|

|

19 May 2022 Volumes cool but volatility on the rise |

| LMAX Digital performance |

|

LMAX Digital volume has cooled off quite a bit after we saw the best volume of the year in the previous week. Total notional volume for Wednesday came in at $496 million, 32% below 30-day average volume. Bitcoin volume printed $291 million on Wednesday, 30% below 30-day average volume. Ether volume came in at $139 million, 37% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,696 and average position size for ether at 5,420. Volatility has been picking back up in recent days after sinking to its lowest levels in months. We’re now looking at average daily ranges in bitcoin and ether of $2,114 and $184 respectively. |

| Latest industry news |

|

We’re not convinced the bottom is in for bitcoin and ether in 2022. While we believe we are getting closer to that point, we still see risk for additional downside in the days ahead. Most of this downside risk we see is directly tied to our outlook for US equities, which for the moment, continue to hold a strong influence on crypto assets. Fear of stagflation is a major concern for the global economy. Central banks are contending with rocketing inflation and slower growth prospects, which has been responsible for a lot of the risk liquidation we’ve been seeing. And given many market participants still see crypto as a young, maturing market, it’s no surprise to see crypto behaving like a risk correlated asset. At the same time, and certainly when it comes to bitcoin, there is so much more to the value proposition than being an asset tied to risk appetite. We expect this value will be recognized as we get closer to $20,000. We’ve also seen some downside pressure in crypto resulting from the latest drama around a collapsing stablecoin. But in our view, the ability for the crypto market to hold up well in the face of such a disaster should be taken as a sign of strength. Technically speaking, the next major level of support for bitcoin comes in at that previous record high from 2017 just ahead of $20,000. We would use this level of support as a proxy for support in the rest of the crypto market. |

| LMAX Digital metrics | ||||

|

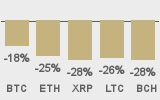

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

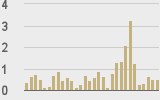

Total volumes last 30 days ($bn) |

||||

|

||||

|

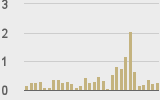

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@KaikoData |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||