|

|

14 June 2022 Volume soars to highest level since early May |

| LMAX Digital performance |

|

LMAX Digital volumes rocketed higher on Monday to the highest level since early May. Total notional volume for Monday came in at $1.79 billion, 261% above 30-day average volume. Bitcoin volume printed $1.2 billion on Monday, 284% above 30-day average volume. Ether volume came in at $402 million, 258% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,503 and average position size for ether at 2,871. There had been some signs of a pickup in volatility in May, though things have trended back down to yearly low levels in recent weeks. We’re now looking at average daily ranges in bitcoin and ether of $1,828 and $141 respectively. |

| Latest industry news |

|

Volumes in the crypto market have been anemic in recent weeks. But on Monday, we saw a big change on that front, with activity picking up in a big way, to the highest levels since early May. Though the volume was accompanied by lower prices, it could also be encouraging and indicative of renewed demand at discounted prices from medium and longer-term players. There has been a lot of talk around the troubles over at Celsius and what looks to be an organization on the verge of imploding. Calls for increased regulatory oversight are likely to ramp up in the days and weeks ahead. Ultimately, the market should welcome this development, as it will ensure better protection for participants navigating the space. The dump in MicroStrategy stock has also been getting a lot of attention, this after the price of bitcoin crossed down below the much talked about $21,000 level the firm cited as a level where it would need to add additional collateral to prevent risk of margin call. But it seems as though steps have been taken at this point and there is no imminent risk for margin call. The biggest risk out there right now remains the overall macro climate. Investors have been shaken up by the reality of a much more aggressive Fed rate hike path and this has sent shockwaves through financial markets. Interestingly enough, we’ve argued that given bitcoin’s true value proposition, at some point into this equity market fallout, we suspect bitcoin will find plenty of demand. We believe we are getting closer to that point. |

| LMAX Digital metrics | ||||

|

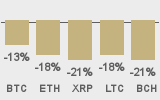

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

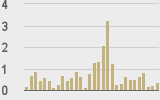

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

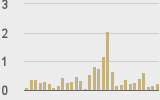

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@Negentropic_ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||