|

|

12 January 2022 The not so scary death cross |

| LMAX Digital performance |

|

LMAX Digital volume cooled off on Tuesday after a strong start to the week. Total notional volume for Tuesday came in at $636 million, 6% below 30-day average volume. Bitcoin volume printed $366 million on Tuesday, 3% above 30-day average volume. Ether volume came in at $193 million, 16% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,126 and average position size for ether at 6,735. Volatility has been trending lower into 2022. We’re now looking at average daily ranges in bitcoin and ether of $2,167 and $216 respectively. |

| Latest industry news |

|

There’s been plenty of bearish talk out there because of warnings out from the world of technical analysis. Those warnings are around a potential death cross in bitcoin, with the 50-day moving average coming dangerously close to crossing down below the 200-day SMA. But we would take this bearish warning with a grain of salt. We think there isn’t enough of a matured bitcoin market to be reading too much into death crosses, and whatever we do have to look at in bitcoin’s short history, doesn’t exactly point to the death cross resulting in devastatingly bearish performance. The other reason we think this should be taken with a grain of salt is that we have yet to see any actual cross. While we do believe short term fundamentals could open more downside pressure in the price of bitcoin in the days and weeks ahead, we also believe there will be strong demand from medium and longer-term players into dips down towards $30,000. As far as the bearish short-term fundamentals go, those revolve around the Fed policy trajectory and if the Fed is indeed forced into a more aggressive rate hike path on account of rising inflation. Today’s US inflation data will be important to keep an eye on. If the data comes in above forecast, this could open renewed downside pressure on stocks, which could then once again weigh on bitcoin. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

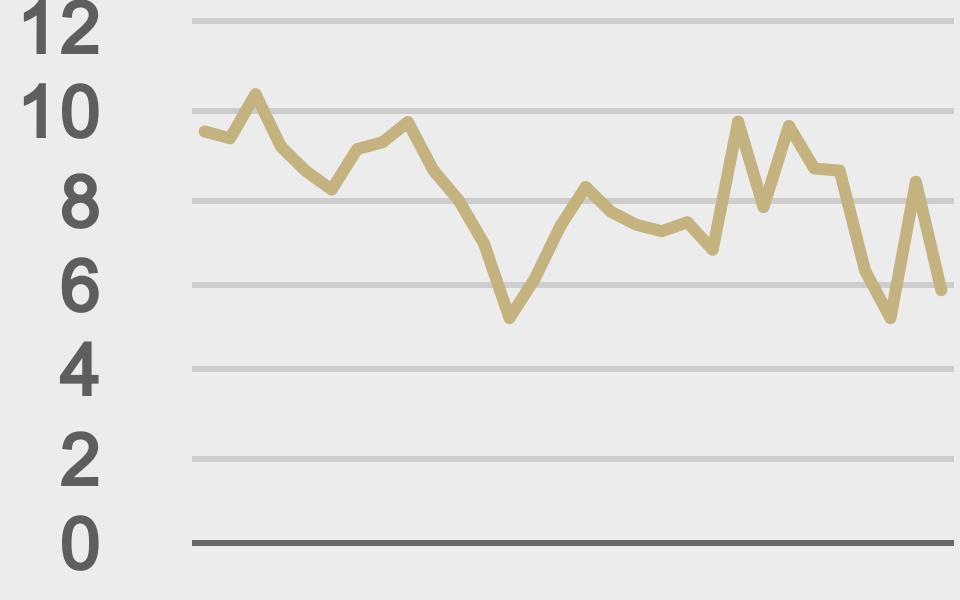

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

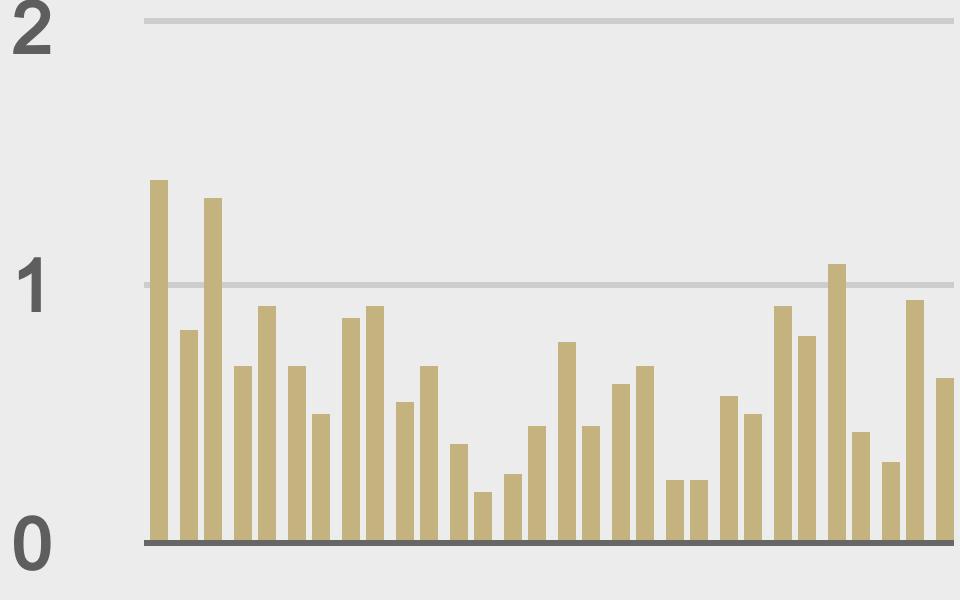

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

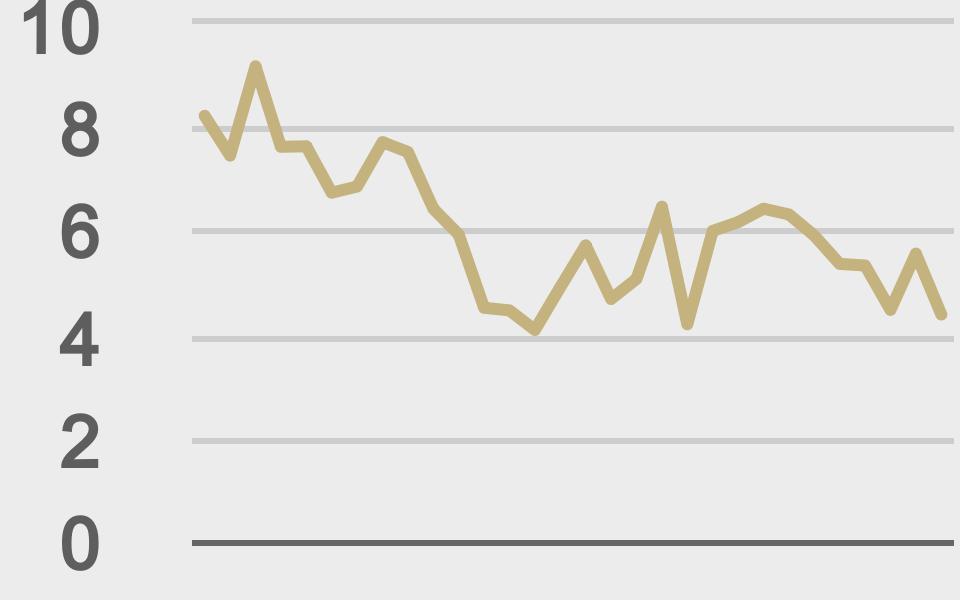

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||