|

|

| Stock market slide hits crypto |

| LMAX Digital performance |

|

LMAX Digital volumes were off quite a bit on Wednesday, with summer trade and tight ranges keeping most participants on the sidelines. Total notional volume for Wednesday came in at an anemic level of $564 million, down about 50% from 30-day average volume. But into Thursday, that story has been changing in a big way, as short-term levels get broken, forcing many traders back into the market. Volumes have already exceeded Wednesday levels at this point in the day and we suspect Thursday will be a big day when the dust settles. Total notional volume at LMAX Digital over the past 30 days comes in at $35 billion. Average trading size for Bitcoin over the past 30 days comes in at $9,079. Average trading size for Ether over the past 30 days comes in at 4,004. The average daily trading range for BTCUSD is $2,424. The average daily trading range for ETHUSD is $201. |

| Latest industry news |

|

The crackdown in China continues to get a lot of attention, but as we’ve already highlighted this week, we believe most of the downside risk associated with this storyline has been priced in. At the same time, this doesn’t mean there isn’t other downside risk to consider. The crypto market has taken a hit on Thursday and we believe a lot of this hit can be reconciled by the deterioration in global risk sentiment and pullback in US equity futures. Crypto is still viewed as an emerging asset class, which makes it somewhat vulnerable to periods of risk off. Technically speaking, there isn’t all that much to talk about as far as this latest pullback being significant. Both Bitcoin and Ether are still very much confined to familiar ranges, both consolidating off recent lows. Bitcoin and Ether would need to break back below their respective June lows at $28,800 and and $1,700 to suggest we’re seeing another wave of meaningful downside pressure that could open bigger declines. Until then, we’re still just consolidating. Institutional demand has picked up in a big way in 2021, and now that the initial wave of parabolic price action has run its course and we are in the throes of a very healthy correction, there is plenty of interest from these players to start building more meaningful exposure. |

|

LMAX Digital metrics |

||||

|

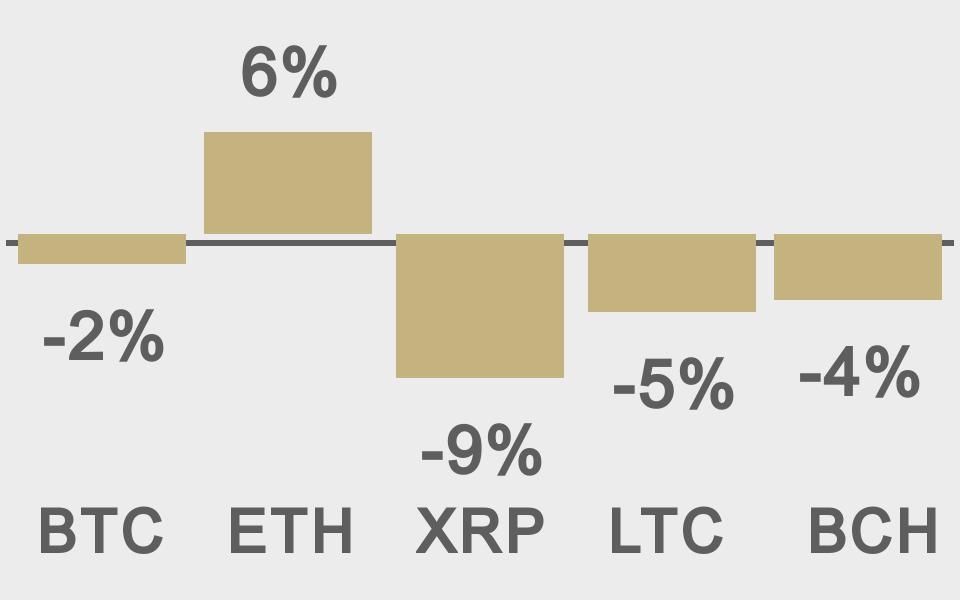

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

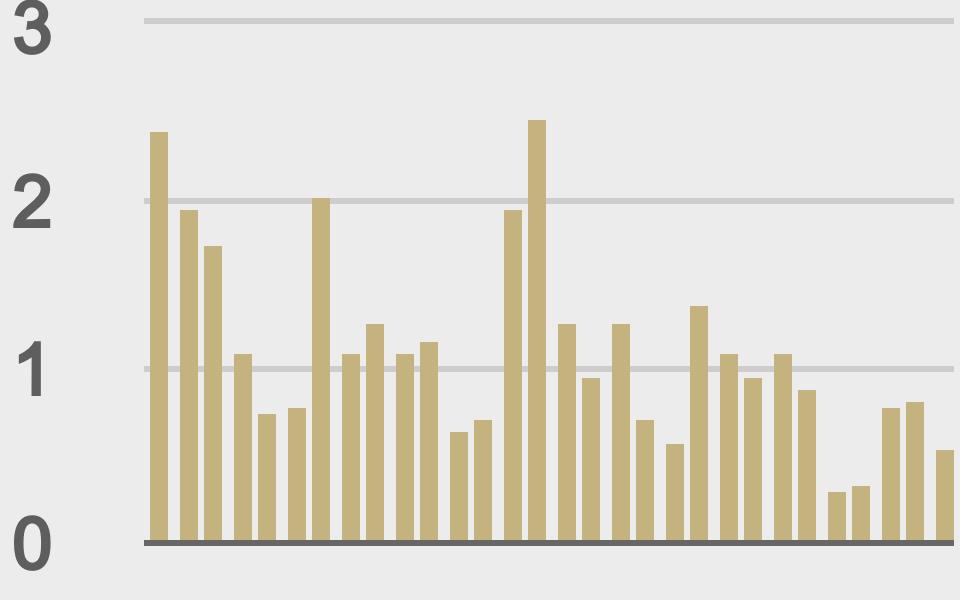

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

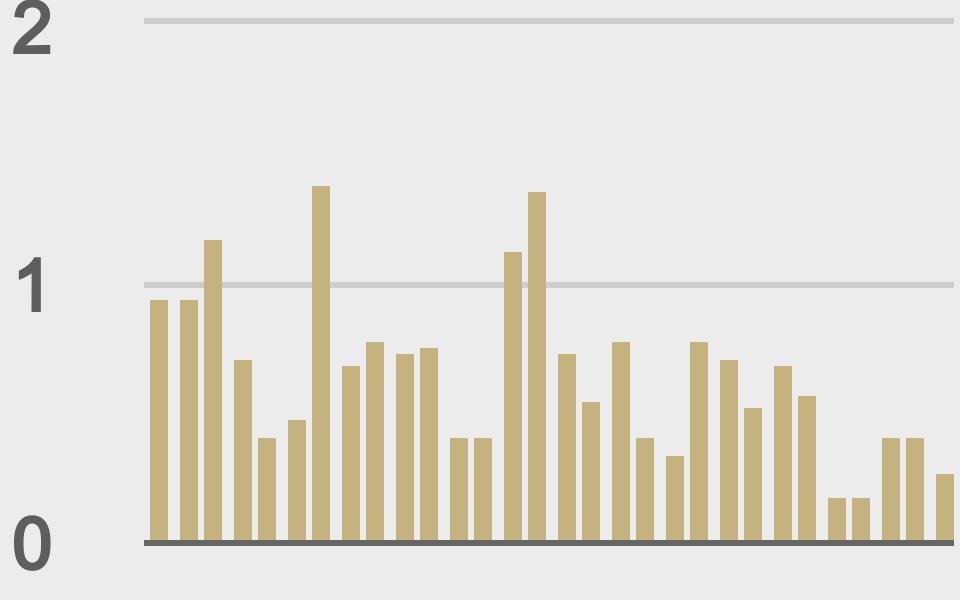

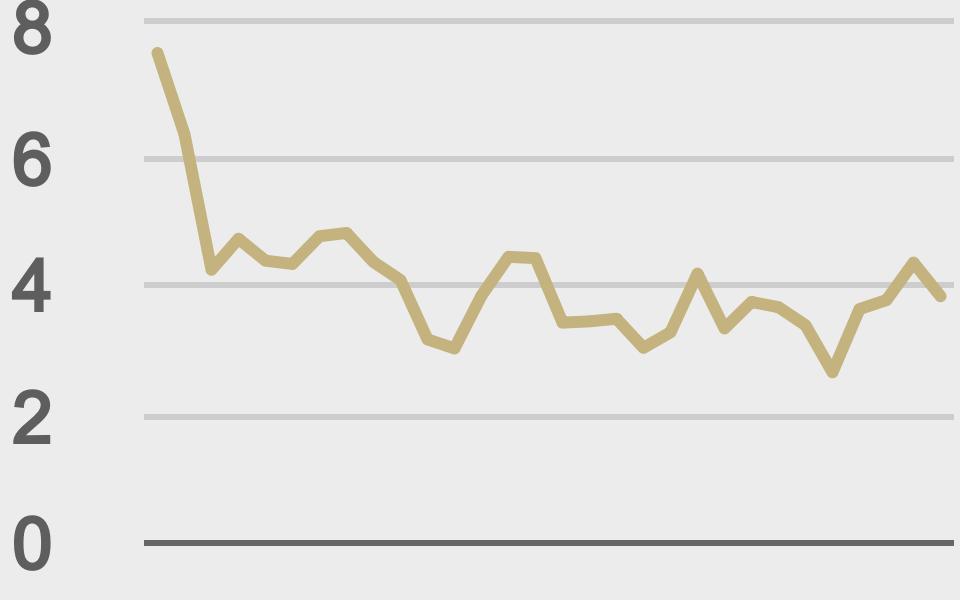

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

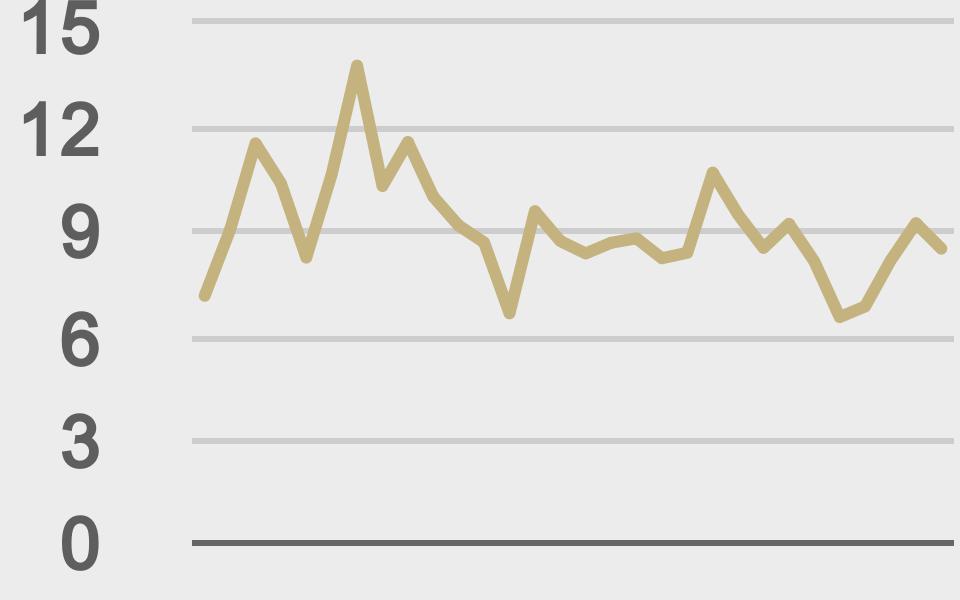

| Average daily range | ||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||