|

| 1 October 2025 Stage set for Q4 breakout |

| LMAX Digital performance |

LMAX Digital volumes were impressive overall on Tuesday. Total notional volume came in at $651 million, 21% above 30-day average volume. Bitcoin volume printed $326 million, 49% above 30-day average volume. Ether volume came in at $178 million, 7% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,900 and average position size for ether at $3,742. Bitcoin volatility is attempting to bottom out off the lowest levels of the year. ETH volatility is also looking to stabilize after a period of cool down off multi-month highs. We’re looking at average daily ranges in bitcoin and ether of $2,278 and $166 respectively. |

| Latest industry news |

Bitcoin spent September consolidating beneath its summer peak, with price action choppy but ultimately resilient. It did not break to fresh highs, but repeated defenses of support underlined strong underlying demand, aided by ongoing ETF inflows and institutional allocations. The tone was one of patience—investors waiting for the next macro or regulatory catalyst to ignite another leg higher. Ethereum mirrored bitcoin’s consolidation but retained a constructive bias, holding above the $4,000 threshold for much of the month. ETF demand, improving network efficiency, and continued corporate treasury interest in ETH reinforced its role as the utility-driven counterpart to bitcoin’s store-of-value narrative. While not as explosive as earlier in the year, ETH’s relative stability reflects healthy positioning heading into Q4. September also brought a pause in broader risk sentiment as investors digested U.S. fiscal risks and the threat of a government shutdown, while Fed policy speculation kept rates in focus. Despite these headwinds, crypto markets weathered the uncertainty well, underscoring their growing resilience. Geopolitically, tentative signs of progress in the Middle East were framed as a constructive potential catalyst, with any move toward normalization of ties carrying implications for cross-border flows and new investment channels. Looking ahead, the setup for October and Q4 is historically favorable. Bitcoin has delivered positive October returns in 10 of the past 12 years, and Q4 remains by far the strongest seasonal stretch for the asset class. Against the backdrop of an extraordinary year for crypto—marked by ETF approvals, regulatory clarity, corporate adoption, and record institutional engagement—the stage is set for another strong finish. With both bitcoin and ETH consolidating just below record highs, conditions appear ripe for fresh all-time highs before year-end. |

| LMAX Digital metrics | ||||

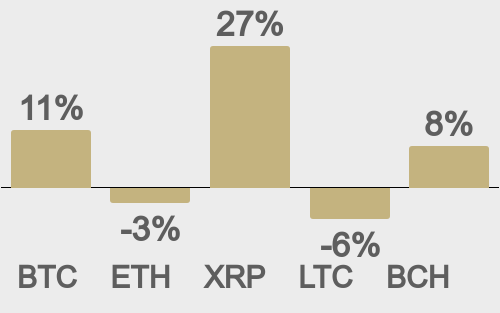

| Price performance last 30 days avg. vs USD (%) | ||||

| ||||

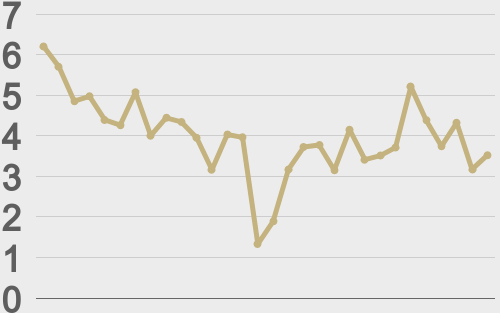

| Total volumes last 30 days ($bn) | ||||

| ||||

| BTCUSD volumes last 30 days ($bn) | ||||

| ||||

| BTCUSD avg. trade size last 30 days ($k) | ||||

| ||||

| ETHUSD avg. trade size last 30 days ($k) | ||||

| ||||

| Average daily range | ||||

| ||||

| ||||

@TheBlock__ | ||||

@TheBlock__ | ||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||