|

| 15 January 2026 Taking the noise in stride |

| LMAX Digital performance |

|

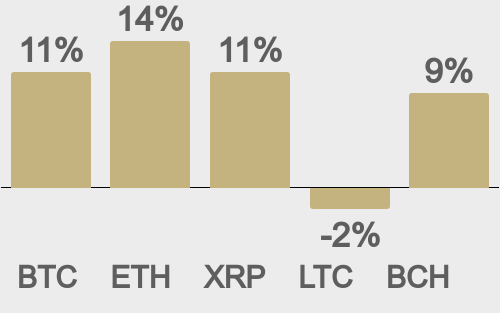

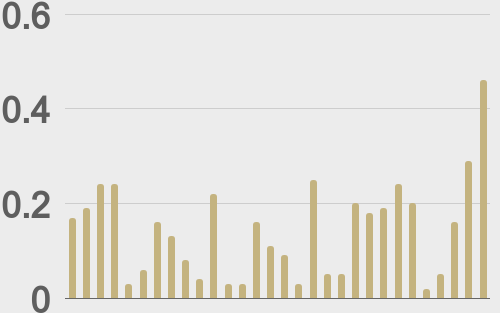

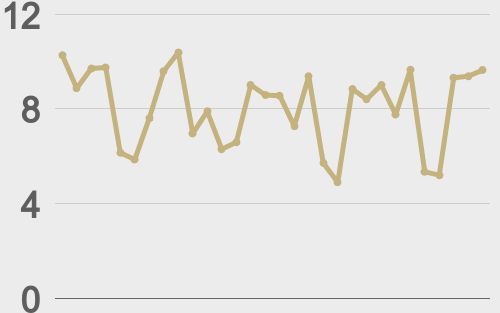

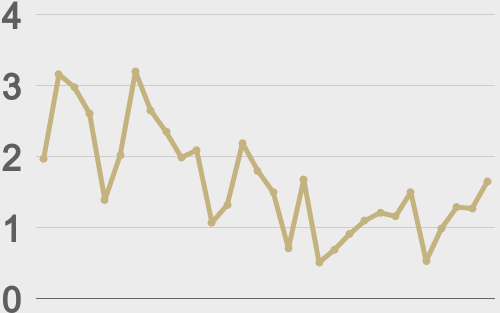

LMAX Digital volumes accelerated further on Wednesday, with total notional turnover reaching $701 million — the strongest daily performance since early December and 176% above 30-day average volume. Bitcoin volume printed $456 million, 214% above 30-day average volume. Ether volume came in at $124 million, 133% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,609 and average position size for ether at $1,473. Bitcoin and ETH volatility is starting to show signs of bottoming out after trending lower for several weeks. We’re looking at average daily ranges in bitcoin and ether of $2,521 and $119 respectively. |

| Latest industry news |

|

Bitcoin has traded with a slightly softer tone over the past 24 hours, easing modestly after its decisive break through the key 95k resistance level earlier in the week. The move higher earlier in the week marked an important technical milestone and helped reassert the broader bullish trend. While some profit-taking has emerged as the market digests the breakout, price action has held up well against a more cautious broader risk backdrop. The ability to remain supported above former resistance suggests underlying demand remains firm. Ethereum has lagged somewhat, with price still struggling to clear the important $3,500 resistance zone. The failure to confirm a breakout alongside bitcoin has capped near-term momentum across large-cap crypto. That said, a clean move through this level would likely provide an important catalyst for a renewed leg higher and help reinforce confidence in the broader market rally. Traditional markets have added to the near-term caution, with US equities closing lower on Wednesday and risk appetite cooling more broadly. This has spilled over into crypto amid still-elevated correlations during periods of macro uncertainty, while geopolitical risks are also back on the upswing. In addition, sentiment has been weighed by growing unease around the latest draft of proposed US crypto market structure legislation, which is seen as less supportive for the industry than hoped. Even so, the market has shown impressive resilience in the face of these headwinds, with downside pressure contained and dip-buying interest clearly evident. |

| LMAX Digital metrics | ||||

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@Cointelegraph |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||