|

|

18 September 2024 Taking a step back |

| LMAX Digital performance |

|

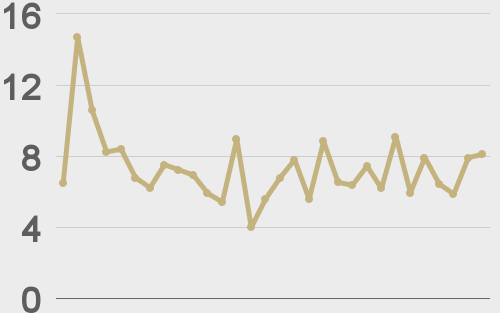

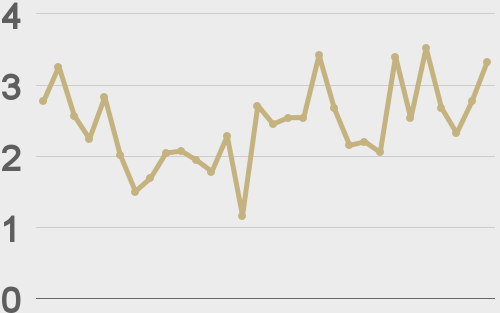

LMAX Digital volumes recovered nicely after a slower start to the week. Total notional volume for Tuesday came in at $359 million, 20% above 30-day average volume. Bitcoin volume printed $230 million on Tuesday, 27% above 30-day average volume. Ether volume came in at $82 million, 13% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,647 and average position size for ether at $2,484. Market volatility has cooled off dramatically in recent weeks. We’re looking at average daily ranges in bitcoin and ether of $2,294 and $116 respectively. |

| Latest industry news |

|

All eyes are on today’s Fed decision, though correlations between crypto and traditional markets have been less relevant in recent weeks. Over the past several weeks, we’ve seen the US Dollar under pressure and stocks pushing back to record highs, all while bitcoin and ETH track sideways. Gold has also broken to its own record high this week, another potential driver of bitcoin demand. And yet, bitcoin has failed to respond to this move as well. Nevertheless, we fully expect there to be crypto volatility in the aftermath of today’s Fed policy decision. The big question right now is whether or not the Fed goes ahead with a 50-basis point rate cut. Calls for this larger cut have been louder in the lead up, with the market pricing a 65% chance the Fed goes ahead with 50. But even if the Fed plays it more conservative with a 25 basis point rate cut, we believe such a move will still be accompanied by enough dovishness in the communication to keep the market feeling good about investor friendly monetary policy. As far as crypto specific headlines go, Microstrategy is back at it. The company has announced its plan to sell up to $700 million in convertible senior notes to buy back debt and increase its bitcoin exposure. One final note for today’s update. It’s important to always take a step back and look at the bigger picture. Indeed, bitcoin has been choppy of late. At the same time, year-to-date, bitcoin (+42%) is still far and away the stronger performer relative to gold (+19%) and the S&P500 (+14%). |

| LMAX Digital metrics | ||||

|

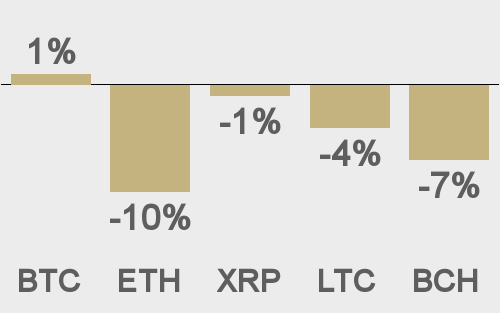

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||