|

|

9 November 2023 They’re calling it a short squeeze |

| LMAX Digital performance |

|

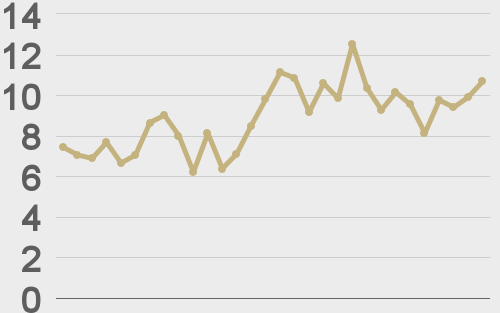

LMAX Digital volumes were off from Tuesday levels but still managed to hold up just above 30-day average volume. Total notional volume for Wednesday came in at $314 million, 1% above 30-day average volume. Bitcoin volume printed $219 million on Wednesday, 7% above 30-day average volume. Ether volume was however anemic, coming in at just $53 million, 27% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,123 and average position size for ether at $2,758. Volatility is showing signs of picking up after a period of consolidation following a rally out from multi-month lows in August. We’re looking at average daily ranges in bitcoin and ether of $1,085 and $56 respectively. |

| Latest industry news |

|

We’ve been highlighting a wave of bullish momentum in recent weeks. Bitcoin’s breakout in October to a fresh yearly high set the stage for this latest round of gains, and after a short period of consolidation, the market has once again continued to climb. The initial target for this run comes in at $40,000, which is both a major psychological barrier and measured move extension target following the consolidation that had been in play between March and October. Fundamentally speaking, we have seen increased optimism around expectation for an SEC approval of bitcoin spot ETFs, all while investors turn their attention to the halving of 2024 and all of the bullish narratives around that event. A report from Bloomberg analysts suggesting the possibility for a more imminent ETF approval in the days ahead, has fueled even more buying interest over the past 24 hours. We’ve also seen an uptick in stablecoin issuance, which reflects a healthy appetite for crypto assets. October was the first month showing a net increase in stablecoin issuance after more than a year of contraction, and the pace has only accelerated into November. Meanwhile, on a bigger picture macro scale, there has been an increased appreciation for bitcoin’s value proposition, both as an emerging, maturing asset, and as a store of value play. This puts bitcoin in the unique position of finding bids in any and all market conditions. As far as the latest Thursday surge to another yearly high goes, there has been a lot of talk around a short squeeze in the market, with reports surfacing of over $62 million in bitcoin shorts getting liquidated on the break above $36,000. |

| LMAX Digital metrics | ||||

|

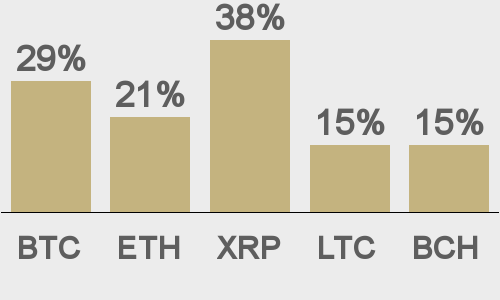

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

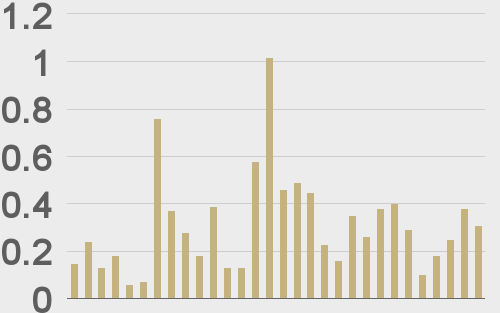

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||