|

|

14 February 2022 Volume ticks up in previous week |

| LMAX Digital performance |

|

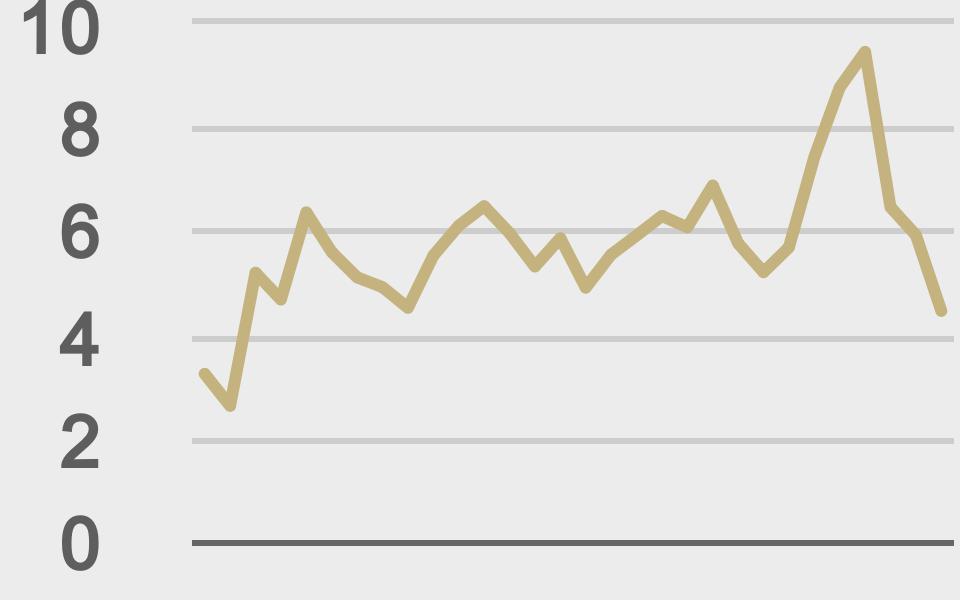

Total notional volume at LMAX Digital was up in the previous week. Total notional volume from Monday through Friday came in at $5.4 billion, up 36% from a week earlier. Breaking it down per coin, Bitcoin volume came in at $3.2 billion in the previous week, up 42% from the week earlier. Ether volume came in at $1.68 billion, up 25% from the week earlier. Total notional volume over the past 30 days comes in at $24.37 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,917 and average position size for ether at $5,726. Volatility has cooled off in recent weeks after topping out in December. We’re now looking at average daily ranges in bitcoin and ether of $1,967 and $189 respectively. |

| Latest industry news |

|

Lots of attention on the crypto space over this weekend, this after the barrage of Superbowl commercials. All of this is a big positive for the space as it continues to translate to mainstream adoption. The key takeaway here is the more and more we see moves like this pushing into the mainstream, the harder it will be for regulators to resist the space. Of course, there will be regulatory hurdles to overcome in 2022 and beyond, but this should make for a smoother go. Unfortunately for crypto, the positive vibes around the commercials haven’t translated to any short-term upside. Both bitcoin and ether have been under pressure of late and could be on the verge of turning lower again. The price action continues to be driven off global macro fundamentals and pricing around the Fed policy outlook. Last Friday’s elevated US CPI print has produced an unsettling investor reaction, especially with the Fed announcing an unscheduled meeting for later today. This meeting will be the central focus of the day. As of now, we still see crypto assets being exposed to deterioration in investor sentiment from more hawkish Fed policy tweaks. We think this could play out for a little while longer, before we eventually get that correlation breakdown and crypto assets are supported on the longer-term value proposition. |

| LMAX Digital metrics | ||||

|

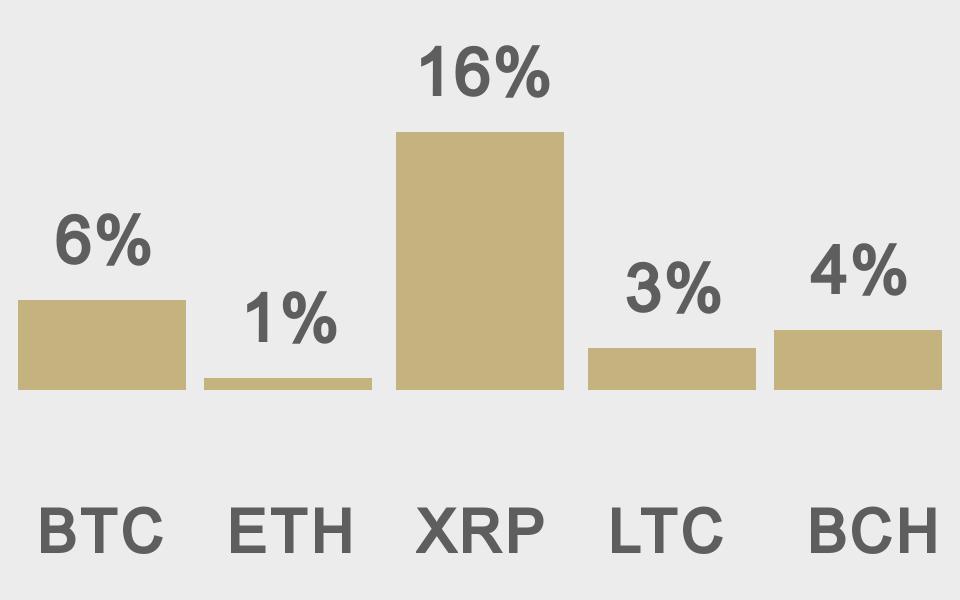

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

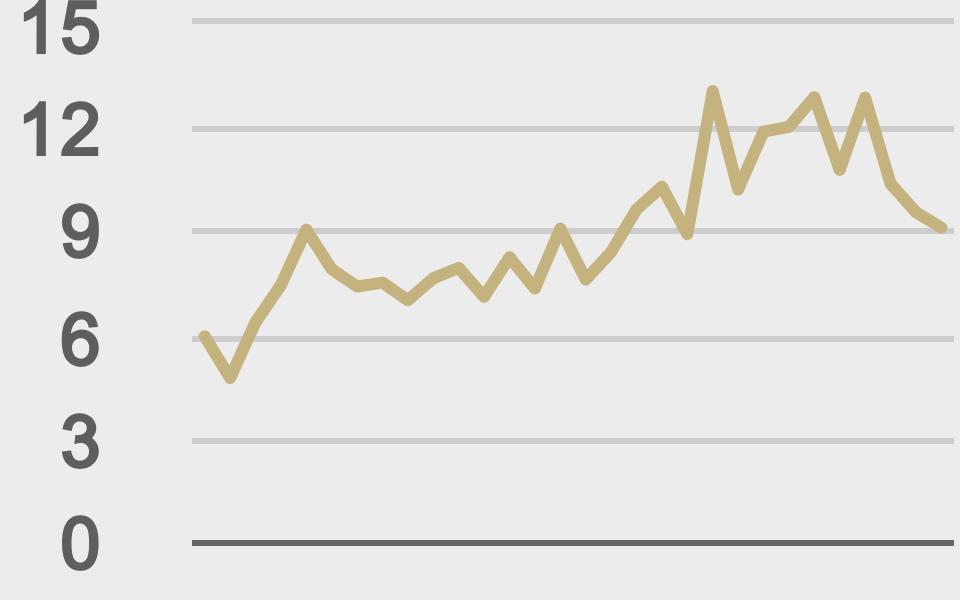

Total volumes last 30 days ($bn) |

||||

|

||||

|

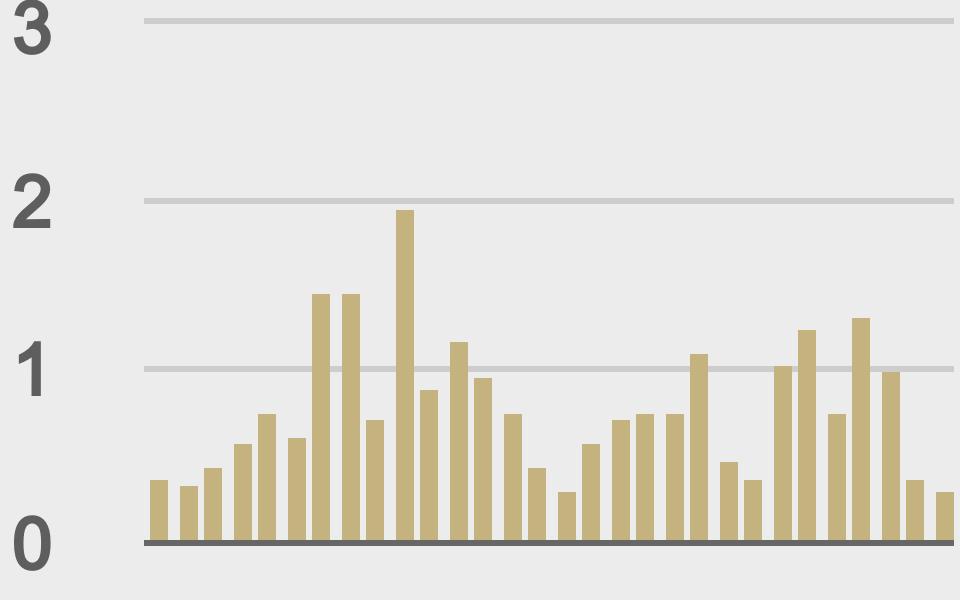

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

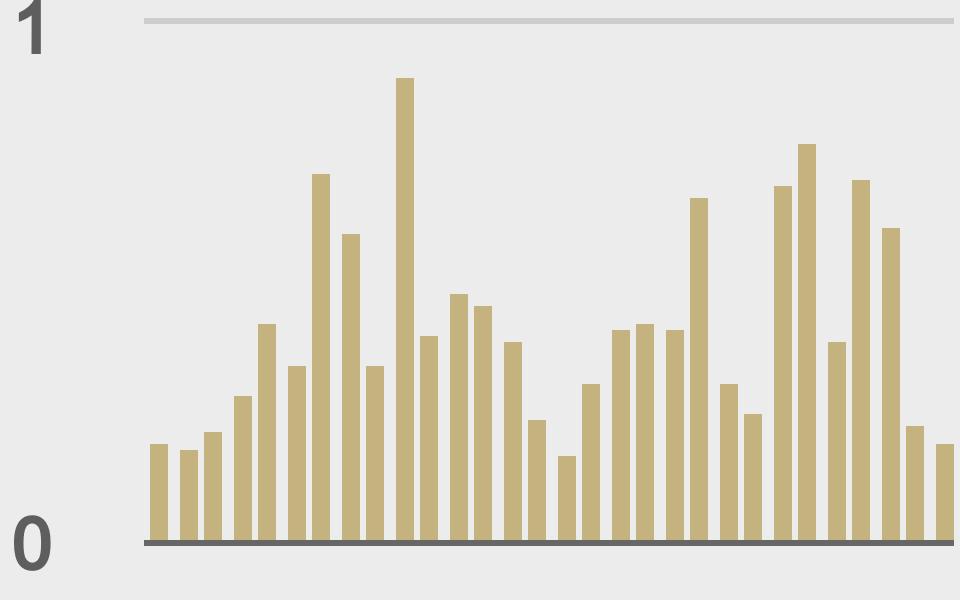

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||