|

|

27 January 2022 Volumes remain robust |

| LMAX Digital performance |

|

LMAX Digital volume continues with its healthy pace this week and remained strong on Wednesday. Total notional volume for Wednesday came in at $1.2 billion, 63% above 30-day average volume. Bitcoin volume printed $490 million on Wednesday, 29% above 30-day average volume. Ether volume came in at $546 million, 112% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,438 and average position size for ether at 5,306. Volatility has been trending lower into 2022. We’re now looking at average daily ranges in bitcoin and ether of $2,376 and $237 respectively. |

| Latest industry news |

|

The Federal Reserve decision has come and gone and investors haven’t taken kindly to the Fed communication. There was hope heading into the decision that the Fed would lighten up on its hawkish talk. But this wasn’t to be the case. The resulting price action has been very much risk off, with stocks selling off and the US Dollar rallying in the aftermath. Of course, given this reaction and current correlations, we have seen this spillover into crypto assets, with bitcoin and ether under pressure in the aftermath as well. At the same time, the setbacks in crypto have been rather mild considering, and this should be taken as a reminder that there are other fundamentals at play which should result in plenty of demand into this crypto dip despite what’s going on with US equities. For now, these correlations with risk off are still very much relevant and we think what will be important to keep an eye on over the coming sessions is the weekly low in the S&P 500. That low came on Monday and has yet to be broken post FOMC. If this low can hold, we could see more upside ahead for crypto. If it can’t, we project an extension of recent declines, with bitcoin and ether perhaps trading down to our next major target zones at $25,000 and $1,00 respectively. But once those levels are tested, we expect the risk off correlation will fade and the outlook for crypto will once again be highly constructive. |

| LMAX Digital metrics | ||||

|

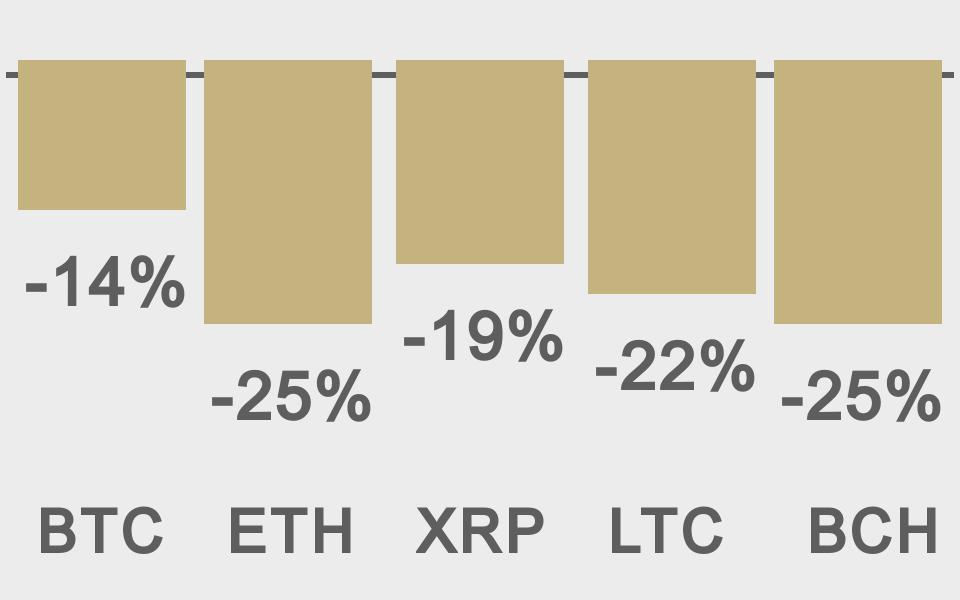

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

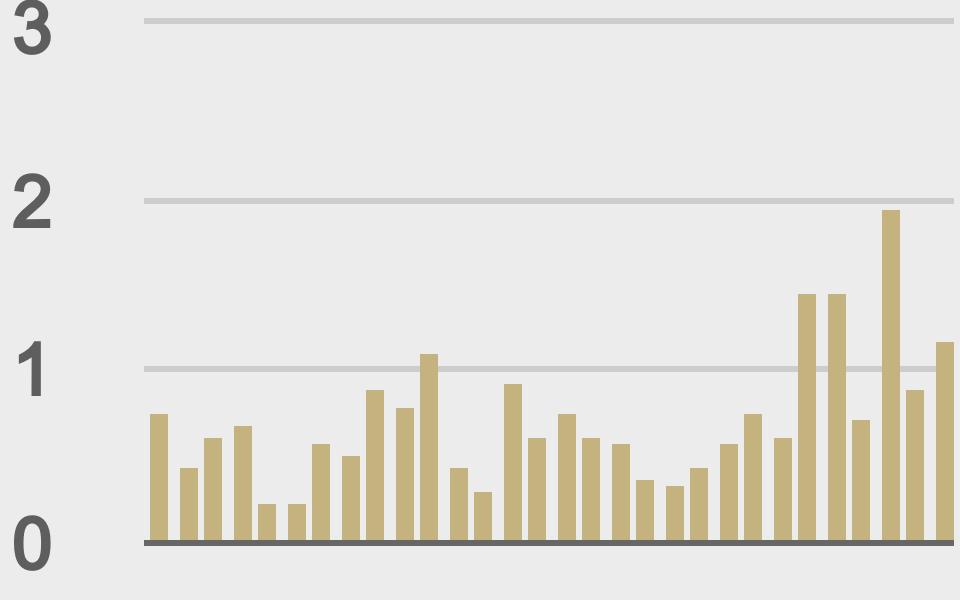

Total volumes last 30 days ($bn) |

||||

|

||||

|

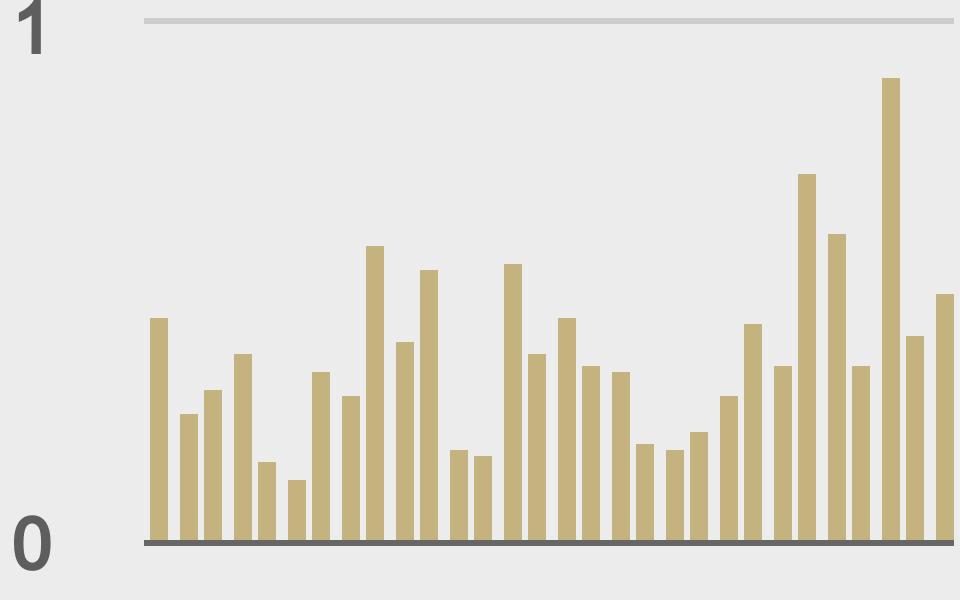

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

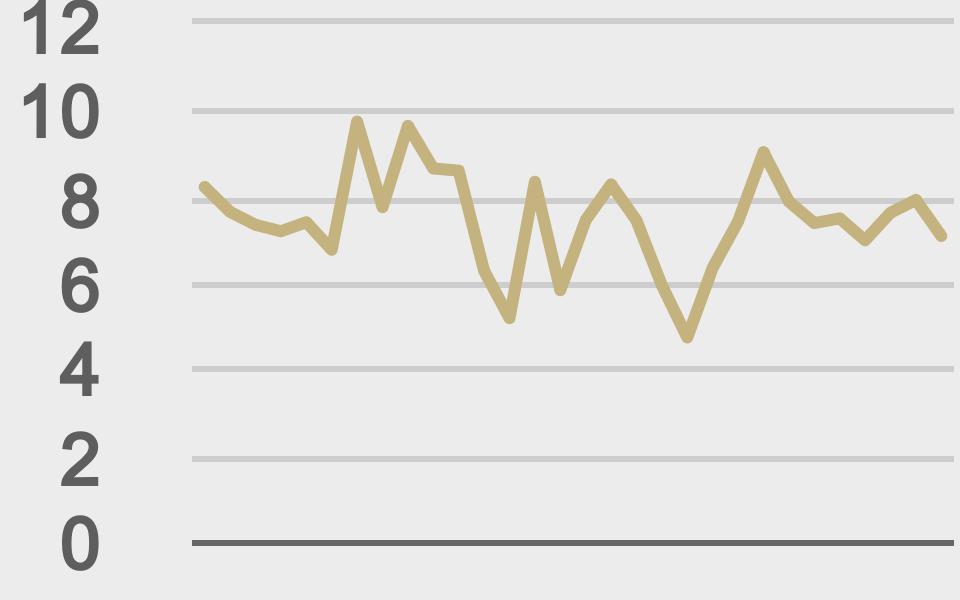

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

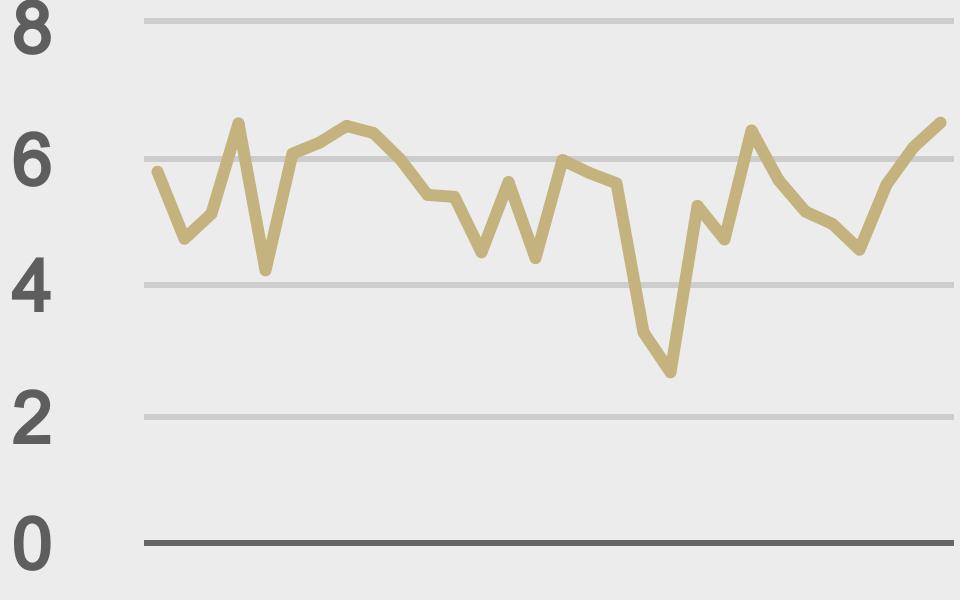

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||