|

|

31 May 2023 Stuck in consolidation |

| LMAX Digital performance |

|

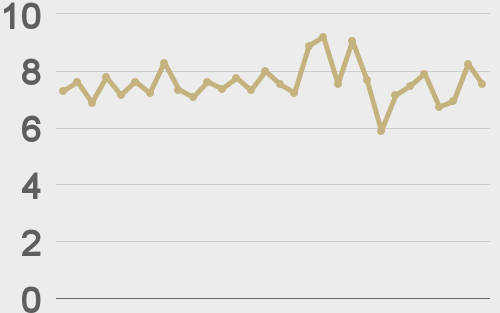

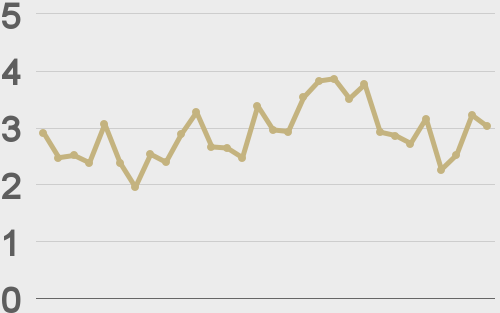

LMAX Digital volumes cooled off just a bit on Tuesday. Total notional volume for Tuesday came in at $321 million, 6% below 30-day average volume. Bitcoin volume printed $157 million on Tuesday, 20% below 30-day average volume. Ether volume held up decently, printing $99 million, 3% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,495 and average position size for ether at 2,813. Volatility has been trending lower in correction mode after peaking out at a yearly high in March. We’re looking at average daily ranges in bitcoin and ether of $818 and $57 respectively. |

| Latest industry news |

|

There doesn’t appear to be anything other than global macro headlines driving crypto prices right now. We haven’t had any market moving updates within the space and the focus has shifted back to bigger picture stories away from crypto. And so, we would attribute the latest slide in crypto prices to a coinciding slide in risk assets and rally in the US Dollar, as the market looks for comfort in more secure assets. There had been a move higher in stocks on the back of optimism around the US debt ceiling deal, but all of this has faded away as the reality of higher rates and a slower global economy comes back to the forefront. On a positive note, gold’s move higher amidst all of the risk off flow should be encouraging for crypto prices. A higher gold price shows the market wanting to diversify into the yellow metal, which ultimately shares many of the same attributes as bitcoin. In fact, we’ve long argued the value of bitcoin as a scarcer asset with more intrinsic value is something that should result in a higher price during times of uncertainty, as the cryptocurrency matures. Technically speaking, the latest topside failure puts the focus back on a bigger picture consolidation going on in the price of bitcoin. And so while we have moved lower, we haven’t really gone anywhere at all just yet. |

| LMAX Digital metrics | ||||

|

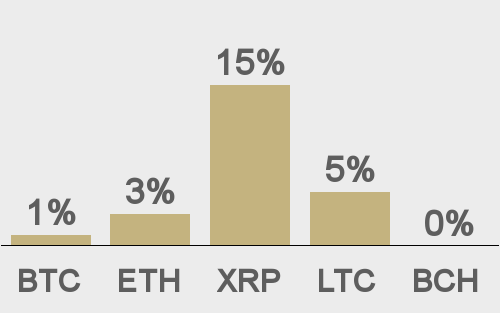

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

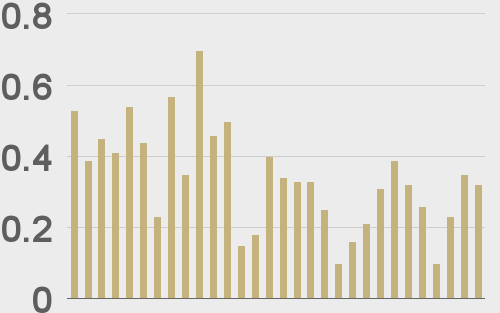

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

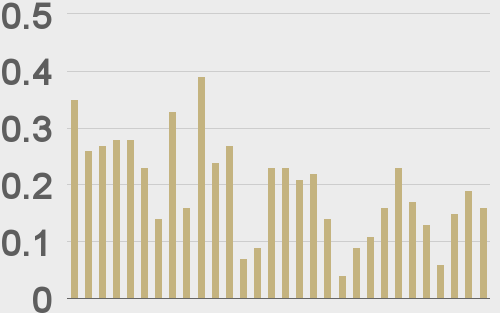

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||