|

|

| UK police crack down |

| LMAX Digital performance |

|

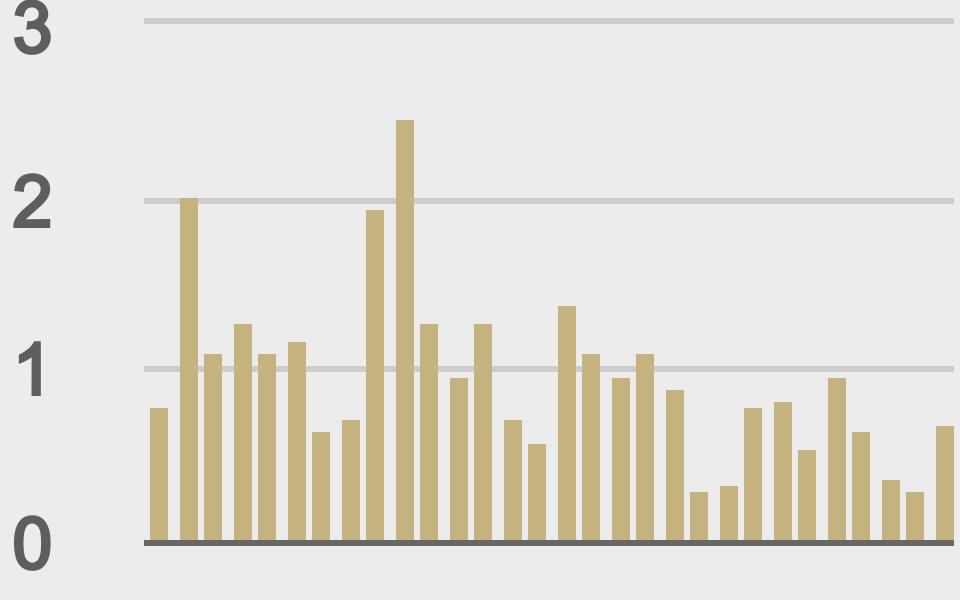

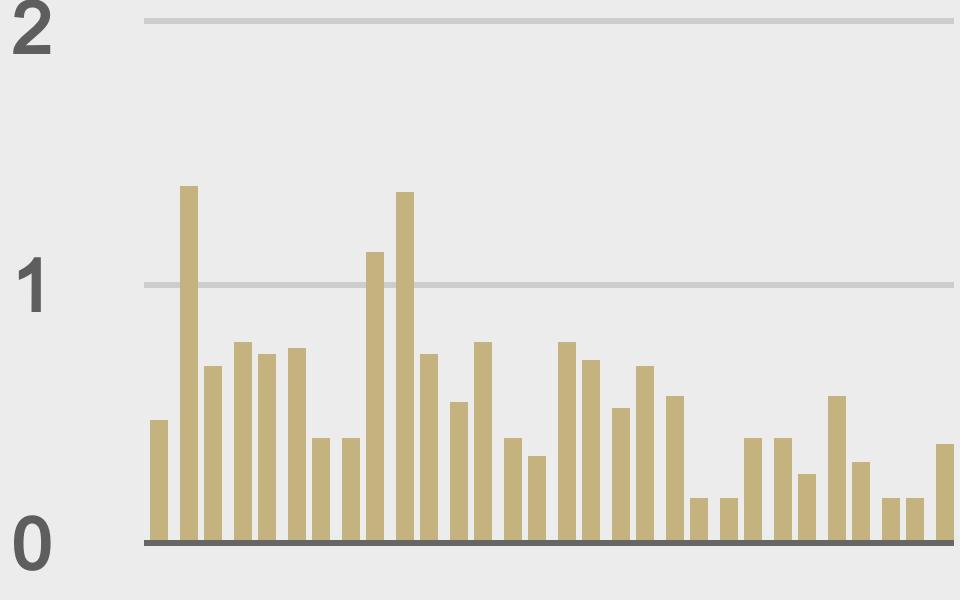

Lack of volatility has resulted in lighter volumes. A lot of this has to do with the summer and many market participants off the desks. Having said that, LMAX Digital volumes picked up nicely from weekend volumes, with total notional volume for Monday coming in at $702 million, compared to $323 million on Sunday. Overall, volumes were off about 30% from 30-day average volumes. Total notional volume at LMAX Digital over the past 30 days comes in at $29.8 billion. Average trading size for Bitcoin over the past 30 days comes in at $8,796. Average trading size for Ether over the past 30 days comes in at 3,674. The average daily trading range for BTCUSD is $2,098. The average daily trading range for ETHUSD is $177. |

| Latest industry news |

|

Reports continue to come in of miners heading for the exit doors in China. The latest story revolves around NYSE listed BIT Mining raising $50 million in a private stock offering in an effort to “acquire additional mining machines, build new data centers overseas, expand its infrastructure, and improve its working capital position.” Over in the UK, police have been cracking down on money laundering operations and have seized $250 million in cryptocurrency. This is a part of an ongoing investigation that has already been successful in seizing some $150 million last month. Meanwhile, the UK’s advertising watchdog has announced it will increase vigilance on crypto ads and campaigns. On the brighter side of things, Grayscale Investments has just added its Digital Large Cap Fund to the list of its SEC reporting funds. We’ve also heard from Fidelity, with the asset manager announcing plans to hire up to 100 employees to bolster its growing cryptocurrency business. Technically speaking, there isn’t all that much to talk about. Both Bitcoin and Ether are still very much confined to familiar ranges, both consolidating off recent lows. Bitcoin and Ether would need to break back below their respective June lows at $28,800 and $1,700 to suggest we’re seeing another wave of meaningful downside pressure that could open bigger declines. Until then, we’re still just consolidating. |

|

LMAX Digital metrics |

||||

|

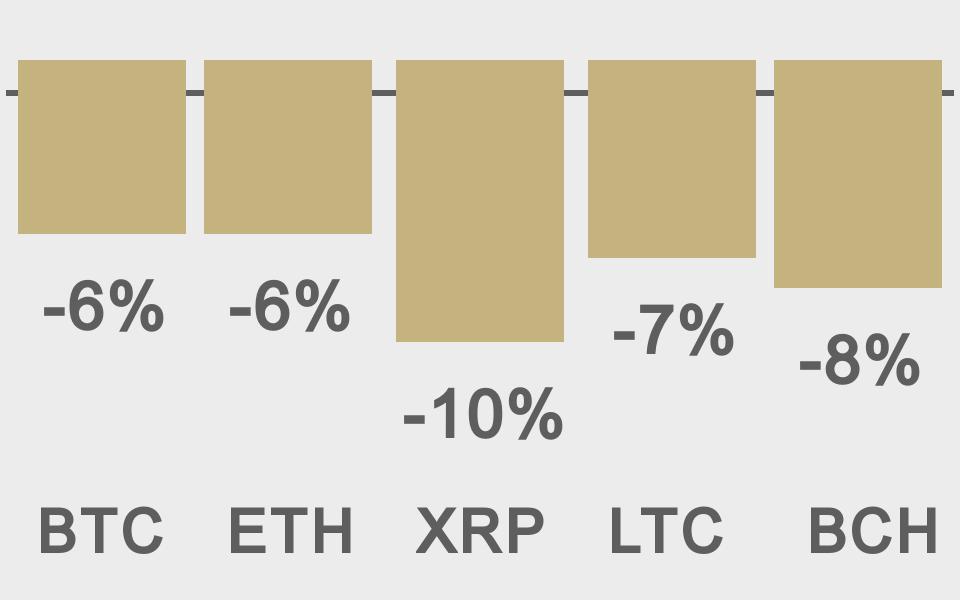

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

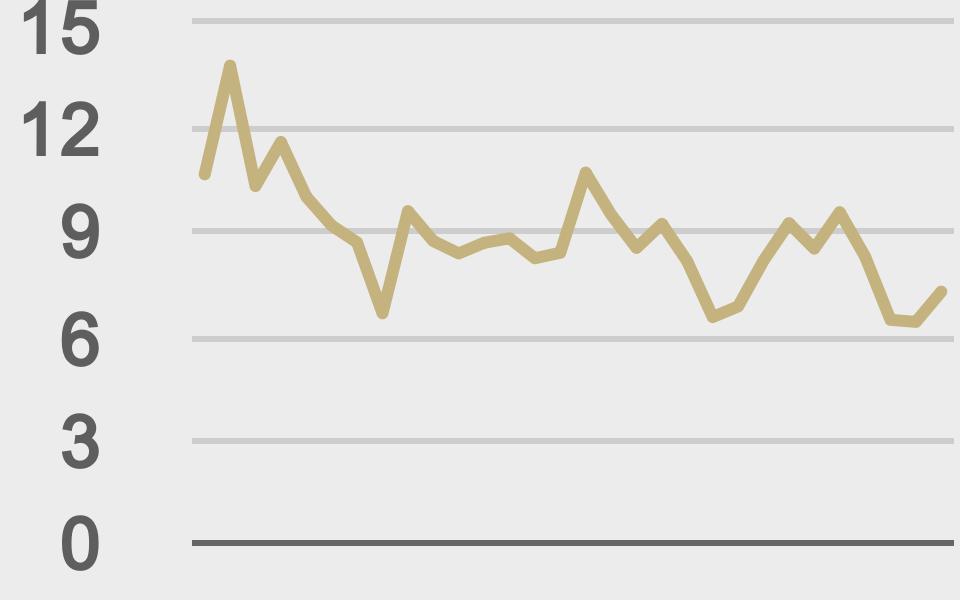

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

|

||||

|

@crypto |

||||

|

@intotheblock |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||