|

|

22 September 2022 Volumes shoot higher on Fed day |

| LMAX Digital performance |

|

LMAX Digital volumes scaled up nicely on Wednesday. Total notional volume for Wednesday came in at $809 million, 90% above 30-day average volume. Bitcoin volume printed $453 million on Wednesday, 82% above 30-day average volume. Ether volume came in at $222 million, 71% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,539 and average position size for ether at 2,436. Volatility has been absent from the market for much of 2022 and is still trending down at yearly low levels. We’re looking at average daily ranges in bitcoin and ether of $985 and $109 respectively. |

| Latest industry news |

|

All things considered, bitcoin help up relatively well on Wednesday, this in the face of some intense risk off flow associated with a hawkish Fed decision and an escalation in geopolitical tension. While most currencies were sinking to fresh multi-year lows against the Buck, bitcoin managed to find support ahead of its yearly low. The same could be said for ether, though eth was under a little more pressure than bitcoin. Of course, we do believe there is a world not far off, where bitcoin should be attractive in periods of risk off, given the compelling economics and fully decentralized nature of the asset. But right now, there is no denying the downtrend and there continues to be risk for deeper setbacks below the yearly low. Should bitcoin take out the yearly low in the $17,600 area, it will open a measured move downside extension targeting $10k. |

| LMAX Digital metrics | ||||

|

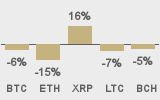

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

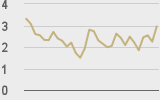

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||