|

| 6 November 2025 Textbook pullback within a bigger bull |

| LMAX Digital performance |

|

LMAX Digital volumes were healthy on Wednesday. Total notional volume came in at $773 million, 8% above 30-day average volume. Bitcoin volume printed $445 million, 21% above 30-day average volume. Ether volume came in at $204 million, 9% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,722 and average position size for ether at $3,456. Bitcoin and ETH volatility have been on the rise in recent sessions, pushing back towards multi-month highs. We’re looking at average daily ranges in bitcoin and ether of $3,921 and $230 respectively. |

| Latest industry news |

|

As we’ve emphasized throughout the week, the latest bout of weakness still looks very much like a healthy correction within a broader and highly constructive uptrend. Despite the elevated fear and uncertainty, the tone of sentiment appears misplaced when viewed against price action that continues to reward investors who approach these pullbacks as opportunities rather than threats. We have been highlighting the 50-week simple moving average as the first meaningful support for bitcoin. Since breaking above this level in 2023, the market has not closed a week below it. While there have been two breaches, both were followed by swift recoveries and weekly closes back above the indicator. The pattern has repeated itself again: bitcoin briefly slipped through the 50-week SMA and momentarily dipped below the psychological $100k level before rebounding sharply and reclaiming the moving average. From here, we are watching for this to form the next important higher low, with confirmation coming via a weekly close tomorrow above the 50-week SMA at roughly $103k. If this holds, it would set the foundation for a broader rebound across the crypto complex after what has been a textbook pullback. Seasonality also works in crypto’s favor: Q4 has historically delivered strong performance, and this year’s backdrop of accelerating adoption, regulatory progress, and continued institutional development only reinforces the potential for a strong finish to 2025. Macro conditions are becoming more supportive as well. The recent run-up in the US Dollar, driven by a less accommodative tone from the Fed, had temporarily widened yield differentials in favor of the dollar. But the larger pattern remains intact: when forced to choose, the Fed has consistently leaned toward accommodation. With the dollar’s surge showing signs of exhaustion, the broader pressure for additional rate cuts should reassert itself, helping create a more favorable risk environment and improving demand for crypto assets. From a technical standpoint, the Dollar Index remains in a broader downtrend, and just as we expect crypto’s uptrend to resume, we anticipate the dollar’s downtrend to re-emerge. Risk appetite has also been buoyed by renewed buying interest in US equities following a brief dip, adding another supportive factor for crypto. All told, we are looking for a strong weekly close in bitcoin to anchor the next leg higher and set the stage for a robust run into year-end—one that could easily carry bitcoin and ETH to fresh record highs. |

| LMAX Digital metrics | ||||

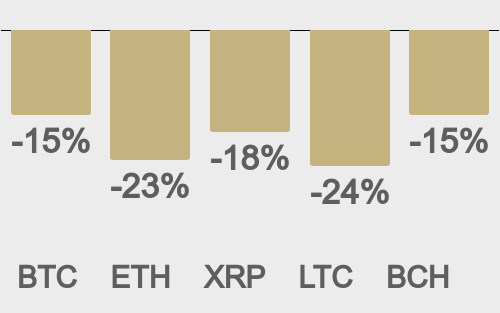

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

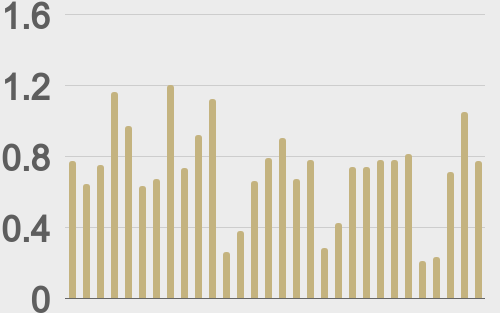

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

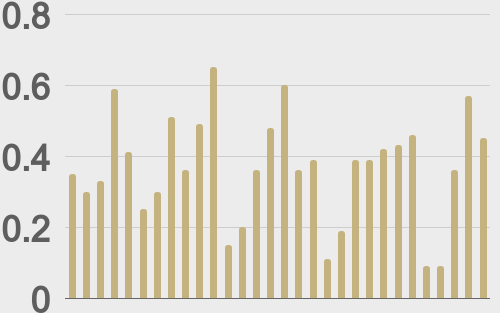

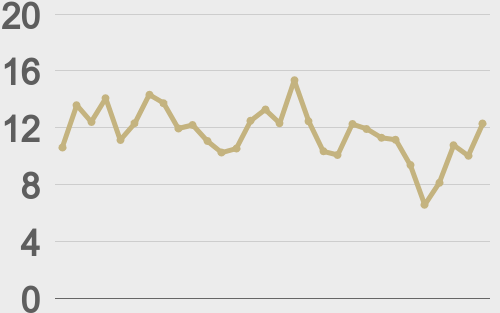

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

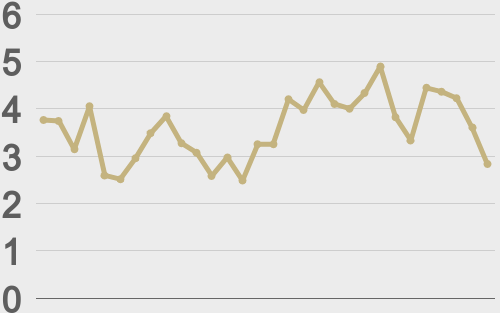

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@woonomic |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||