|

|

18 October 2022 Tight consolidation leads to lower volume |

| LMAX Digital performance |

|

LMAX Digital volumes were soft on Monday. Total notional volume for Monday came in at 206 million, 40% below 30-day average volume. Bitcoin volume printed $117 million on Monday, 37% below 30-day average volume. Ether volume came in at $72 million, 35% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $5,818 and average position size for ether at 2,614. Volatility is still struggling to show signs of picking back up. We’re looking at average daily ranges in bitcoin and ether of $647 and $58 respectively. |

| Latest industry news |

|

Activity remains quite light as crypto markets remain confined to exceptionally tight ranges. On a positive note, bitcoin and ether held up well in the face of risk off flow from last week’s US CPI data, and have continued to find support as risk appetite attempts to return to global markets. We also continue to see signs of institutional adoption, which encourages the broader outlook despite the 2022 price declines. Nevertheless, these players are still looking for more clarity on the regulatory front, and would like to see the asset class less risky and less volatile. But as far as volatility goes, we believe these investors should be looking at the longer-term trend, which definitely shows volatility in crypto trending lower over time. In fact, crypto volatility is sitting at a yearly and multi-month low. And in recent weeks, crypto has been much less volatile than traditional financial markets. Technically speaking, we’re keeping an eye on the latest tight consolidation in bitcoin and will need to see a break above the October high, or below the October low, for clearer directional insight. Until then, the market is trading in no-man’s-land and it remains a game of wait and see. |

| LMAX Digital metrics | ||||

|

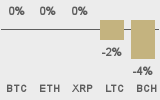

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

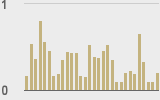

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@wealth |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||