|

|

21 August 2023 Volumes improve in previous week |

| LMAX Digital performance |

|

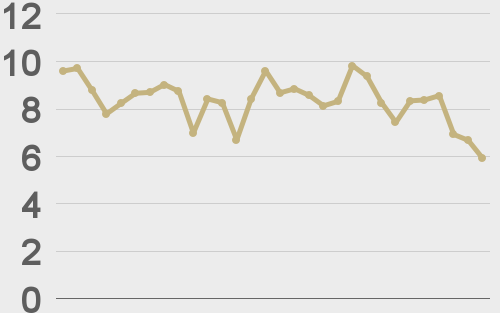

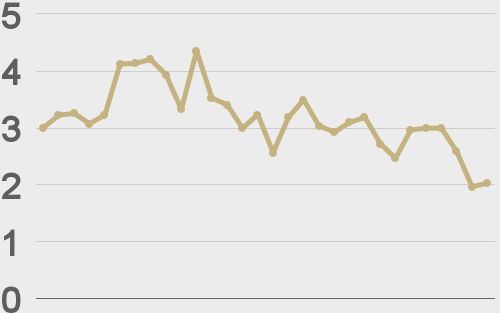

Total notional volume at LMAX Digital picked up nicely in the previous week. Total notional volume from last Monday through Friday came in at $1.2 billion, 39% higher than the week earlier. Breaking it down per coin, Bitcoin volume came in at $713 million in the previous week, 38% higher than the week earlier. Ether volume came in at $312 million, 40% higher than the week earlier. Total notional volume over the past 30 days comes in at $5.8 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,208 and average position size for ether at $3,172. Volatility has finally started to show some signs of life after trending to a major low. We’re looking at average daily ranges in bitcoin and ether of $693 and $46 respectively. |

| Latest industry news |

|

Most of what we’ve seen in recent sessions has been a breaking away from any focus on crypto fundamentals, with the market focusing back on global macro economics. We see two reasons for this shift in focus. The first is the fact that there is just too much hanging in the balance on the crypto side at the moment. The market is waiting for more clarity from the SEC and the courts. Until such clarity is provided, we’ve fallen into a game of wait-and-see. The second reason is the overall scope of the moves we’ve been seeing in traditional markets. US equities sold off aggressively in the previous week, and the US Dollar was in high demand. Whenever we get moves as big as this, it becomes exceptionally difficult for crypto to ignore the price action. As far as the catalyst for all of this goes, the biggest one was the market reaction to the Fed Minutes in which the central bank was not ready to close the door on the possibility for higher rates on account of an inflation picture the Fed is still worried about. This resulted in yield differentials moving back in the US Dollar’s favor and equities getting slammed on the less investor friendly implication. And so, we saw this trickle over into crypto, with both bitcoin and ether selling off hard before finally finding some support. As per today’s technical note, bitcoin setbacks have held up above critical support. So long as bitcoin continues to hold up above $25k on a weekly close basis, we suspect we will see renewed demand and a push back to the topside in the days ahead. If this happens, ether and the rest of the crypto space should follow along. On a positive note, the crypto market did get some upbeat news around the SEC’s groundbreaking decision to approve an ETH futures ETF. Another positive comes from the volatility side of things. While crypto has been under pressure, this has been accompanied by a welcome pickup in volatility. Looking ahead, the market will be hoping for a favorable outcome from the courts on the Grayscale case. There is added reason for optimism in light of the SEC ETH futures ETF approval. There will also be focus on a Fed Chair Powell speech from Jackson Hole on Friday. |

| LMAX Digital metrics | ||||

|

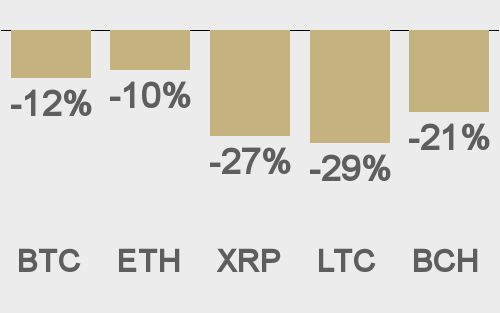

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

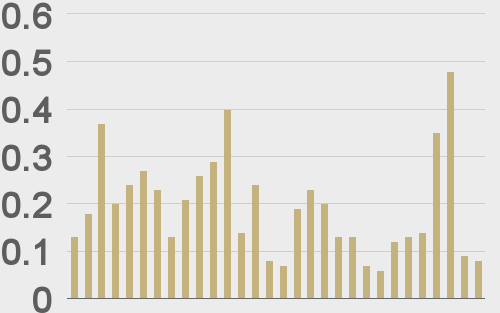

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

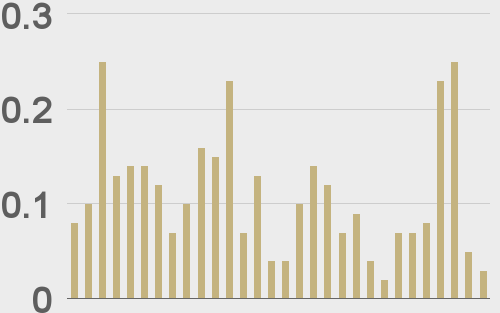

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||