|

|

20 May 2025 Setbacks well supported |

| LMAX Digital performance |

|

LMAX Digital volumes were impressive as the week got going. Total notional volume for Monday came in at $647 million, 48% above 30-day average volume. Bitcoin volume printed $277 million, 30% above 30-day average volume. Ether volume came in at $187 million, 86% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,551 and average position size for ether at $2,248. Bitcoin volatility continues to be rather subdued, just off recent yearly low levels, while ETH volatility has nearly doubled since bottoming out earlier this month. We’re looking at average daily ranges in bitcoin and ether of $2,783 and $155 respectively. |

| Latest industry news |

|

The cryptocurrency market started the week under a little pressure, driven by high leverage liquidations and a bitcoin selloff, exacerbated by global macro headwinds like Moody’s U.S. credit downgrade and a spike in 30-year Treasury yields. However, bitcoin has since recovered impressively, supported by a broader risk asset stabilization and healthy demand from medium and longer-term players into dips as we had outlined in our Monday note. Overall, the crypto market remains robust, with bitcoin holding above $100,000, bolstered by strong spot ETF inflows, whale accumulation, and a Fear and Greed Index at 71. The market’s resilience is further underpinned by institutional adoption, highlighted by JPMorgan CEO Jamie Dimon’s announcement that the bank will allow clients to purchase bitcoin, relying on third-party custodians, marking a significant step in institutional normalization. Meanwhile, positive regulatory developments, including the U.S. Senate advancing a stablecoin bill and Coinbase’s S&P 500 inclusion, are reinforcing mainstream acceptance, countering macro pressures from cautious Federal Reserve commentary. The latest recovery also aligns with broader market dynamics, as risk assets stabilize and tariff-related concerns from U.S.-China trade tensions ease, though lingering Fed patience on rate cuts until September 2025 could be slowing some of the upside momentum. |

| LMAX Digital metrics | ||||

|

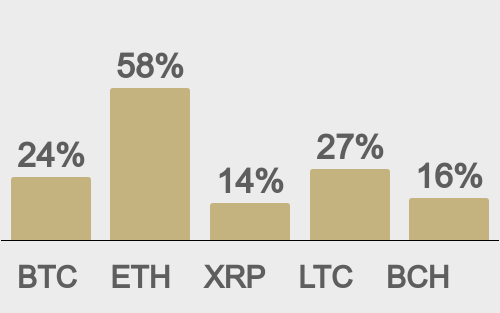

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

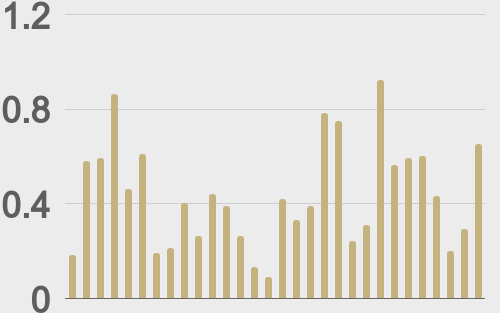

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

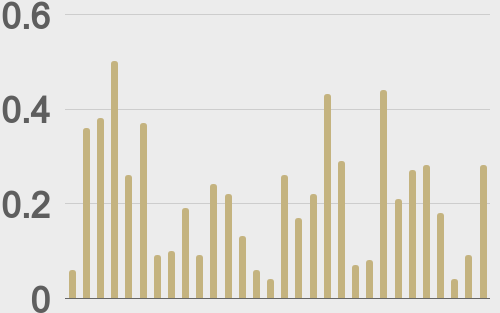

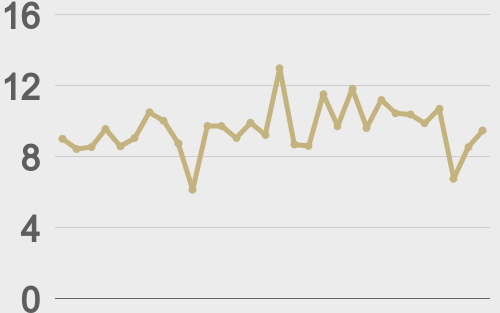

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

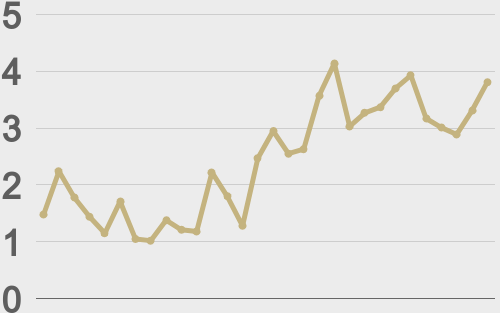

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@woonomic |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||