|

|

8 March 2022 Seasonality analysis suggests weakness in March |

| LMAX Digital performance |

|

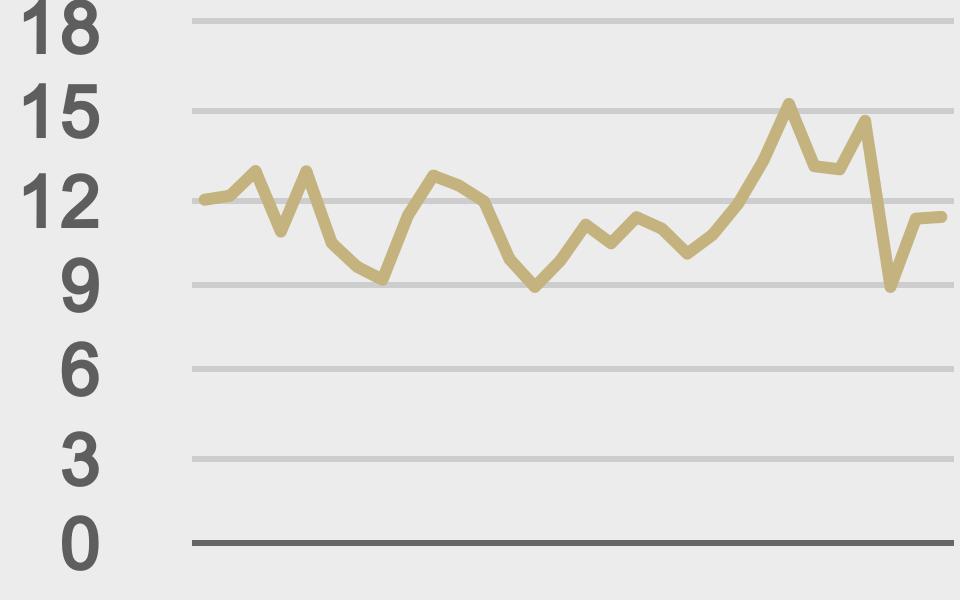

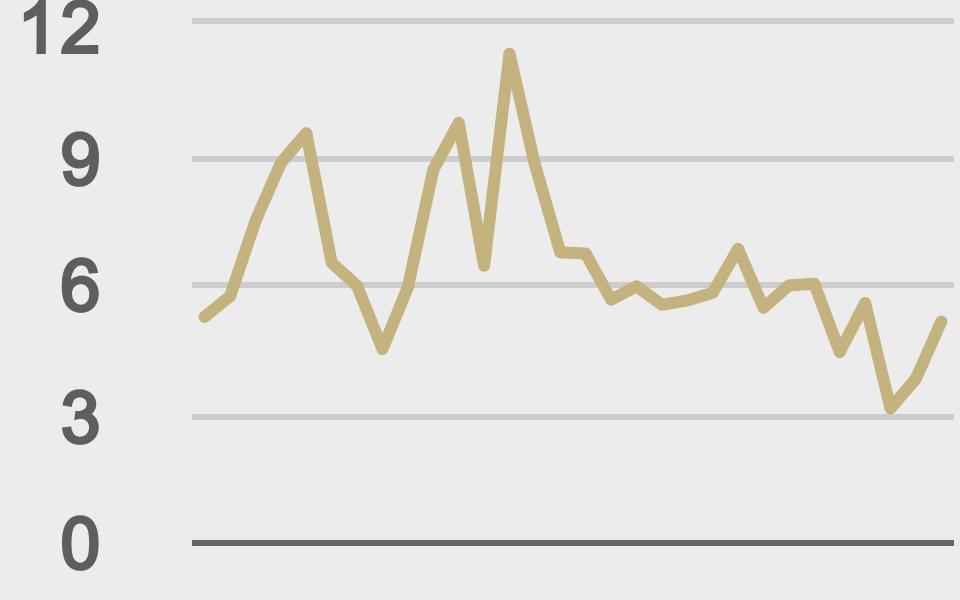

LMAX Digital volume got off to a solid start to the week. Total notional volume for Monday came in at $841 million, 3% above 30-day average volume. Bitcoin volume printed $517 million on Monday, 12% above 30-day average volume. Ether volume came in at $235 million, 16% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,404 and average position size for ether at 6,379. Volatility has been trending lower in 2022. We’re now looking at average daily ranges in bitcoin and ether of $2,338 and $198 respectively. |

| Latest industry news |

|

Stocks were down in a big way on Monday, and yet, crypto markets held up well on a relative basis. While we still believe crypto will be exposed to more intensified periods of risk off for the foreseeable future, Monday’s price action also encourages the prospect of the strength of the asset class on the longer-term value proposition of bitcoin as a flight to safety, store of value play. Worry around inflation and escalating tension on the geopolitical front are themes that should indeed attract more attention to crypto as an alternative asset during challenging times, and though the evidence isn’t overwhelming just yet, we are seeing signs of movement in crypto on the back of these developments. Blockchain analytics firm Elliptic believe energy-rich Russia could still turn to Bitcoin mining to dent the sanctions impact. Crypto research firm Delphi Digital say supply of ‘active’ bitcoin, or the amount of bitcoin moving between addresses in 24 hours, soared to around 565,000, the highest level seen in over a year. Seasonality will also be important to watch over the coming weeks as far as price action goes. March tends to be one of bitcoin’s weakest months of performance. Over the past 7 years, bitcoin has dropped in March on average of 5.7%. Technically speaking, as per our analysis, the recent failure to get above the February high keeps the pressure on the downside. |

| LMAX Digital metrics | ||||

|

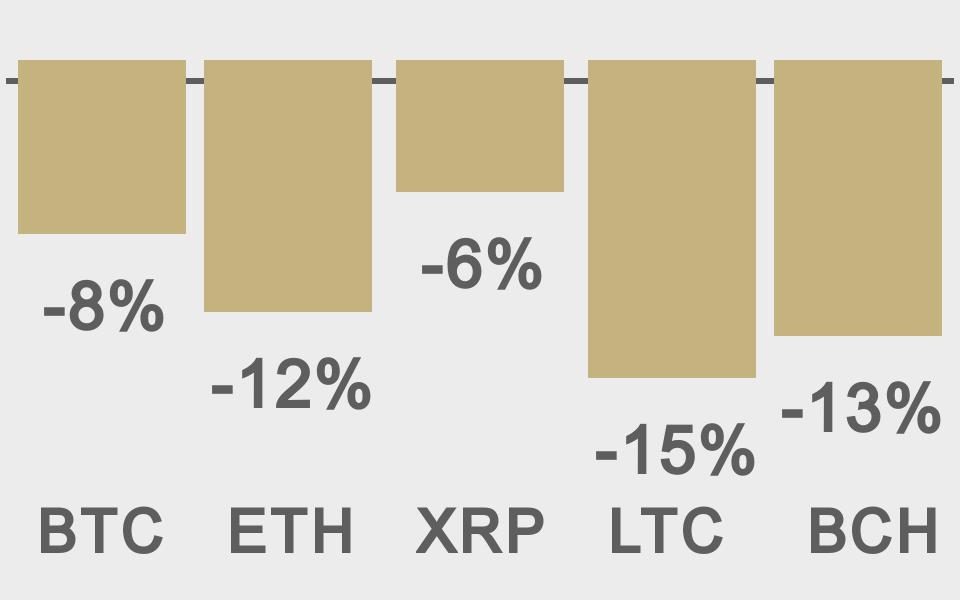

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

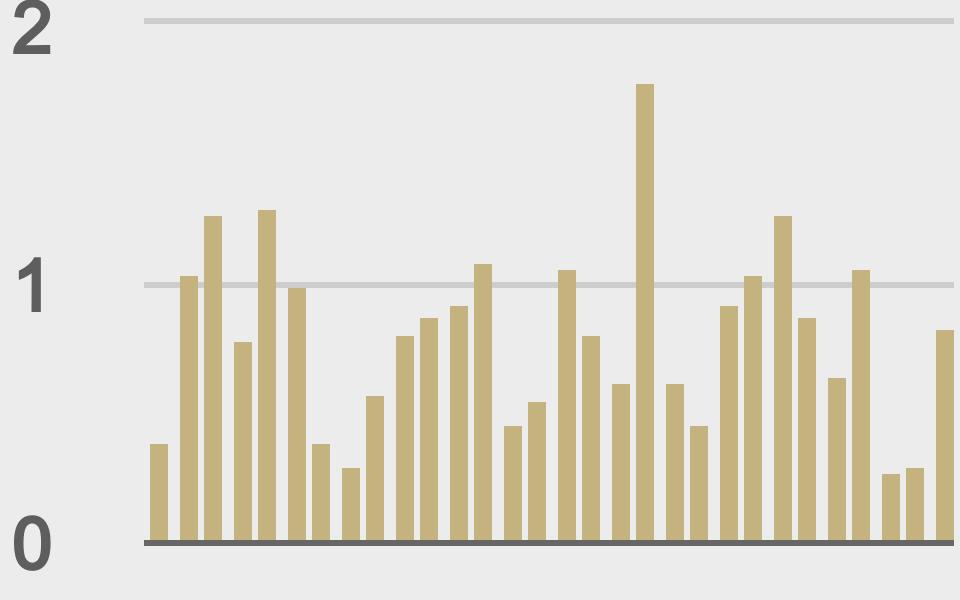

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

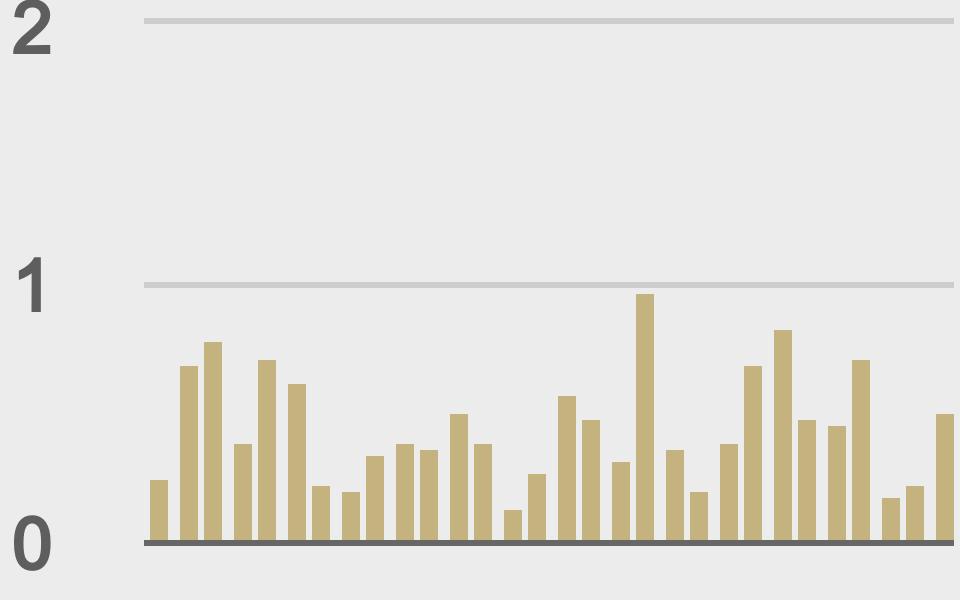

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@DocumentingBTC |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||