|

|

26 October 2021 Volumes cool as market consolidates |

| LMAX Digital performance |

|

LMAX Digital volumes took a dip on Monday, this with the market in consolidation mode after bitcoin had traded to fresh record highs in the previous week. Total notional volume for Monday came in at $986 million, 15% below 30-day average volume. Bitcoin volume slid down to $517 million, 20% below 30-day average volume, while ether volume held up a little better despite coming in below 30-day average volume. On Monday, ether volume came in at $318 million, just 6% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $13,123 and average position size for ether at $5,973. Volatility has been slowly picking up since finding a bottom in July. We’re now looking at average daily ranges in bitcoin and ether of $2,850 and $219 respectively. |

| Latest industry news |

|

The market has entered a period of consolidation after bitcoin broke out to a fresh record high in the previous week, on the back of the US bitcoin ETF finally going live. The launch was welcome with open arms, with the ETF shooting out of the gate to become the second-heaviest traded fund on record. Elon Musk has been helping to support the market on news he had continued to be a large investor in the space, with exposure taken across bitcoin, ether, and dogecoin. At the same time, Musk was also quick to warn that people shouldn’t be betting the farm on crypto. Other players in the market cite bitcoin demand from macro forces, with hedging bets stepping in long bitcoin as oil prices continue to soar. We’ve also heard about Walmart’s plans to sell bitcoin through a pilot program at Coinstar kiosks, and of Spanish banks preparing to offer crypto services. It’s worth noting headlines haven’t been all positive for the space this week. There is some risk, at least as far as the stablecoin outlook in the US goes, this after the news broke that the US Treasury would be giving SEC oversight on stablecoins. This of course could lead to enforcement actions against some of these currencies. |

| LMAX Digital metrics | ||||

|

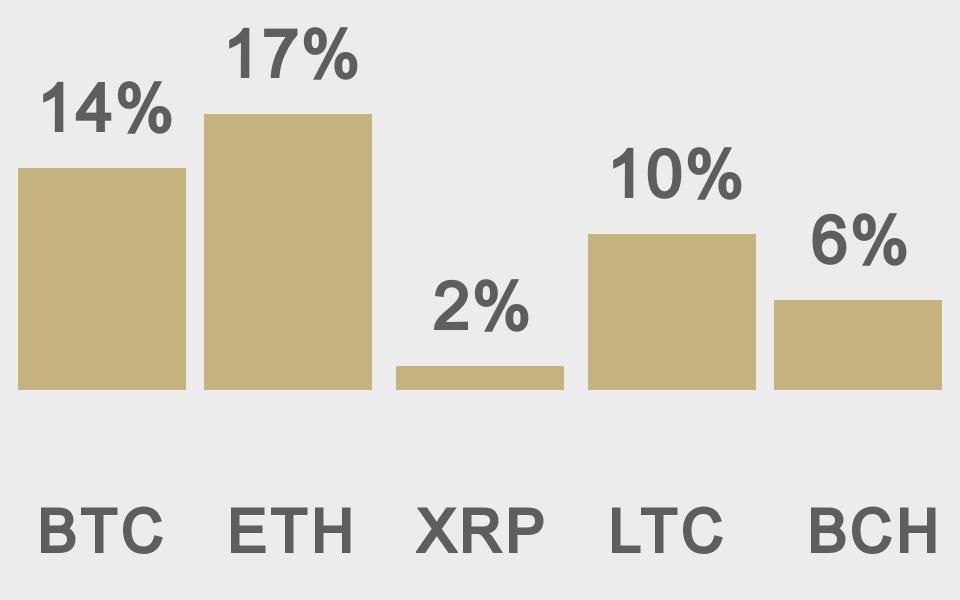

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

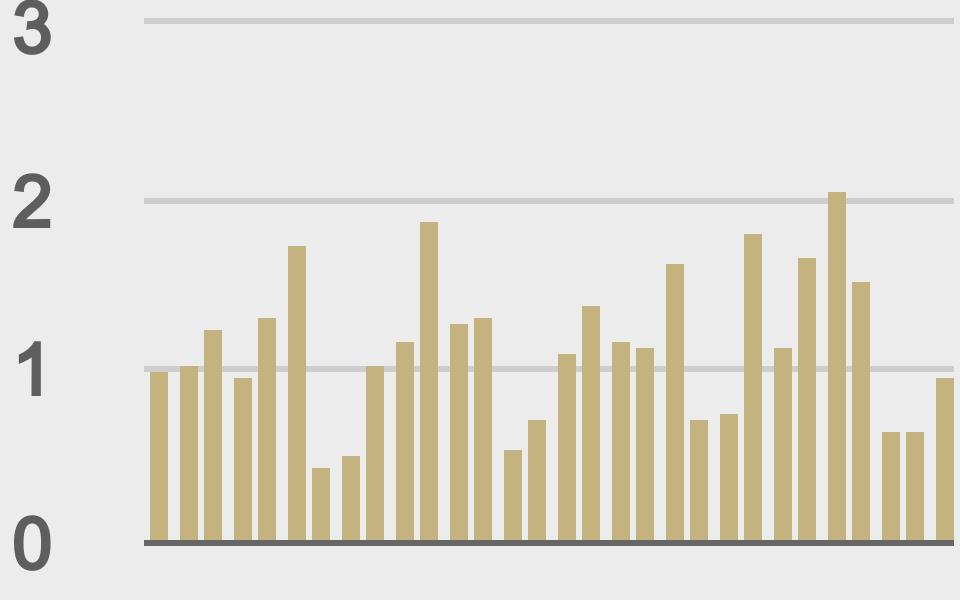

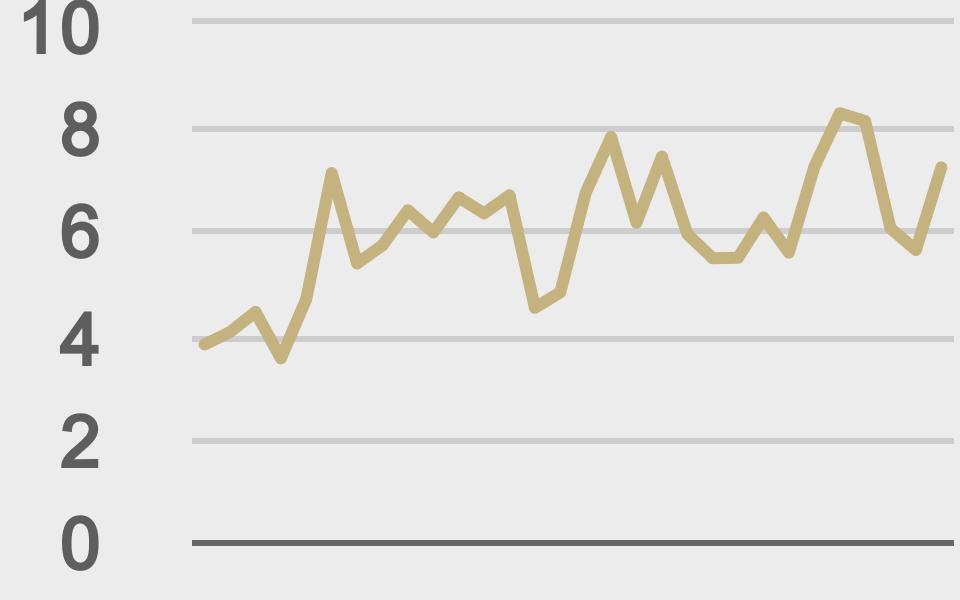

Total volumes last 30 days ($bn) |

||||

|

||||

|

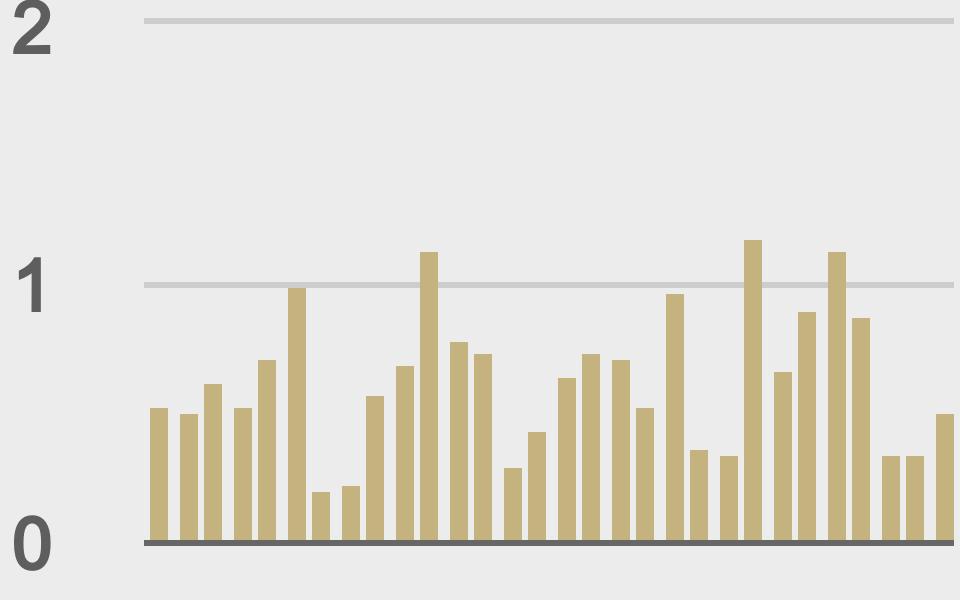

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

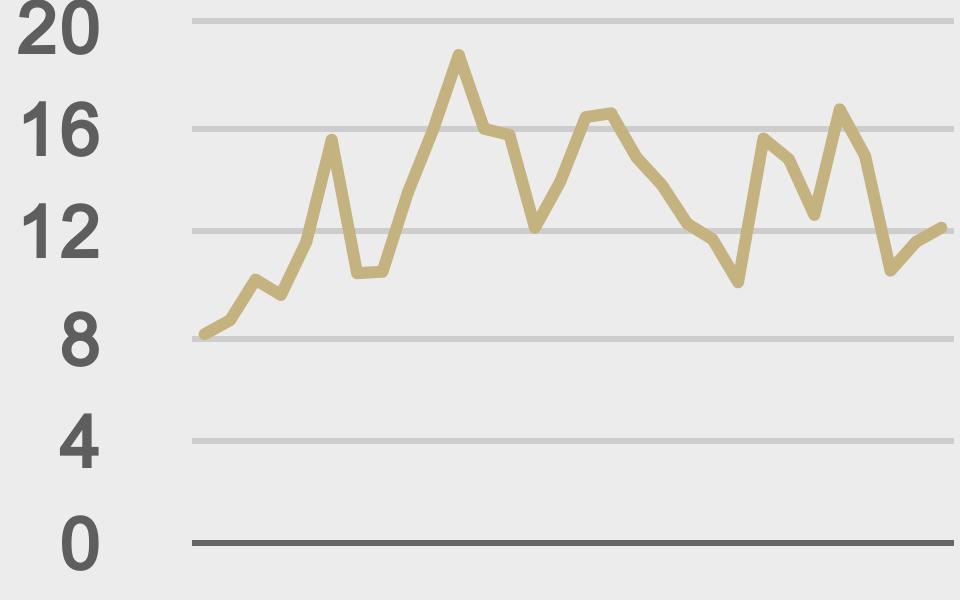

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@Cooopahtroopa |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||