|

|

9 January 2023 Things are looking up |

| LMAX Digital performance |

|

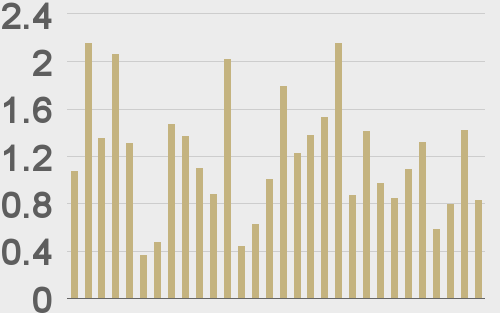

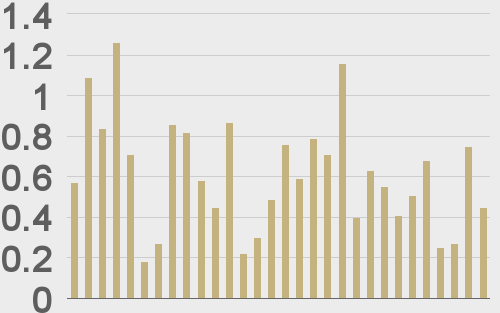

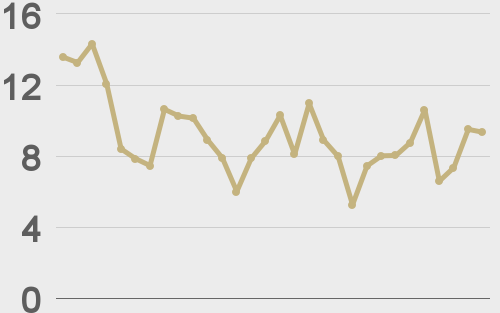

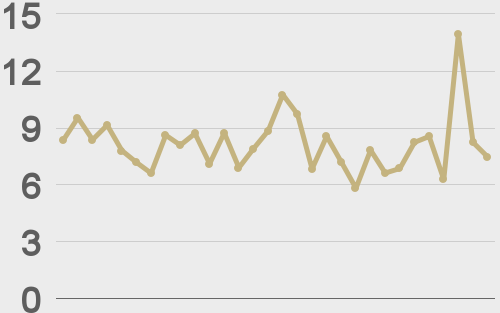

Total notional volume at LMAX Digital was up a nice amount in the previous week. Total notional volume from last Monday through Friday came in at $1.1 billion, 39% higher than the week earlier. Breaking it down per coin, Bitcoin volume came in at $570 million in the previous week, up 22.5% from a week earlier. Ether volume came in at $237 million, 19% higher from the week earlier. Total notional volume over the past 30 days comes in at $5.22 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $4,472 and average position size for ether at $1,777. Volatility is still suppressed at multi-month lows. We’re looking at average daily ranges in bitcoin and ether of $271 and $34 respectively. At the same time, this could be a warning sign of a major surge in volatility ahead. |

| Latest industry news |

|

Things have been looking up for cryptocurrencies as the year gets going. At the moment, there are three primary drivers of the latest push higher. The first driver is all about volume. As much as volumes are still low, things have started to move back in the right direction. As per the overview in today’s LMAX Digital performance section, we have seen volumes pushing back well above previous weekly levels. The second driver of the more bullish price action is global macro fundamentals. This past Friday, the market got that Goldilocks jobs report in which the headline NFP was strong, while the average hourly earnings were soft. All of this helps to paint a picture in which things are good and inflation could be peaking out, which means a pivot back to more investor friendly monetary policy. Finally, there has been a wave of increased optimism around the news of withdrawals from Ethereum staking being enabled in Q1 2023. The view here, beyond the obvious that this is a positive development, is that it will also open up a lot more liquidity in the system as assets are unlocked that were previously frozen. |

| LMAX Digital metrics | ||||

|

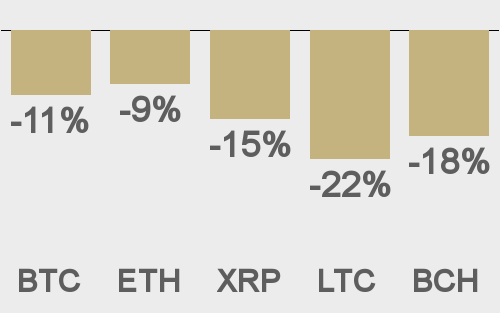

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||