|

|

14 March 2024 This crypto asset is still looking to make a fresh record high |

| LMAX Digital performance |

|

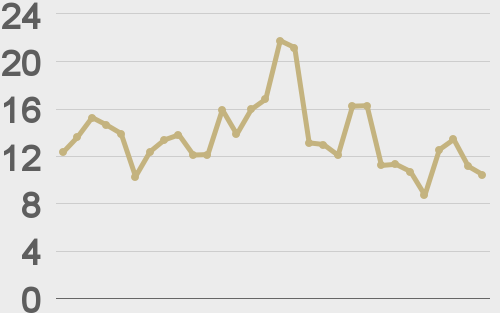

LMAX Digital volumes for Wednesday cooled off from Monday and Tuesday’s elevated levels. Total notional volume for Wednesday came in at $720 million, 12% below 30-day average volume. Bitcoin volume printed $415 million on Wednesday, 19% below 30-day average volume. Ether volume came in at $209 million, 1% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $14,268 and average position size for ether at $4,159. Market volatility is tracking at its highest levels since 2022. We’re looking at average daily ranges in bitcoin and ether of $2,991 and $184 respectively. |

| Latest industry news |

|

Clearly, the run in bitcoin and crypto assets has been more than impressive in 2024. Bitcoin is now pushing record highs on a daily basis and continues with its climb, despite overbought technical readings that would argue otherwise. Still, this week’s quick pullback did allow for those readings to unwind a bit and while the market remains well in overbought territory, there is more room to run, with sights now set on the next psychological barrier at $80k. One of the things that could be continuing to fuel momentum is ether. It’s possible that with bitcoin having finally broken its record high from 2021, ether will be wanting to do the same during this bull move. At the moment, ether has broken back above $4k and is getting closer to that next push towards the record high from November 2021 at $4,865. And so with ether having yet to achieve this critical milestone, this could be what continues to drive momentum over the coming days. When considering developments on the macro front, while correlations between crypto and traditional assets have been lower, the fact that US equities continue to trade to record highs and overall sentiment remains elevated, certainly isn’t hurting crypto’s cause. Next week’s Fed decision will be getting a lot of attention and the market will be very interested to know what kind of tone the central bank sets in its communication – hopefully for the market’s sake, it’s an accommodative, investor friendly tone. |

| LMAX Digital metrics | ||||

|

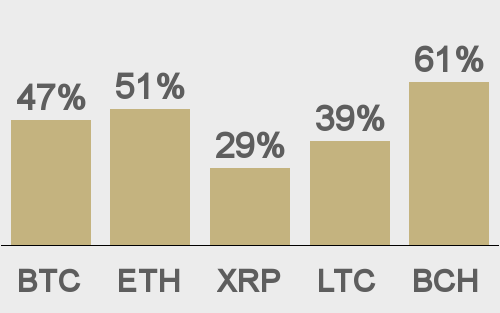

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

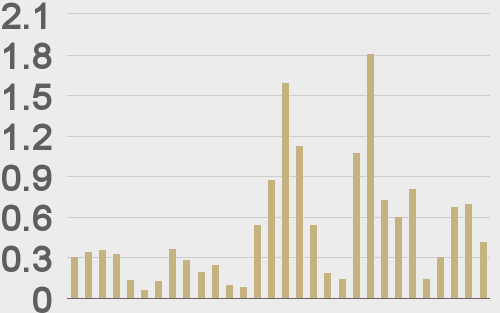

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@woonomic |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||