue to highlight short-term bitcoin resistance at $65,000. We will need to see a break above this barrier to get that next wave of momentum going that should inspire a run towards a retest and break of the record high. |

| LMAX Digital metrics | ||||

|

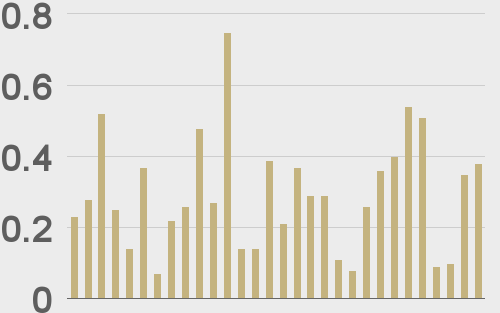

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

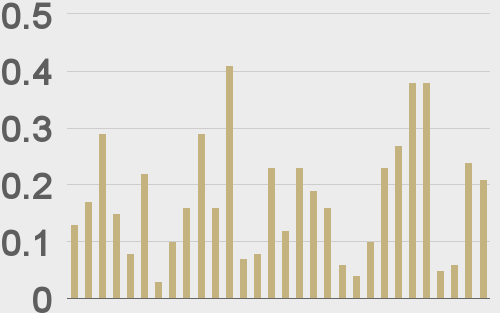

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||