|

|

8 January 2024 Volumes jump as 2024 gets going |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital was exceptionally robust in the first week of the new year. Total notional volume from last Monday through Friday came in at $6.9 billion, 160% higher than a week earlier. Breaking it down per coin, bitcoin volume came in at $5.9 billion in the previous week, 218% higher than the week earlier. Ether volume came in at $681 million, 84% higher than the week earlier. Total notional volume over the past 30 days comes in at $17.6 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $17,376 and average position size for ether at $3,662. Volatility is tracking just off multi-month highs set in the opening days of 2024. We’re looking at average daily ranges in bitcoin and ether of $1,625 and $96 respectively. |

| Latest industry news |

|

The crypto market has been totally consumed with any and all updates out around the bitcoin ETF story. Bitcoin has been consolidating off recent multi-month highs as it waits for official clarity on the matter. The broad expectation is that the SEC will finally go ahead and approve a batch of bitcoin ETFs this week. At the same time, given how bumpy things have been along the way, there are many out there taking the ‘believe it when I see it’ approach. The good news is that ultimately, there is a strong core of market participants in the crypto space who will be looking to continue to build exposure whatever the result. Should the SEC fail to approve the spot ETFs this week, we suspect there could be a decent pullback in price. But we also expect any pullbacks to be exceptionally well supported above $30k in 2024. Alternatively, if we do finally get an approval of a bitcoin spot ETF, we believe this will translate to an immediate rally to the tune of 10-15%. Again, there is a nice amount of capital sitting on the sidelines waiting for confirmation, which should fuel a healthy jump. We also anticipate another bout of consolidation kicking in once the rally has played out, with newer market participants likely to trickle in before the ETFs get fully up and running. Overall, the outlook remains highly constructive and we anticipate we could see a fresh record high in the price of bitcoin towards the second half of the year. |

| LMAX Digital metrics | ||||

|

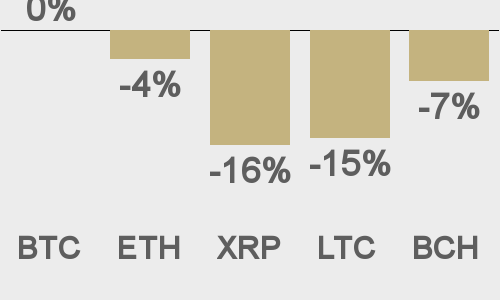

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

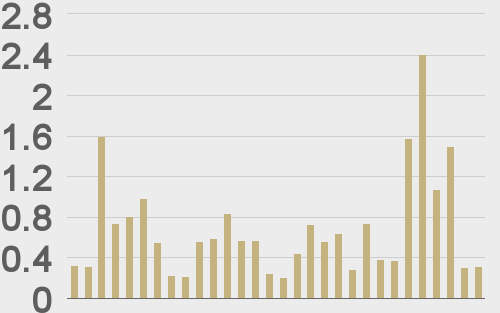

Total volumes last 30 days ($bn) |

||||

|

||||

|

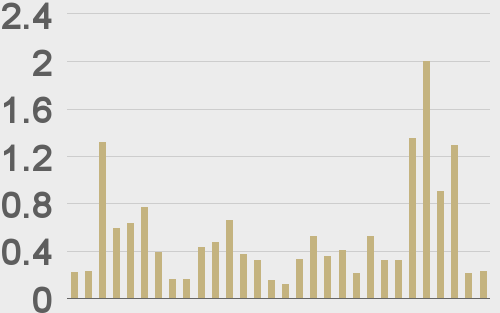

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

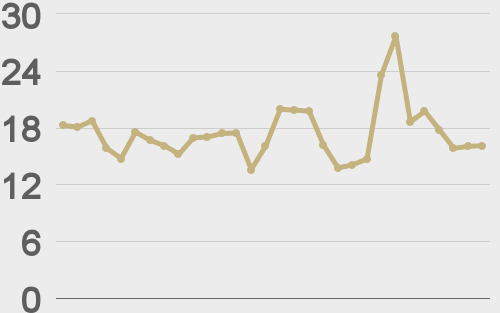

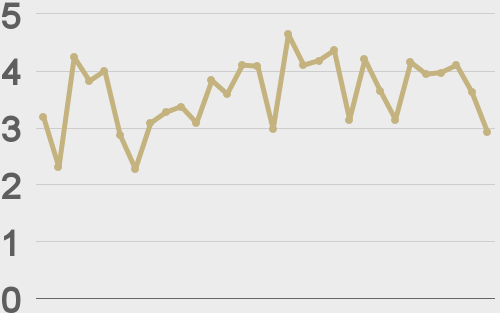

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||