|

|

11 October 2023 Volumes cool as traditional markets consolidate |

| LMAX Digital performance |

|

LMAX Digital volumes cooled off on Tuesday as global markets deferred to tight consolidation trade. Total notional volume for Tuesday came in at $148 million, 31% below 30-day average volume. Bitcoin volume printed $80 million on Tuesday, 42% below 30-day average volume. Ether volume came in at $51 million, 14% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,678 and average position size for ether at $2,420. Volatility continues to consolidate just off the August low levels. We’re looking at average daily ranges in bitcoin and ether of $635 and $45 respectively. |

| Latest industry news |

|

In the absence of any fresh, industry specific catalysts, and amidst all the global turmoil, we’ve seen less activity around crypto assets, which has resulted in some downside pressure. Nevertheless, as per our technical insights, at this stage, the currency pullback in the price of bitcoin is viewed as nothing more than a corrective decline within a market that has been trending higher since late September, and a market that continues to show exceptional support into the $25k area. There has been some chatter around the SEC-Grayscale case and the end of a 45 day window for the SEC to appeal the court’s verdict that was in favor of Grayscale. A decision on behalf of the SEC to hold off from appeal could generate a fresh wave of demand for bitcoin and other crypto assets, as it translates to more pressure on the SEC to need to move forward and approve a spot ETF application. For now, the focus will be on the FOMC Minutes due later in the day. Still, it would be difficult to determine which direction bitcoin would lean, even if we knew the result of the Minutes. On the one hand, a hawkish leaning Minutes means more risk off flow, which would inspire a flight to quality. There are many out there who would be looking to build bitcoin exposure on such a development given their understanding of bitcoin as an attractive store of value asset. At the same time, there are still many market participants who view bitcoin as a risk correlated, emerging market asset, which means bitcoin could just as easily come under pressure should we see a risk off reaction to the Minutes. |

| LMAX Digital metrics | ||||

|

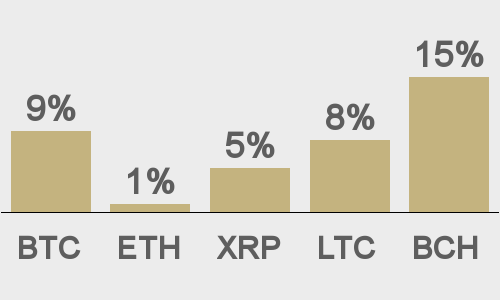

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

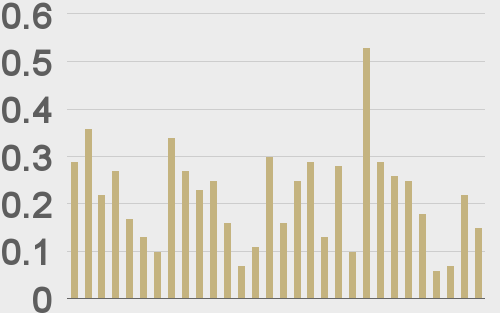

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

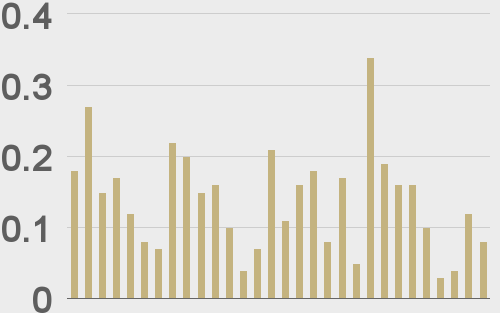

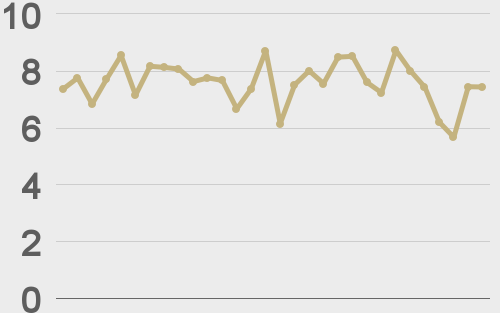

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

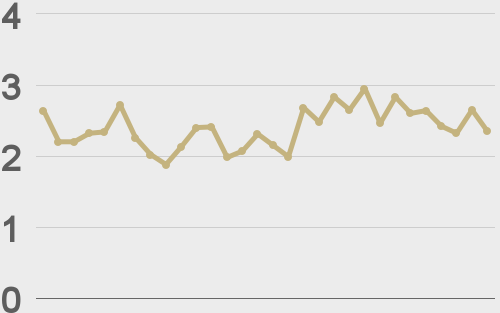

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TuurDemeester |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||