|

|

6 September 2022 Volumes dip in razor thin holiday trade |

| LMAX Digital performance |

|

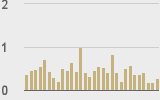

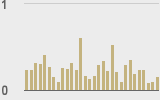

LMAX Digital volumes got off to an exceptionally slow start this week, though the anemic price action could easily be reconciled by the fact that the US market was out for the long holiday weekend. Total notional volume for Monday came in at $265 million, 42% below 30-day average volume. Bitcoin volume printed $159 million on Monday, 38% below 30-day average volume. Ether volume came in at $81 million, 50% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,616 and average position size for ether at 2,983. Volatility is still struggling to show signs of picking back up. We’re looking at average daily ranges in bitcoin and ether of $782 and $99 respectively. |

| Latest industry news |

|

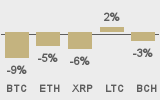

Activity is finally expected to pick up going forward – this on account of the US market returning from the long weekend holiday, and on account of finally moving out of the summer and into more active trading months. Unfortunately, bitcoin performance has been discouraging over the past 5 years, with the cryptocurrency putting in 5 consecutive negative performances. At the moment, we’re still seeing crypto correlating somewhat with broader macro flow and themes around risk sentiment. This could expose the market to more downside in the days ahead, supporting the case for another bearish September. At the same time, we’ve also seen evidence of a breaking away from this correlation, with many players stepping in into the dip to take advantage of attractive pricing on an asset class with an incredible longer-term value proposition. In the days ahead, there will be plenty of anticipation building towards the Ethereum Merge. On balance, the Merge is expected to massively reduce Ethereum’s energy consumption, reduce the number of new coins created, eventually lead to a reduction in fees, usher in a deflationary currency through the perpetual burn mechanism, and take Ethereum to about halfway on the roadmap towards the final vision for the blockchain. There are many worries around how smoothly this transition will play out and this could create some volatility around the event. One thing that is sure to happen is an uptick in chatter around the narrative between proof of work versus proof of stake. Ethereum will be moving to a proof of stake system, directly in contrast to bitcoin’s proof of work system. A lot of what might make for drama here is whether or not decentralization is more compromised in a proof of stake system. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||