|

|

31 October 2023 Seasonality trends less relevant for November |

| LMAX Digital performance |

|

LMAX Digital volumes got off to a good start this week. Total notional volume for Monday came in at $351 million, 20% above 30-day average volume. Bitcoin volume printed $238 million on Monday, 23% above 30-day average volume. Ether volume came in at $74 million, 3% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,614 and average position size for ether at $2,724. Volatility has settled down in recent sessions after breaking out to the topside. We’re looking at average daily ranges in bitcoin and ether of $1,058 and $56 respectively. |

| Latest industry news |

|

The month of October has not only been an impressive one for bitcoin performance (+27%), we’ve also seen healthy inflows into digital asset investment products. Last week, we saw $326 million of inflows into digital asset investment products, the biggest week since July of 2022. The combination of recognition of bitcoin as a compelling store of value asset, along with ongoing expectations the SEC will soon approve bitcoin spot ETFs, has been the combination that has been behind bitcoin’s standout, across the board outperformance. Now that we’re closing out October and the month has delivered as per seasonality trends, the focus shifts to November. Performance in November has been less predictable over the years, with some months coming in strong and others producing discouraging results. On net, the takeaway as far as expectations based on seasonality trends for November is to not really use this metric to forecast performance for the next 30 days. Instead, the focus will be on updates from the SEC and global macro developments. Of course, on the topic of all things global macro, there continues to be a focus on geopolitical risk, which seems to have calmed down a bit as the week gets going. The market will now spend a lot of the remainder of the day worrying about added volatility from month end flow and positioning into tomorrow’s always highly anticipated Fed policy decision. |

| LMAX Digital metrics | ||||

|

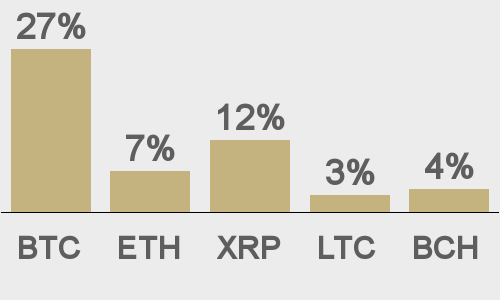

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

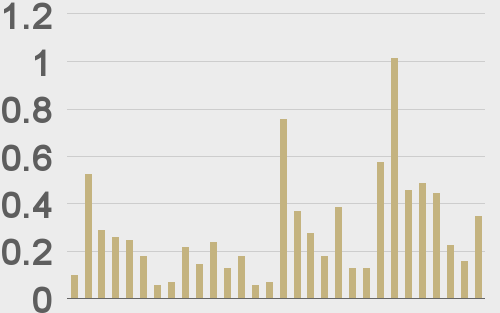

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

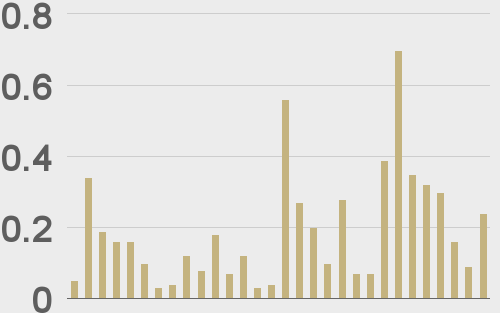

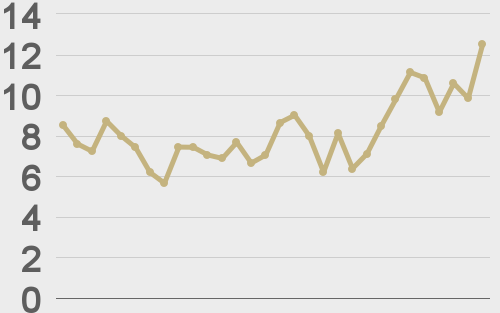

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

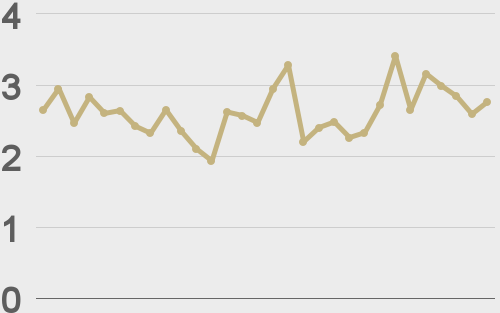

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||