|

|

13 April 2022 Volume cools off into mid-week |

| LMAX Digital performance |

|

LMAX Digital volume cooled off on Tuesday after a solid start to the week. Total notional volume for Tuesday came in at $565 million, 7% below 30-day average volume. Bitcoin volume printed $297 million on Tuesday, 22% below 30-day average volume. Ether volume came in at $188 million, 14% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,760 and average position size for ether at 5,912. Volatility has been trending lower in 2022. We’re now looking at average daily ranges in bitcoin and ether of $1,744 and $151 respectively. |

| Latest industry news |

|

A Bank of America fund manager survey showing global growth optimism at an all-time low has not been good for risk assets, and in turn, has not been good for crypto, with bitcoin and ether still very much tied to traditional market sentiment. As per the report, the share of investors expecting the economy to deteriorate is the most ever. At the same time, stagflation expectations have jumped to the highest level since August 2008. Nevertheless, we have seen some demand into Wednesday, with cryptocurrencies perhaps benefitting from the reality of surging inflation and the necessity for investors to seek out alternative investments with deflationary economics. Technically speaking, the latest pullback in bitcoin leaves the cryptocurrency at risk for a deeper setback towards rising trend-line support in the $36,000 area. This of course would likely weigh on the price of ether as well. |

| LMAX Digital metrics | ||||

|

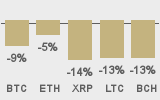

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

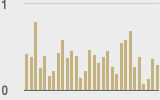

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||