|

|

27 March 2023 The supportive fundamental backdrop |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital was solid in the previous week but did cool off from a week earlier. Total notional volume from last Monday through Friday came in at $3.1 billion, 20% lower than the week earlier. Breaking it down per coin, Bitcoin volume came in at $1.8 billion in the previous week, 27% lower than the week earlier. Ether volume came in at $776 million, 11% lower than the week earlier. Total notional volume over the past 30 days comes in at $14.7 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,200 and average position size for ether at $3,397. Volatility has also turned up nicely in recent sessions, trading back into yearly high levels. We’re looking at average daily ranges in bitcoin and ether of $1,254 and $83 respectively. |

| Latest industry news |

|

The ability for bitcoin to continue to hold up and outperform, especially in the face of this latest banking turmoil in traditional markets, has been exceptionally impressive. The big takeaway is just how much all of the fear around the banking sector has shed a positive light on bitcoin. Market participants have become more inclined to reconsider their views of the asset given the draw of security, self-custody, and extreme limited supply. There have also been calls out there about the price of bitcoin reaching $1 million, which have only added to the buzz around the cryptocurrency, perhaps propping it up that much more. Moreover, there have been a number of stories around players that have been in the crypto space for quite some time, who have been using recent days to build up already healthy position exposure. Technically speaking, that recent break above $25k was significant, and the subsequent hold above this psychological barrier has been even more encouraging with respect to the probability the market has established the next higher platform ahead of the start to a run back towards and eventually through the record high. Any setbacks we do see over the coming sessions should now be well supported ahead of $20k, with the previous resistance turned support at $25k ideally serving as a place where buyers will look to reassert. |

| LMAX Digital metrics | ||||

|

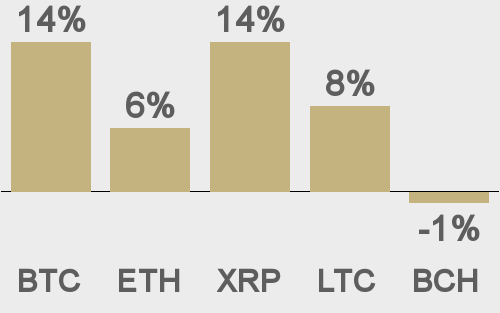

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

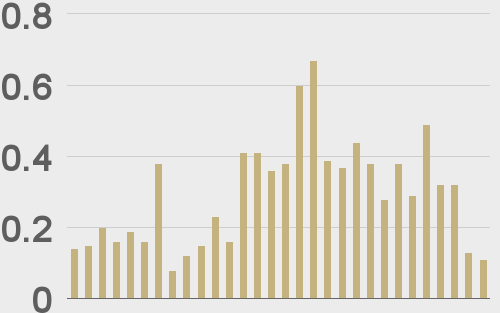

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

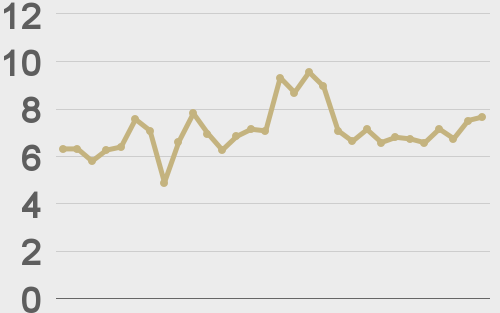

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||