|

|

12 February 2025 US inflation data in focus |

| LMAX Digital performance |

|

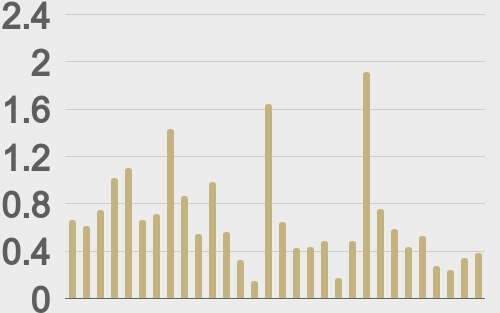

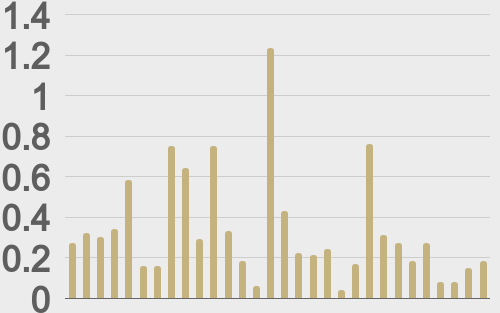

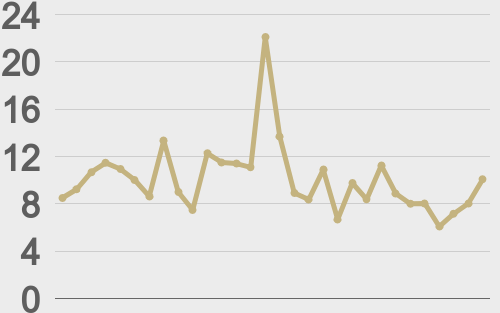

LMAX Digital volumes improved from Monday levels but were still lighter overall on Tuesday. Total notional volume for Tuesday came in at $377 million, 43% below 30-day average volume. Bitcoin volume printed $177 million on Tuesday, 46% below 30-day average volume. Ether volume came in at $52 million, 47% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $10,592 and average position size for ether at $2,531. Market volatility has been cooling off since peaking out the other week. We’re looking at average daily ranges in bitcoin and ether of $3,883 and $201 respectively. |

| Latest industry news |

|

We believe the story right now is more about the market getting reacquainted with President Trump’s tactics than any material risk associated with extreme tariff measures. While there could be short-term volatility on new announcements, we don’t see this risk causing any major shakeups from here on and expect crypto assets to continue to be well supported by medium and longer-term players looking to build exposure into dips. One such name making headlines on Tuesday was Goldman Sachs. The highly regarded investment bank has doubled down on its bitcoin ETF holdings, taking total exposure to $1.5 billion. As far as today goes, there should be quite a bit of attention around the US CPI data, which could have an impact on price action in crypto markets. Remember, last Friday’s average hourly earnings were above forecast and if today’s inflation data comes in hot, there is risk it will weigh on stocks while inviting another wave of US Dollar demand. This would be further accentuated by the fact that the Fed Chair reminded the market the central bank was in no rush to make additional rate cuts. If on the other hand the data comes in soft or even as expected, it could fuel a risk on reaction and broad based US Dollar selling, leading to a push higher in crypto markets. |

| LMAX Digital metrics | ||||

|

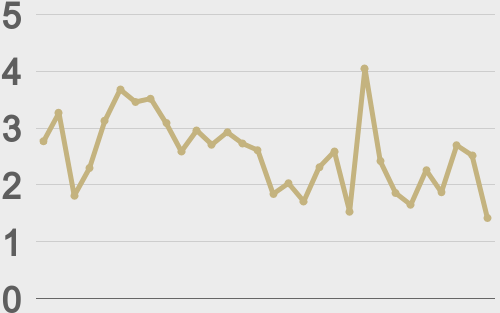

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||