|

|

14 July 2022 Volume picks up as the week rolls on |

| LMAX Digital performance |

|

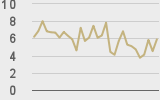

LMAX Digital volumes have been trading up as the week goes on, but are still well off 30-day average volumes. Total notional volume for Wednesday came in at $345 million, 35% below 30-day average volume. Bitcoin volume printed $221 million on Wednesday, 40% below 30-day average volume. Ether volume came in at $73 million, 38% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,297 and average position size for ether at 2,287. Volatility continues to decline to yearly lows. We’re looking at average daily ranges in bitcoin and ether of $1,235 and $93 respectively. |

| Latest industry news |

|

Technical readings continue to point to more weakness in bitcoin and ether over the coming days. Both cryptocurrencies have been unable to muster any momentum to the topside, and both have been in the process of consolidating off recent yearly lows. As things stand, there continues to be correlation with risk assets and an inverse correlation with broad US Dollar performance. Wednesday’s hot US CPI data has only served to fuel more downside pressure on stocks and more demand for the US Dollar, which has weighed on bitcoin and ether. Calls for a 100 basis point rate hike from the Fed later this month have ramped up significantly, with those odds now crossing 50%. Meanwhile, earnings over at JP Morgan were a disappointment after the banking giant missed on EPS and revenue forecasts. Finally, crypto lender Celsius has been back in the headlines over the past day, this on the news that it had filed for Chapter 11. Still, we believe the crypto market has actually held up relatively well when considering all of the implosion around Celsius and other big names in the space in recent months. As far as key levels to watch go, we recommend keeping an eye on bitcoin $22,500 on the topside. We will need to see bitcoin back above this level at a minimum, to suggest we could be seeing the start to a reversal. Until then, there is scope for fresh declines down towards next critical support in the $14,000 area. |

| LMAX Digital metrics | ||||

|

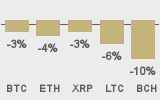

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

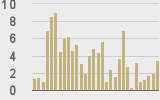

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

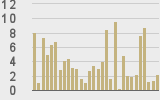

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||