|

|

17 January 2024 Volumes lighten up as market consolidates |

| LMAX Digital performance |

|

LMAX Digital were quite light on Tuesday relative to daily volumes we’ve been seeing in recent weeks. Total notional volume for Tuesday came in at $514 million, 37% below 30-day average volume. Bitcoin volume printed $358 million on Tuesday, 43% below 30-day average volume. Ether volume came in at $112 million, 5% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $15,843 and average position size for ether at $4,020. Volatility has cooled off from multi-month highs set in the previous week. We’re looking at average daily ranges in bitcoin and ether of $1,985 and $118 respectively. |

| Latest industry news |

|

Crypto assets continue to hold up well into dips as the market navigates through the ‘selling of the fact’ in the aftermath of the bitcoin ETF approvals. However, beyond the ‘selling of the fact,’ participants have cited other drivers for the recent round of less than stellar price action. This includes below forecast ETF inflows as the new products get up and running. Of course, some are also pointing to global macro fundamentals. In recent sessions, we’ve seen a resurgence in demand for the US Dollar, also accompanied by a downturn in risk sentiment. But we don’t believe any of these drivers justify any meaningful selling pressure. As far as the below forecast ETF inflows are concerned, it was always the expectation of this desk that once approved, it would take more time for funds to really start pouring in. And with respect to crypto coming under pressure from broad US Dollar demand, we’ve long argued the case for crypto demand, particularly bitcoin demand during periods of risk off flow, given bitcoin’s highly attractive properties as a flight to safety asset. Technically speaking, there’s been no change to the outlook. Bitcoin has been exceptionally well supported on dips ahead of $40k. So long as the price holds above $40k, we look for the next major upside extension to play out through the next major barrier at $50k. Ultimately, only a daily close back below $40k would delay the highly constructive outlook. |

| LMAX Digital metrics | ||||

|

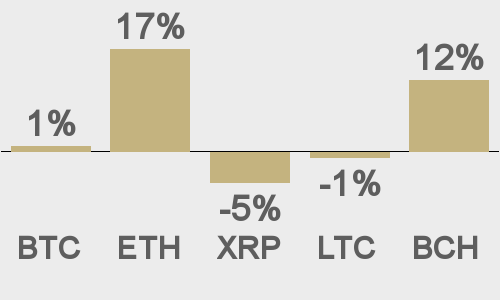

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

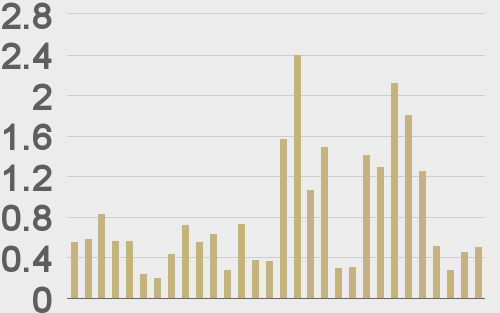

Total volumes last 30 days ($bn) |

||||

|

||||

|

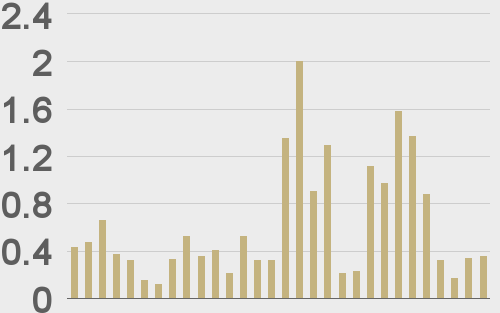

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

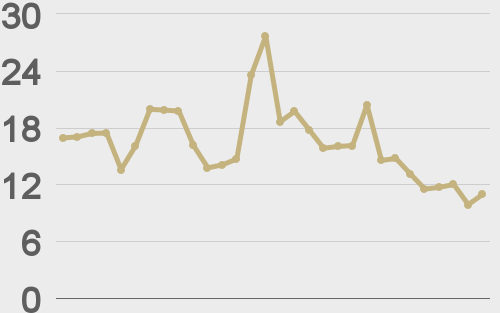

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

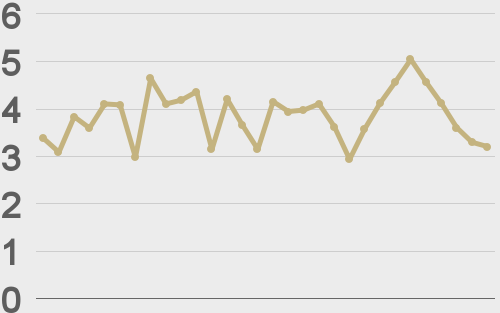

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||