|

|

14 March 2023 Volume comes roaring back |

| LMAX Digital performance |

|

LMAX Digital volumes shot up in a big way to start the week. Total notional volume for Monday came in at $1 billion, 126% above 30-day average volume. Bitcoin volume printed $1595 million on Monday, 129% above 30-day average volume. Ether volume came in at $243 million, 117% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,631 and average position size for ether at 3,168. Volatility has turned up nicely in recent sessions and, trading back up a fresh yearly high. We’re looking at average daily ranges in bitcoin and ether of $1059 and $76 respectively. |

| Latest industry news |

|

Monday kicked off with a bang and the result may have come as a surprise to many. In recent weeks, we’ve highlighted our expectation that crypto will start to break away from correlations with traditional risk assets. And on Monday, this certainly proved to the case, as we got another glimpse of an example where crypto was running higher, while US equities remained under pressure. The issue at hand right now is the spotlight on the US banks and worry about the safety of deposits on a systemic level. At the moment, we don’t believe there is any real systemic risk. But at the same time, the questions that have been brought up around potential vulnerabilities within the banking system, are questions that shed positive light on bitcoin. And so, we’ve seen a major surge in renewed demand for bitcoin, ether and other crypto assets, presumably on the value proposition of investing in alternative, safe, secure, store of value currency that can be self-custodied. Still, we are careful to use the wording ‘glimpse’ above, as we don’t believe we’re fully there yet when it comes to a complete breakdown in correlations with risk sentiment. Crypto is still widely considered to be a young, maturing asset class, which gives it properties that align with an emerging market asset sharing correlations with risk sentiment. And technically speaking, despite all of the positive price action on Monday, bitcoin remains capped below critical resistance in the $25,200 area, and will need to establish above this level to truly encourage bullish prospects. |

| LMAX Digital metrics | ||||

|

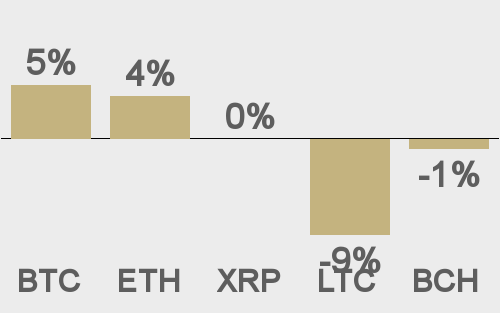

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

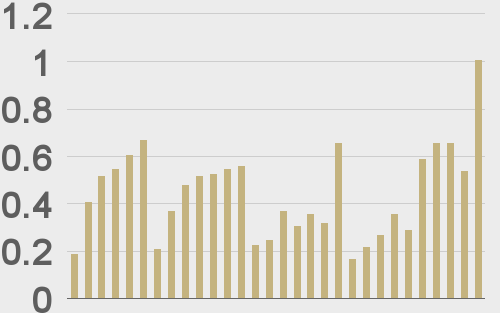

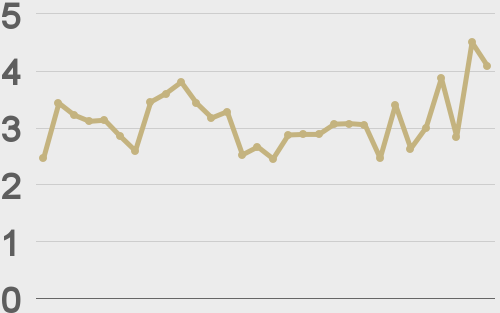

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

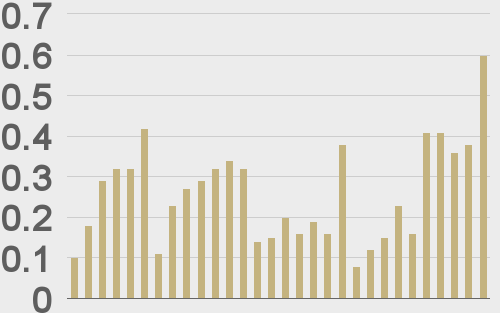

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

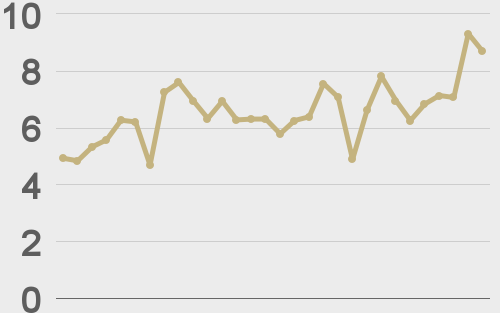

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||