|

|

6 September 2023 September not a friendly month for crypto |

| LMAX Digital performance |

|

LMAX Digital volumes were higher on Tuesday, also pushing back above 30-day average volumes. Total notional volume for Tuesday came in at $192 million, 7% above 30-day average volume. Bitcoin volume printed $117 million on Tuesday, 9% above 30-day average volume. Ether volume came in at $53 million, 10% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,546 and average position size for ether at $2,469. Volatility is trying to hold up after recovering from cycle lows earlier this month. We’re looking at average daily ranges in bitcoin and ether of $667 and $44 respectively. |

| Latest industry news |

|

We haven’t seen much movement at all in recent sessions, with crypto assets confined to some very tight consolidation. Technically speaking, we have traded back down into a critical support zone (bitcoin $25k area), which could encourage the prospect for a bounce. However, for the moment, there are two drivers of weakness worth highlighting. One of these drivers comes from all things global macro, while the other is more specific to crypto assets. On the macro front, rates have been driving higher, all while the global growth outlook sours and inflation remains a concern. Ultimately, this has resulted in broad based US Dollar demand as yield differential move in the Buck’s favor. On the crypto front, we believe seasonality could be playing a part. September has not been a strong month for bitcoin. Over the past ten years, there have been only two profitable September performances. Clearly this is doing very little to inspire speculative demand. In the interim, we continue to wait for the SEC to move forward with the approval of bitcoin ETFs following the latest delays. On Tuesday, Grayscale upped the pressure on the SEC, seeking a meeting to push for the approval of its ETF application. |

| LMAX Digital metrics | ||||

|

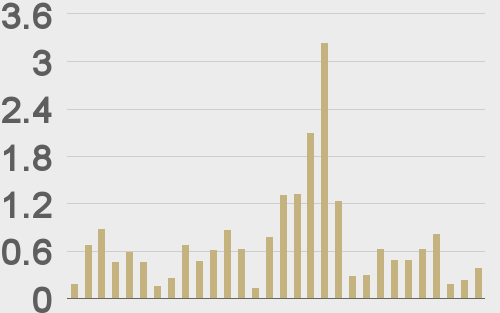

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

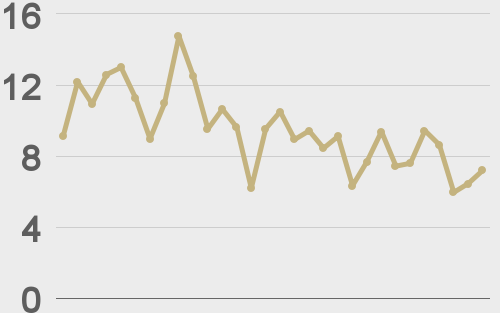

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

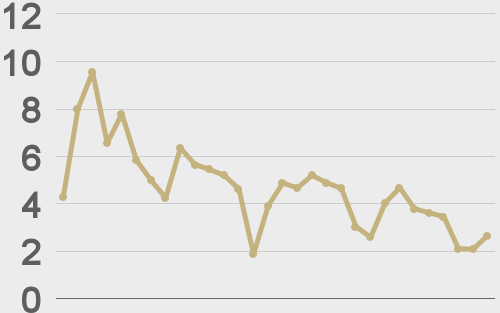

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||