|

|

26 April 2022 Volume jumps as week gets going |

| LMAX Digital performance |

|

LMAX Digital volume got off to a nice start this week. Total notional volume for Monday came in at $678 million, 27% above 30-day average volume. Bitcoin volume printed $372 million on Monday, 20% above 30-day average volume. Ether volume came in at $225 million, 42% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,003 and average position size for ether at 6,417. Volatility has been trending lower in 2022. We’re now looking at average daily ranges in bitcoin and ether of $1,599 and $135 respectively. |

| Latest industry news |

|

Heading into April, it was looking like it could be an impressive month of performance for crypto. Seasonality trends were showing strong historical performance in April, and yet, to this point, this analysis has been a letdown. Of course, we still have some time left before month end, so it will be interesting to see if we get a late surge in the market. For now, global macro fundamentals are weighing on crypto assets and this could very well continue, with no end in sight to the woes. There is very little in the way of crypto specific fundamentals that seem to be having any influence on price at the moment. Instead, the market has been mostly weighed down on worry around Russia-Ukraine, a China slowdown, and rising inflation risk. We do expect regulation to play a part in price action over the coming months, and this should be something to keep an eye on. The crypto market has been waiting for more regulatory clarity and it seems we’re getting closer and closer to that point. Technically speaking, we’re really neither here nor there. Indeed, bitcoin and ether have come under pressure in recent weeks. At the same time, we’re trading within a choppy consolidation and waiting for that next big break on either end. |

| LMAX Digital metrics | ||||

|

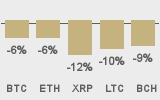

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

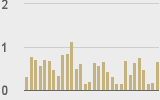

Total volumes last 30 days ($bn) |

||||

|

||||

|

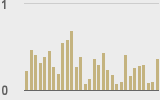

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@KaikoData |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||