|

|

13 December 2022 US inflation and SBF Fallout |

| LMAX Digital performance |

|

LMAX Digital volumes got off to another slow start this week. Total notional volume for Monday came in at 181 million, 30% below 30-day average volume. Bitcoin volume printed $76 million on Monday, 27% below 30-day average volume. Ether volume came in at $17 million, 59% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $3,147 and average position size for ether at 1,657. Volatility has been anemic in 2022, and after seeing a little pick-up in recent weeks, we’re right back down to yearly low levels. We’re looking at average daily ranges in bitcoin and ether of $443 and $53 respectively. |

| Latest industry news |

|

Volatility is expected to return to the market today, and things could get a lot more interesting from now into the end of the year. Later today, we get the highly anticipated US CPI data, this ahead of a Fed decision and other major central bank decisions later in the week. The key point of focus will be on whether or not there are signs of inflation peaking. The last round of CPI data had investors excited about this prospect, and this led to a wave of risk on flow, which helped to prop up crypto assets. But we believe the reaction was premature and overall, the trend continues to point towards higher inflation. With that said, should CPI come in above forecast, we should expect another downturn in risk assets, which could then weigh on crypto assets. It’s worth noting US producer prices were out late last week and did in fact come in above forecast. Investors shrugged this off and didn’t pay much attention. But we think this should have been considered a lot more than it was. As far as crypto specific events go, the big story on this Tuesday is the news of the arrest of Sam Bankman-Fried in the Bahamas, and the request on behalf of the US to extradite the former FTX CEO. We don’t think this will have any direct impact on price action over the coming sessions, though it is worth considering what type of regulatory crackdown the FTX implosion provokes. It’s clear there has been a need for a clearer regulatory framework when it comes to crypto. At the same time, it’s also important regulators don’t overreact in a counterproductive way. This will likely be a major theme into 2023. |

| LMAX Digital metrics | ||||

|

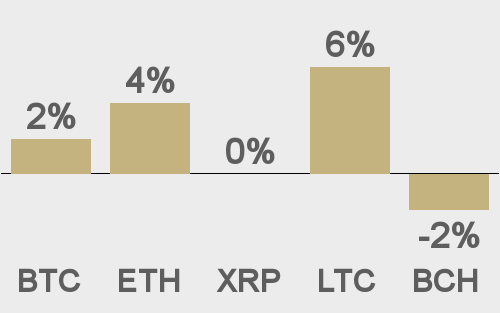

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

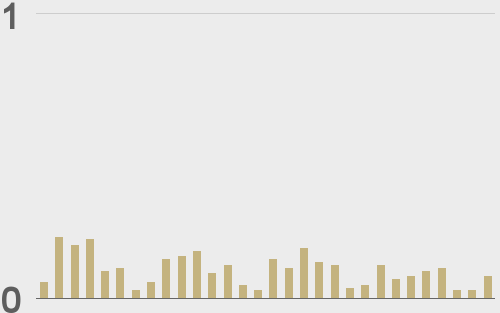

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||