|

|

21 December 2021 Volumes cool down into holiday season |

| LMAX Digital performance |

|

LMAX Digital volume got off to a good start this week, after a cool down in the previous week. Total notional volume for Monday came in at $1.43 billion, 19% above 30-day average volume. Bitcoin volume printed $751 million on Monday, 23% above 30-day average volume. Ether volume jumped to $506 million, 28% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,144 and average position size for ether at $8,129. Volatility has been slowly picking up since finding a bottom in July. We’re now looking at average daily ranges in bitcoin and ether of $2,835 and $279 respectively. |

| Latest industry news |

|

Bitcoin and ether have been confined to tighter trading ranges of late, though at the moment, the prospect for deeper setbacks can not be ruled out. Technically speaking, we would want to see bitcoin back above $52,000 to take the pressure off the downside. Fundamentally, worry around President Biden’s spending plan coming to fruition has resulted in a bout of mild selling of the US Dollar into Tuesday, which has proven to be a prop for cryptocurrencies. Perhaps the market was pleased with the latest rate cut out of China as well. As we head into the final days of the year, the primary focus is on the US inflation outlook, Fed policy trajectory, and updates around the coronavirus. All of these are macro themes that we expect will dominate and dictate the direction in crypto markets in the days ahead. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

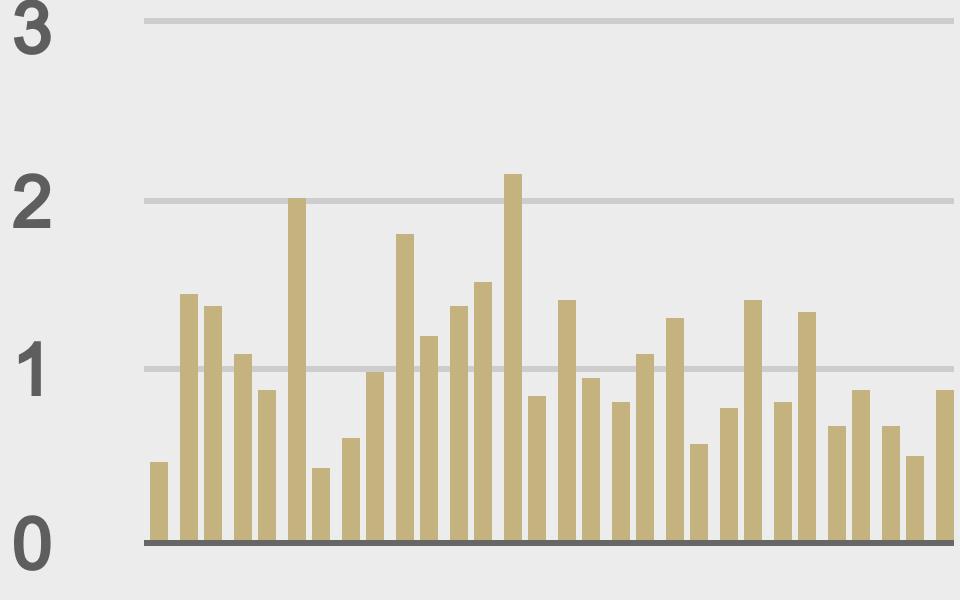

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@gladstein |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||