|

|

9 July 2024 Upcoming volatility catalysts |

| LMAX Digital performance |

|

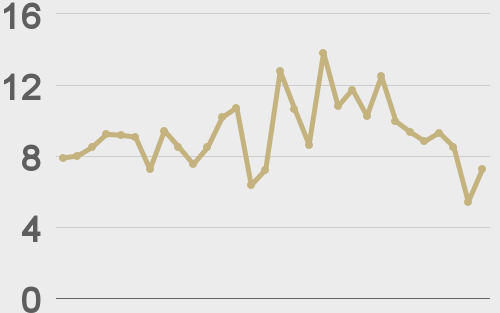

LMAX Digital volumes got off to a healthy start this week. Total notional volume for Monday came in at $510 million, 35% above 30-day average volume. Bitcoin volume printed $306 million on Monday, 65% above 30-day average volume. Ether volume came in at $154 million, 5% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,234 and average position size for ether at $5,256. Market volatility is finally showing signs of turning back up after trending lower since March. We’re looking at average daily ranges in bitcoin and ether of $2,440 and $153 respectively. |

| Latest industry news |

|

The story remains the same as the new week gets going. The market remains fixated on the batch of liquidations coming from the German government and Mt. Gox. But with liquidity conditions returning to normal post the US holiday break, the market is doing a better job absorbing the selling pressure. Most of the German selling has now gone through, leaving potential Mt. Gox liquidations in the days ahead as the primary focus. However, we believe a lot of the Mt. Gox selling has been priced in, which should help to limit additional downside pressure from current levels. Our biggest concern about the outlook right now comes from the traditional markets where soaring US equities are looking increasingly at risk for a major correction. We’ll be looking for crypto assets to relatively outperform in such a case, though it will be hard for crypto assets to avoid coming under some form of pressure in a fully risk off market. As far as catalysts for volatility go in the days ahead, we would highlight the possibility for the ETH ETFs to go live, while at the same time, focusing in on Thursday and Friday’s batch of inflation data out of the US. Technically speaking, we’ll continue to keep an eye on the bitcoin $56,500 level. So long as the price can hold above this level on a weekly close basis, the outlook remains constructive. |

| LMAX Digital metrics | ||||

|

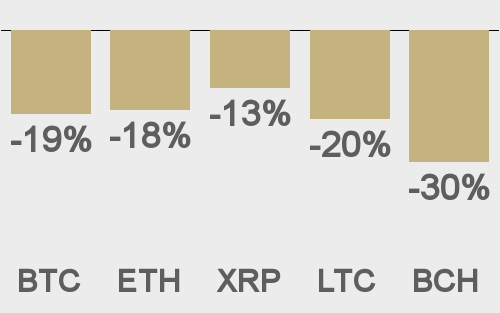

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

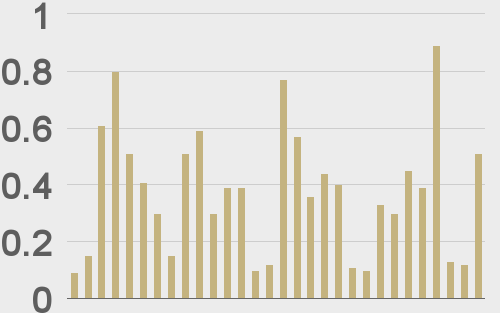

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

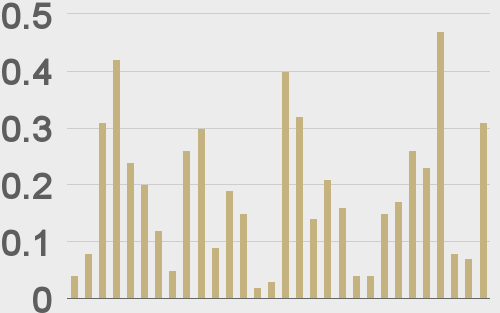

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

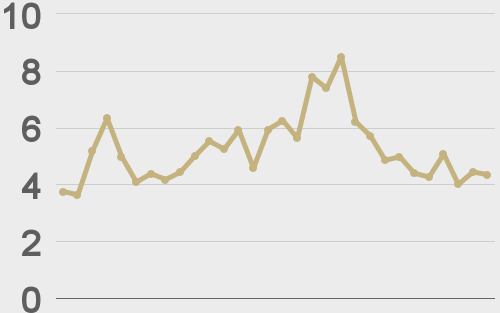

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||