|

| 29 July 2025 Treasury demand fueling ETH outperformance |

| LMAX Digital performance |

|

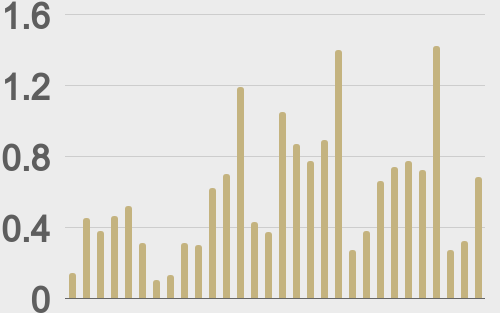

LMAX Digital volumes got off to a solid start this week. Total notional volume for Monday came in at $677 million, 15% above 30-day average volume. Bitcoin volume printed $310 million, 14% above 30-day average volume. Ether volume came in at $208 million, 39% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,851 and average position size for ether at $2,982. Bitcoin volatility continues to track just off yearly low levels. ETH volatility has picked up and has recently pushed to its highest levels since March. We’re looking at average daily ranges in bitcoin and ether of $2,719 and $167 respectively. |

| Latest industry news |

|

Over the past 24 hours, bitcoin has remained rangebound, continuing its recent pattern of consolidation as markets digest a dense macro calendar. Despite the lack of headline volatility, bitcoin remains well supported on dips, underpinned by steady institutional demand and a constructive long-term narrative. That said, softening equity sentiment and renewed uncertainty around U.S. fiscal policy have kept crypto bulls from pressing aggressively higher. ETH continues to outperform, both tactically and structurally. Since early June, when ETH treasury buying began gaining traction, ETH has rallied strongly against bitcoin — with the ETHBTC ratio making a nice run higher. This trend reflects not just relative price action, but a broader shift in market architecture. ETH is now the clear beneficiary of strategic treasury allocation and record-setting ETF inflows. The past four weeks has marked the best stretch ever for ETH ETFs, providing a clear catalyst for the recent strength. Treasury-level accumulation is a growing theme across the crypto ecosystem. Firms building ETH-based balance sheets have emerged as meaningful marginal buyers, complementing the flows from ETF issuers. This dual demand shock — from corporates and institutions — has created a tightening supply environment that continues to compress ETH’s risk premium. Futures open interest and onchain metrics further support this view, suggesting leverage is being deployed in a disciplined, upward-trending fashion. From a macro standpoint, markets are in wait-and-see mode ahead of key data prints and central bank decisions. The upcoming FOMC, Q2 GDP, Core PCE, and payrolls releases will set the tone for broader risk appetite. Meanwhile, geopolitical uncertainty remains elevated, with U.S. trade posturing and European political discord adding layers of complexity. For now, crypto appears relatively insulated, but a hawkish Fed surprise or sharp move in real yields could still disrupt the current equilibrium. |

| LMAX Digital metrics | ||||

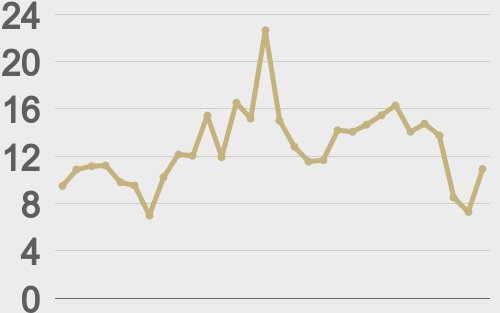

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@CoinDesk |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||