|

|

10 January 2022 Volume picking back up as new year gets going |

| LMAX Digital performance |

|

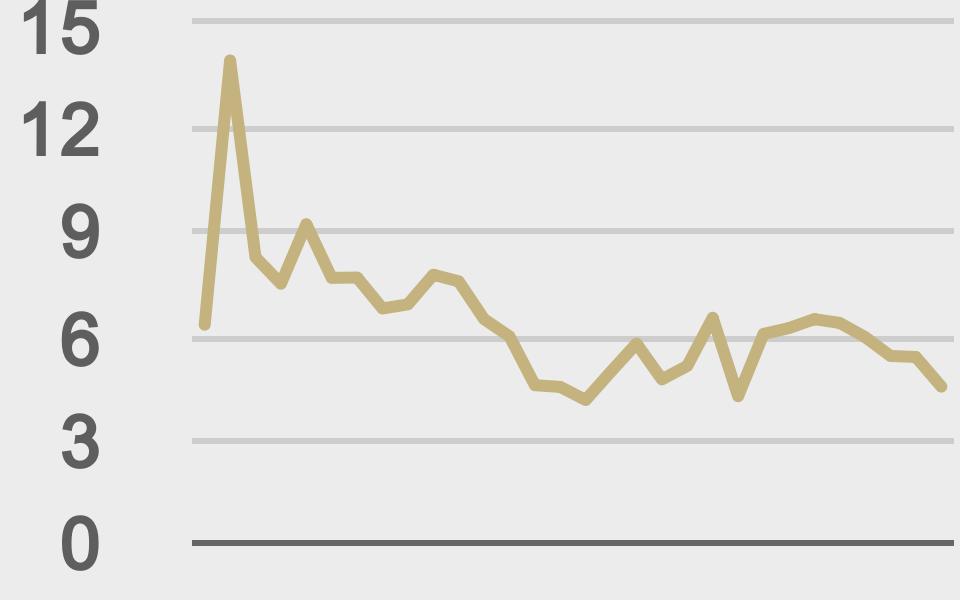

Total notional volume at LMAX Digital picked up quite a bit in the previous week. Total notional volume from Monday through Friday came in at $3.9 billion, up 29% from a week earlier. Breaking it down per coin, Bitcoin volume came in at $2.1 billion in the previous week, up 32% from the week earlier. Ether volume came in at $1.4 billion, up 47% from the week earlier. Total notional volume over the past 30 days comes in at $20 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,055 and average position size for ether at $8,060. Volatility has cooled off in recent weeks after topping out in December. We’re now looking at average daily ranges in bitcoin and ether of $2,185 and $216 respectively. |

| Latest industry news |

|

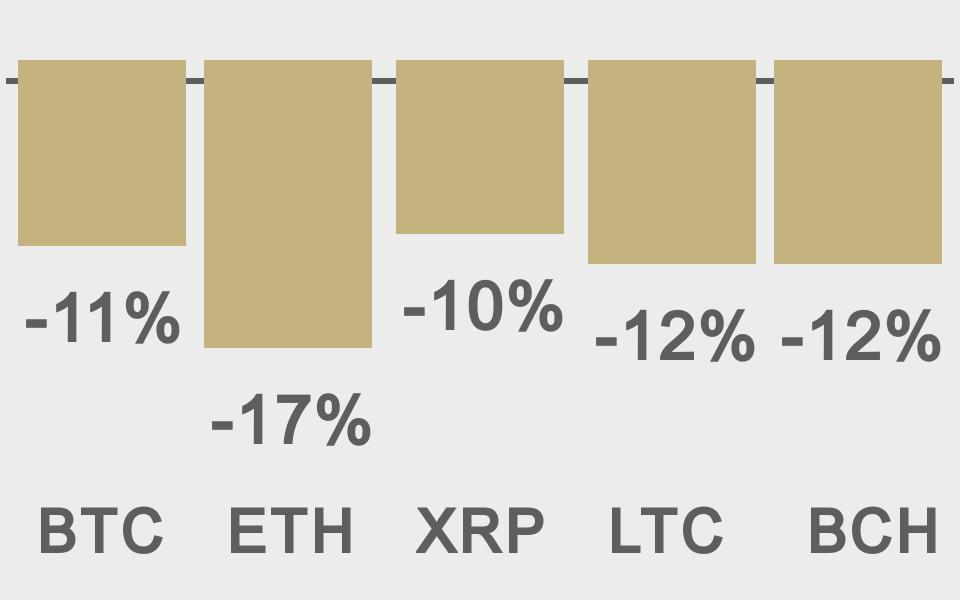

Correlations between crypto and performance in US equities remain high, with bitcoin and ether under pressure into the new week as stocks continue to stumble. The primary catalyst for the downturn in global sentiment has come from the reality that the Federal Reserve will be less accommodative with policy going forward. We have warned things would play out this way into 2022, and believe we still could see more downside pressure on crypto assets in the days and weeks ahead on account of this shift in Federal Reserve expectations. Last week, we also flagged risk ether would be more exposed in such a backdrop, and indeed, the more risk correlated ether has come under more pressure than bitcoin. Interestingly enough, this comes at a time when the bitcoin dominance ratio has been on the slide, dropping to its lowest level since April of 2018. What this means is that despite this recent run of underperformance in the price of ether, the cryptocurrency has done a good job overall capturing market share from bitcoin. Elsewhere, Goldman Sachs is getting attention for its recent analysis of bitcoin and comparisons with gold. The US firm believes bitcoin will continue to capture more market share versus gold as a store of value asset, given the expectation for broader adoption of digital assets over the coming years. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||