|

|

22 February 2024 Sentiment uptick keeps crypto assets supported |

| LMAX Digital performance |

|

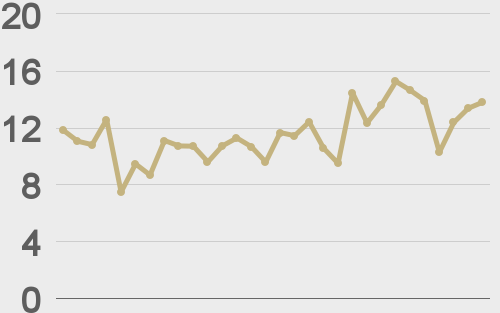

LMAX Digital volumes have been impressive all week. Total notional volume for Wednesday came in at $576 million, 44% above 30-day average volume. Bitcoin volume printed $294 million on Wednesday, 28% above 30-day average volume. Ether volume came in at $229 million, 92% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,855 and average position size for ether at $3,597. Volatility has been showing signs of wanting to turn back up after dropping by more than 40% from the January peak. We’re looking at average daily ranges in bitcoin and ether of $1,537 and $105 respectively. |

| Latest industry news |

|

In this week’s reports, we’ve highlighted the fact that there has been some technical overextension on the charts, which had warned, at a minimum, we could be in for a period of consolidation. We did have some concerns that we could even see a deeper pullback in crypto assets with US equities looking at risk for a material correction on account of less investor friendly updates in the economy. But for the moment, things have held up rather well. Wednesday’s bitcoin decline stalled out ahead of our key short-term level of support at $50,600. Bitcoin has since traded back to the topside, leaving the door open for a fresh push to yearly highs. Fundamentally, a lot of what could be driving flow right now is coming from US markets. On Wednesday, the traditional markets were relieved there were no major surprises in the Fed Minutes, while also getting a nice boost from Nvidia earnings. We’ve talked a lot about how correlations between traditional markets and crypto have been less relevant of late. At the same time, a boost in traditional markets like the one seen on Wednesday is definitely not going to be something that hurts crypto assets. It’s also important to remember that when the US Dollar is selling off, it means yield differentials are moving out of the US Dollar’s favor and into the rest of the currency market. Crypto by extension, should also benefit from such flow. |

| LMAX Digital metrics | ||||

|

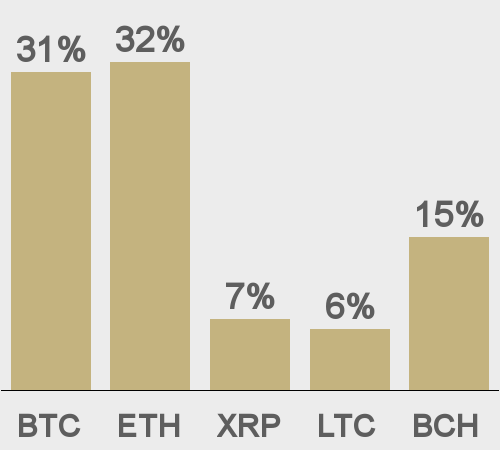

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

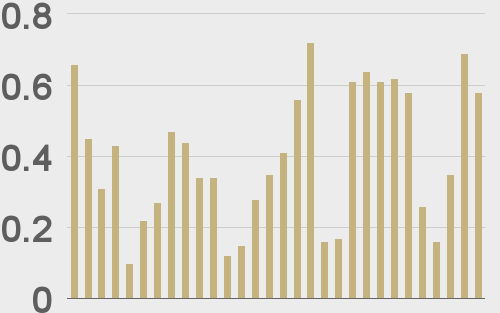

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

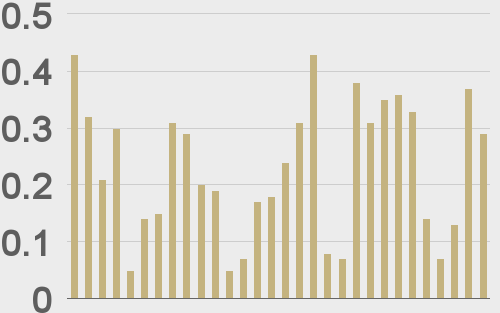

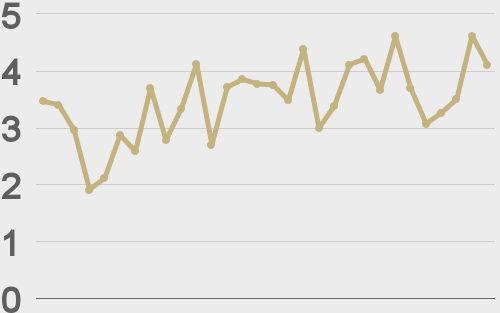

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@woonomic |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||