|

|

30 May 2024 Short-term headwinds |

| LMAX Digital performance |

|

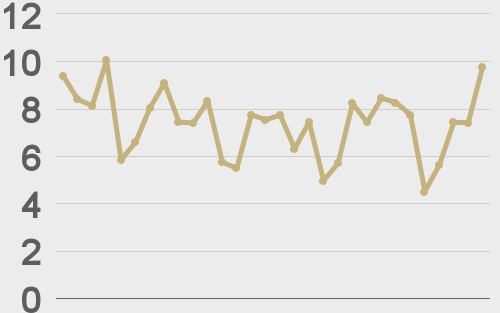

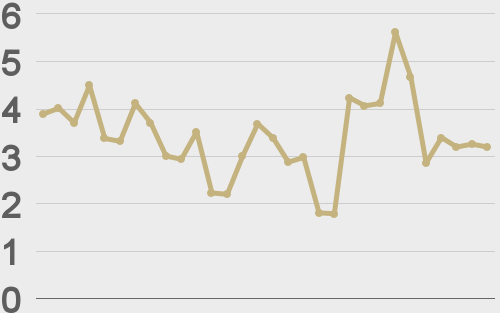

LMAX Digital volumes have been improving all week and continue to trend back towards 30-day average volume levels. Total notional volume for Wednesday came in at $359 million, 19% below 30-day average volume. Bitcoin volume printed $151 million, 37% below 30-day average volume. Ether volume came in at $156 million, 13% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,848 and average position size for ether at $3,730. Bitcoin volatility continues to trend lower since peaking in March. Ether volatility has however shown signs of turning back up in recent sessions. We’re looking at average daily ranges in bitcoin and ether of $2,386 and $168 respectively. |

| Latest industry news |

|

The medium and longer-term outlook remains exceptionally bright for crypto assets. But at the moment, we are seeing some headwinds on the shorter-term time frame that have been weighing on the market. We see these headwinds compounded by the fact that they are coming from both the technical and fundamental fronts. On the technical side, the bitcoin chart has been rolling over after stalling out ahead of the recent record high. And while the pullback remains within a strong uptrend, the chart shows the possibility for more weakness in the sessions ahead before we get that next big push to the topside. On the fundamental side, we believe a lot of this latest downside pressure is coming from the world of traditional markets. In recent days, US economic data has come out better than expected, all while Fed officials have been on the wires with less dovish speak. This combination is a combination that has translated to a repricing of Fed rate cut bets, in the direction of less investor friendly monetary policy. As of today, the market is pricing less than 30 basis point of rate cuts from the Fed in 2024. And the resulting price action has been risk off in nature, with yield differentials moving back to the US Dollar, currencies selling off, and stocks taking a turn for the worse. All of this has spilled over into the world of crypto, which has been a beneficiary of what has mostly been a risk supportive backdrop in 2024. Ultimately, there is a place where crypto assets can outperform traditional assets. We also believe traditional investors will find a way to pressure the Fed back into more accommodative policy. So on net, we are seeing some downside pressure in crypto right now. But the takeaway, both technically and fundamentally is that any weakness we see should be short-lived. |

| LMAX Digital metrics | ||||

|

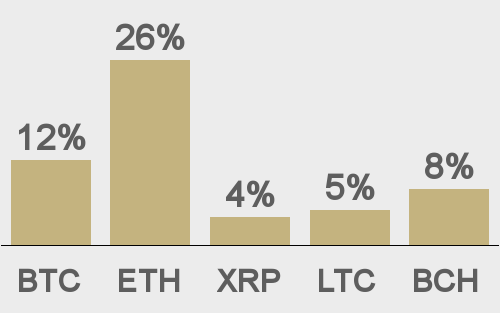

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

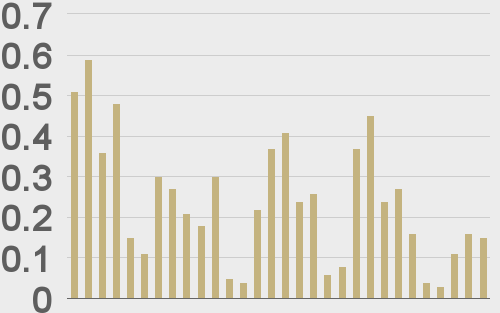

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||