|

|

11 January 2022 Three takeaways from Monday’s price action |

| LMAX Digital performance |

|

LMAX Digital volume got off to a very impressive start this week. Total notional volume for Monday came in at $951 million, 40% above 30-day average volume. Bitcoin volume printed $555 million on Monday, 57% above 30-day average volume. Ether volume came in at $290 million, 22% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,032 and average position size for ether at 6,356. Volatility has been trending lower as we come into 2022. We’re now looking at average daily ranges in bitcoin and ether of $2,200 and $220 respectively. |

| Latest industry news |

|

It’s getting a little wild out there in financial markets and with that said, we have a few interesting insights and takeaways from recent price action in crypto: 1. Correlations. There’s been a lot of talk about bitcoin (crypto) being highly correlated to stocks. While this has been the case of late, this isn’t a correlation that is expected to last for anything more than the short-term. There is plenty of demand for bitcoin into dips from medium and longer-term players who recognize the value proposition of the asset as a store of value alternative to something like gold. On Monday, we got a little taste of this when stocks continued to extend declines, all while demand came flying back in for bitcoin. 2. ETHBTC. While we believe crypto will be supported even at a time when stocks are falling, this doesn’t mean that all crypto is the same. It’s critical to understand that when comparing bitcoin to ether, we are talking about comparing two very different assets. Bitcoin is more store of value, while ether is more risk correlated. And so, whenever we do see downside pressure in stocks and a deterioration in global sentiment, we should definitely be looking for ether underperformance against bitcoin, as we have been seeing. 3. Technicals. As much as the market wanted to make a big deal about the bitcoin break below $40,000 on Monday, it really wasn’t that big a deal from a technical standpoint. The big level of support for bitcoin isn’t $40,000, rather the September 2021 low at $39,600. Interestingly enough, while $40,000 was indeed broken on Monday, that September low was not, with bitcoin stalling out just ahead of $39,600. |

| LMAX Digital metrics | ||||

|

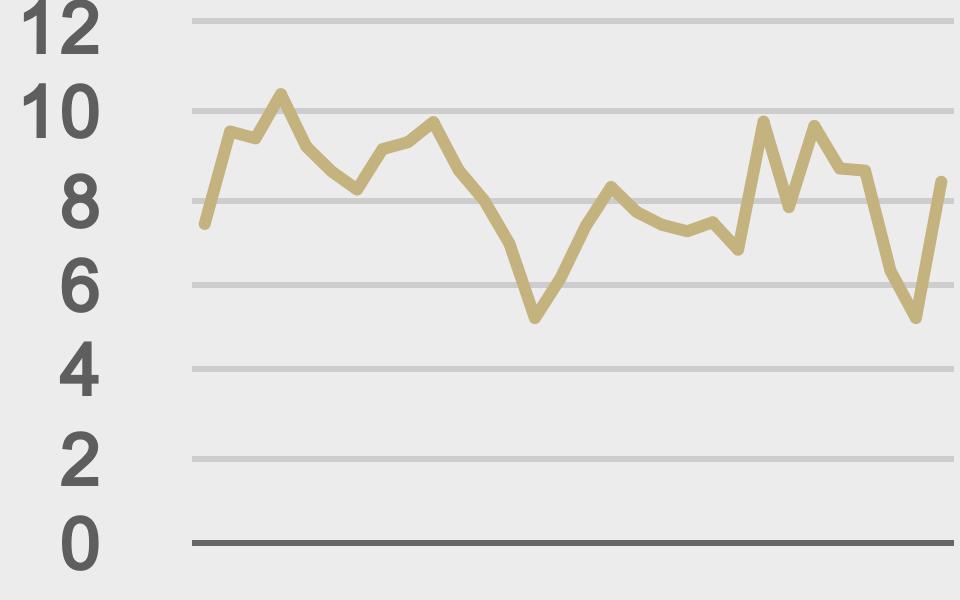

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||